American Trucking Associations

advertisement

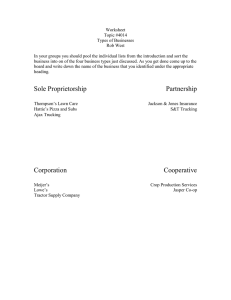

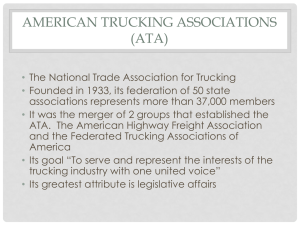

American Trucking Associations The American Trucking Associations submits the attached comments for the consideration of the President's Advisory Panel on Federal Tax Reform. We thank you for the opportunity to provide them. Robert C. Pitcher Vice President, State Laws ATA Alexandria, VA NOTICE: This e-mail message and any attachments to it contain confidential information and are intended solely for the use of the individual(s) or entities to which it is addressed. If you are not the intended recipient, or an employee or agent responsible for delivering this message to the intended recipient, you are hereby notified that you are prohibited from reviewing, retransmitting, converting to hard copy, copying, disseminating, or otherwise using in any manner this email or any attachments to it. If you have received this message in error, please notify the sender by replying to this message and delete it from your computer. American Trucking Associations COMMENTS TO THE PRESIDENT’S ADVISORY PANEL ON FEDERAL TAX REFORM BY THE AMERICAN TRUCKING ASSOCIATIONS March 31, 2005 Robert C. Pitcher Vice President, State Laws American Trucking Associations 2200 Mill Road Alexandria, VA 22314 Phone 703-838-7939 Email: bpitcher@trucking.org American Trucking Associations March 31, 2005 The Honorable Connie Mack Chairman The President’s Advisory Panel on Federal Tax Reform 1440 New York Avenue, N.W. Suite 2100 Washington, DC 20220 By email: comments@taxreformpanel.gov Dear Senator Mack: These comments are made in response to the call for comments issued February 16, 2005, by the President’s Advisory Panel on Federal Tax Reform, specifically to the first question posed by the Panel; that is, what are examples of: Headaches, unnecessary complexity, and burdens that taxpayers – both individuals and businesses – face because of the existing system. Our comments also address indirectly the Panel’s second and third questions, which request “aspects of the tax system that are unfair,” and “examples of how the tax code distorts important business or personal decisions.” ATA is the national trade association of the interstate trucking industry. It is a united federation of motor carriers, 50 state trucking associations, and national trucking conferences created to promote and protect the interests of the trucking industry. ATA's direct dues-paying membership includes more than 2,000 trucking companies and industry suppliers of truck equipment and services. Directly and through its affiliated organizations, ATA represents over 34,000 companies of every size, type, and class of motor carrier operation in the country. American Trucking Associations Page 2 Senator Connie Mack III March 31, 2005 Since the interstate trucking industry comprises more than half a million motor carriers, some 96% of which operate 20 trucks or fewer, a great many of ATA’s members are small businesses rather than large corporations. Many of these smaller operations are subchapter S corporations or other pass-through entities for tax purposes. Their owners are therefore interested in the Panel’s efforts from the point of view of individual as well as business taxpayers. The Panel has posed the question: What are examples of “Headaches, unnecessary complexity, and burdens that taxpayers - both individuals and businesses face because of the existing [federal tax] system.” ATA’s members tell us that the following features of the Tax Code or its administration prove to be extremely burdensome for them as both business and individual taxpayers: The alternative minimum tax for corporations; The alternative minimum tax for individuals; The phasing out and immediate reinstatement of the federal estate tax, which makes planning both difficult and necessarily short-term; The continual changes in and the complexity of the tax laws relating to defined-benefit pension plans; The continuing uncertainty over the proper structure and functioning of cashbalance pension plans; The continual changes in the depreciable lives for buildings; American Trucking Associations Page 3 Senator Connie Mack III March 31, 2005 The complexity of the tax treatment of foreign operations; Compliance with the broad requirements related to the disclosure of transactions “substantially similar” to listed transactions (such as loss transactions or transactions with significant differences between book and tax values); and The continued necessity for a motor carrier’s state of vehicle registration to rely on a hard-copy proof of payment of the federal heavy vehicle use tax, imposed under §§ 4041, ff. The American Trucking Associations appreciates the opportunity to offer comments on these matters. We are following the Panel’s work with great interest. Sincerely, Robert C. Pitcher Vice President, State Laws