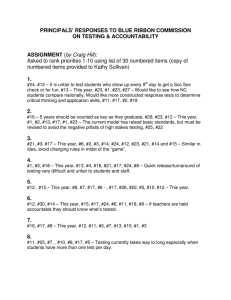

From: GARY BURGER [ ] Sent: Saturday, February 19, 2005 1:18 PM To:

advertisement

![From: GARY BURGER [ ] Sent: Saturday, February 19, 2005 1:18 PM To:](http://s2.studylib.net/store/data/015586034_1-7c33310e5e907106251e2237a446e51b-768x994.png)

From: GARY BURGER [mailto:GBurger@JSHFIRM.com] Sent: Saturday, February 19, 2005 1:18 PM To: comments@taxreformpanel.gov Subject: 4 areas of comments 1. Headaches, etc. The entire income tax code. It needs to be replaced, not reformed. Please resist making half a devils food cake, half angel food, mixing them and then baking. You will not get a good cake. 2. Unfair. Taxing income punishes people who studied hard, work hard and long, save and play by the rules. It should be abolished in favor of a system consistent with the wisdom of our Founders. They knew how destructive "head" taxes were and they prohibited them in the Constitution. The 16th Amendment was the worst mistake in American economic history. Let's fix it. There are so many individual unfair provisions in the current code, its difficult to know where to start. Try the child tax credit. It ends at age 16. Do your seventeen and eighteen years olds cost you less, or more? The tax is means tested at 110,000 for married couples. So any couple that has been working regularly and well the past 20 years is over the limit, e.g., a teacher and a fireman. What kind of fairness is that? 3. Economic distortions. Lawyers used to network and have personal contacts with clients to build their practice. Then the tax laws changed to take away club memberships, and limits meals and entertainment expenses. TV advertising is still 100% deductible. Guess what happened? On the personal level, I have had to remain "house poor" and drive old cars because of the tax code favoring the former over the latter. So I burn lots more electricity and pollute the air from old engines much more that if I had a reasonable sized house and could afford a new car. 4. Goals and options: The only tax reform proposal that fulfills the goals of neutrality, simplicity, visibility, fairness and economic growth is also the one that is consistent with the Founders principles, the Fairtax, H.R.25. Any form of income tax fails. VAT taxes are hidden and costly to administer. The Fairtax eliminates the IRS, over 100 million tax filers, and billions of hours and dollars in keeping records and doing forms. The federal government will no longer know the intimate details of our lives and no longer be hated and feared by all Americans. Americans will no longer be turned into liars and cheats by an unfair and formerly unconstitutional system. Gary H. Burger 1128 East Todd Drive Tempe, Arizona 85283 480-820-3706 Attorney 602-263-1768

![From: David Emmith [ ] Sent: Sunday, February 20, 2005 5:22 PM To:](http://s2.studylib.net/store/data/015586048_1-6f2a637d2867ab2d6ec343d040713a59-300x300.png)

![-----Original Message----- [mailto:] Sent: Saturday, March 19, 2005 1:16 PM](http://s2.studylib.net/store/data/015586054_1-bf836922aa4e822d2b834fc160831671-300x300.png)