Evolution of Employee Benefits As Provided through the Internal Revenue Code

advertisement

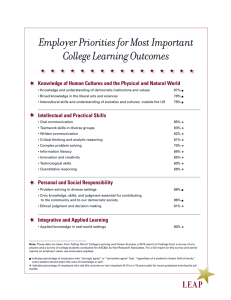

Evolution of Employee Benefits As Provided through the Internal Revenue Code Professor Kathryn J. Kennedy Testimony before the President’s Advisory Panel on Federal Tax Reform March 16, 2005 INTERNAL REVENUE CODE Provides enormous tax savings for employees and employers when certain employee benefits are provided: Pension & profit sharing benefits Health and dental benefits Other welfare benefits (e.g., disability, dependent care) Pension and profit sharing plans provide tax-deferred benefits for employees, whereas health benefits provide tax-free benefits and other welfare benefits provide tax-free benefits with maximum caps (e.g., $5,250 for educational assistance, $5,000 for dependent care) Why are employee benefits offered by employers? To compete for workers who look for benefits, especially health and retirement, as a condition for employment To promote economic security by insuring against certain risks and to raise living standards To add economic stability by securing the income and welfare of employees and their families To encourage employee savings which contributes to capital formation and economic productivity 2 ERISA: Additional Layer of Regulation ERISA is a federal labor statute passed in 1974 to regulate employee benefit plans Imposes substantive rules for pension/profit sharing plans Amended portions of IRC §401(a) Exempts governmental and church plans Since 1974, ERISA and the Code have been amended over 30 times to expand and narrow the scope of employee benefit plans, resulting in: A patchwork of conflicting public policy concerns Increased administrative and legal costs in providing benefits Undue complexity for employers in deciding to adopt plans Confusion for employees in understanding plan choices Due to the complexity of administering pension/profit sharing plans and the difficulty in making timely amendments due to changes in the law IRS has adopted a correction program known as Employee Plans Correction Resolution System (EPCRS) for employers to correct defects 3 Code’s Original Retirement Plan Models Pension versus Profit Sharing Model Pension plans are designed to provide retirement benefits and thus restrictions imposed on withdrawals, types of distributions (e.g., joint & survivor annuities for married participants), accrued benefits rules, minimum funding requirements Profit sharing plans are designed as capital