Taxation for the 21st Century: The Automated Payment Transaction [APT] Tax

advertisement

![Taxation for the 21st Century: The Automated Payment Transaction [APT] Tax](http://s2.studylib.net/store/data/015585484_1-24d6ca22ac3bb24b6aeb9050fbbf71ed-768x994.png)

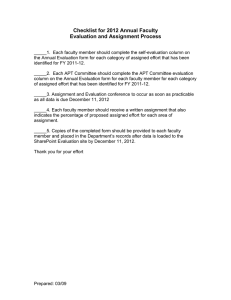

Presentation to the President’s Advisory Panel on Federal Tax Reform Taxation for the 21st Century: The Automated Payment Transaction [APT] Tax May 11, 2005 Edgar L. Feige University of Wisconsin-Madison The Problem Our Current Tax System • Overly Complex – Opaque – Annual administration and compliance costs ≈ $200 Billion • Inefficient – Annual misallocation costs - ≥$300 Billion • Inequitable – System is perceived as unfair, non-progressive and riddled with loopholes favoring the wealthy and special interests. • Tax Evasion – Annual evasion costs ≈ $325 Billion The Challenge • To design an alternative tax system that is: – Revenue Neutral – Simple – Comprehensible-Transparent-Stable – Efficient – Minimal allocation distortions - lowest possible tax rate - broadest possible tax base. – Equitable – treats all individuals fairly and is progressive. – Relatively costless to administer and comply with. – Growth promoting. The APT Tax Proposal • Replace federal, state and local personal and corporate income taxes, excise, capital gains, import and export duties, gift and estate taxes with a single comprehensive revenue neutral flat rate tax on all voluntary transactions. • Eliminate all deductions, exemptions, credits, exclusions and adopt “zero tolerance” policy on any form of “tax expenditure.” • Collect the tax automatically at the source of payment, namely, through the banking/payment clearing system when financial accounts are credited and debited. Currency is taxed as it is withdrawn from and deposited to the banking system. Special Features • Revenue Neutrality is achieved with a tax rate ≈ .6% on estimated tax base of ≈ $337 Trillion. The buying and selling party to each transaction pays ≈ .3% on each transaction. • Highly progressive – Since tax base is heavily skewed toward the wealthy who undertake the bulk of asset exchange transactions. Progessivity is automatically introduced through the tax base. • Eliminates filing of all information and tax returns. Automated assessment and collection is the electronic financial equivalent of a highway EZ pass. • Highly efficient – lowest conceivable tax rate on largest conceivable tax base. Eliminates most costs of compliance and administration. • A public brokerage fee assessed by government to pay for the provision, maintenance and use of the monetary, legal, military and political institutions that facilitate and protect free market trade and commerce. Benefits • Elimination of current system promises potential annual savings ≈ $825 Billion in efficiency, compliance and evasion costs. • Simple to understand, transparent, stable. • Equitable – progressive – non invasive. • Shifts tax burden away from wealth producing (positive sum activities) to wealth redistributing (zero sum) activities thereby stimulating economic growth. • Lengthens holding periods for equity and debt, stabilizing markets and stimulating real long term investments. • Stimulates home ownership because of low turnover of owner occupied housing. Potential Costs • Every tax system introduces costs and distortions and the APT tax is no exception. These new costs require empirical documentation and must be shown to be of a magnitude approaching the $825 billion – the gains in annual savings from scrapping the tax current system. • New costs – Transition costs. – Costs of administration. – Distortions introduced by cascading of intermediate payments. – Costs of increased vertical integration. – Costs of reduction in liquidity of asset markets. – Costs of attempted evasion. Appendix • Choice of tax base. • Determination of “revenue neutral” tax rate. • Equity – Distribution characteristics of the tax base. • Administration and compliance. • Simplicity, transparency and privacy. • Efficiency effects and distortions. • Benefits and costs. Choice of Tax Base • Most taxes are based on income or consumption and tax these transactions at rates between 5-40%. • Strange choice since societies would like to raise income and consumption standards but high tax rates reduce both. • The voluntary transaction can be viewed as the fundamental element of economic activity. • The APT tax proposes to expand the tax base to the largest conceivable base, namely to each and every transaction undertaken in the economy. • Every transaction involves a voluntary exchange (trade or transfer of property rights to goods, services and assets) between a buyer and a seller. Therefore every transaction voluntarily undertaken must improve the perceived well being of both parties. Tax Rate Determination -Mechanics • Single flat rate (t) to be determined. • t=R*/[T] where R* is required revenue (given) and T is the estimated volume of transactions (= payments) that will be undertaken after the tax is imposed. • 2001-2002 Required Revenue Simulation: R=$1.821 Trillion. • Initial tax base is estimated to be $674 trillion. We shall assume that total transactions fall by 50% so that the effective tax base will become ≈ $337 Trillion debits. Transaction Estimates for the US Figure 1 United States Estimated Initial Tax Base 900 Dollars (Trillion) 800 700 600 500 400 300 200 100 0 80 81 82 83 84 85 86 87 88 89 BIS Payments 90 91 92 93 94 95 96 Debits 1 + Domestic cash payments 97 98 99 2000 2001 2002 Revenue neutrality requirement Table 1: Revenues to be replaced by APT Tax for 2001-2002 Federal[1] State Local[2] Dollars (Bil.) Dollars (Bil.) Dollars (Bil.) Percent Individual Income Tax $970 $203 $1173 64% Corporate Income Tax $176 $28 $204 11% Excise and Customs Tax $85 $324 $409 22% Estate and Gift Tax $28 $7 $35 2% Total $1259 $562 $1821 100% Revenue Source [1] Budget and Total of the United States government: Historical Tables: Tables 2.1 and 2.5 Report of the President: 2005 Table B-86 [2] Economic Table 2: Effective APT Tax Base and Required Revenue Neutral APT Tax Rates - 2002 Data Potential Percentage Reduction in Initial Total Payments 10% 20% 30% 40% 50% 60% 70% Effective Tax Base ($Trillion) $606 $539 $472 $404 $337 $270 $202 Tax Rate Per Transaction (%) 0.30 0.34 0.39 0.45 0.54 0.67 0.90 Tax Rate Per Transactor (%) 0.15 0.17 0.19 0.23 0.27 0.34 0.45 Source: Author’s calculations Required revenue neutral tax rate • A conservative estimate of the APT flat tax rate required to raise the same amount of revenue as the 2001-2002 tax system (federal and state) is roughly .6 percent per transaction. This calculation assumes that total transactions fall by roughly 50%. • This amounts to a public brokerage fee of .3% paid by the buyer and seller to each transaction. Equity • Most flat rate taxes are regarded as inequitable. Citizens desire an effective progressive tax structure. • In APT tax, progressiveness is provided through the tax base rather than the structure of tax rates. • Transactions are highly skewed toward the wealthy. • Flat rate APT tax is progressive. Distribution of Net Worth and Transactions Distribution Effects Transactions (Credits and Debits) are highly skewed. Administration and Compliance Costs • The APT tax exploits a natural discontinuity in the administration and compliance cost function. • Compliance costs depend upon the need to distinguish between taxable and non taxable transactions and deductible and non deductible expenses. • Taxing all transactions with no deductions or exemptions minimizes the cost function. • Estimated to save $200 billion annually. Administrative collection features • Tax is automatically collected by bank or financial institution via a tax escrow account. • Software automatically and permanently links the tax escrow account to each account capable of settling a final payment. • No deductions or exemptions are permitted. • Currency is taxed as it enters and leaves the banking system. The tax rate on currency is a multiple (3 times) of the rate on bank debits to allow for the turnover velocity of cash between the time it leaves and reenters the banking system. • This eliminates the tax evasion associated with the cash underground economy. Administration and Compliance • New administrative costs – System conversion. – Guarding against payment systems fraud. – Defeat counterfeit payment systems. • Compliance costs reduced to minimum. • Automatic assessment and collection. • No tax or information returns. • If intermediate payments are allowed to be exempted through a net VAT collection system this will introduce new costs and greater complexity. Low costs for banks, individuals, firms and the government • Banks – Banking system already collects all necessary information in the normal course of doing business • Individuals – Collection is automatic-No forms Virtually costless compliance. • Firms – No more filing of information and tax returns. • Federal Government – Administration requires auditing of several thousand financial intermediaries instead of 100 million taxpayers. • State Government – Can piggyback APT tax collection on resident’s bank accounts. Simplicity, Transparency and Privacy • Every taxpayer has real time record of all taxes paid. • Government is paid from Escrow Account. Real time collection. • Government can not monitor individual transactions. • Government expenditures are explicitly in government budget, not in hidden tax expenditures. Efficiency Effects-1 • Shifts burden of taxation from wealth producing to wealth redistributing activities. • Lowest marginal tax rate, lowest deadweight welfare losses. • Cannot prevent currency and banking crises but will reduce short term speculative trading and hence reduce variance of exchange rate fluctuations and international capital flows. • Incentives for ex ante investment in information rather than asset churning for short term gains. Efficiency Effects 2 • Shifts term structure of financial assets to long term investments. • Favors home ownership since owner occupied housing represents a long term asset holding with an average turnover frequency of only once every ten years. • May have negative effect of providing incentive for vertical integration. • Introduces new distortions resulting from cascading effect on final products with many stages of production. • Cascading issue can be eliminated by permitting producers (at their expense) to adopt net VAT collection procedure, but this will complicate an otherwise seamless system. Advantages • Greatest benefit is elimination of current system with all attendant distortions. • Greatly reduces collection, administration and compliance costs. • Shifts political focus away from opaque taxation expenditures toward more transparent direct government expenditures. • Promotes equity, simplicity , transparency and perception of comprehensibility and fairness of tax system. Special features • Payment for state services via brokerage fee. • Entry ticket to free market exchange. • Government is not a party to exchanges, therefore longer participates in gains or losses of individuals or firms. • Eliminates all tax expenditures. – Improves transparency. – Total burden of government expenditure is shifted to budget process. Summary • APT tax is “revenue neutral” but not “distribution neutral”. • Efficient and Equitable. • Simple and Comprehensible. • Transparent and Private. • Low cost of administration and compliance. • Increased level of compliance. Summary of potential benefits and costs • Benefits: Elimination of Current System • Potential Estimated gains – Allocation costs -------------$300 Bil. – Compliance and administration - $200 Bil. – Reduced evasion -------$325 Bil. – Total estimated annual benefits -- $825 Bil. • Costs – To be empirically documented. – Transition and administration costs. – New allocation costs. – Total costs are highly unlikely to approach expected benefits.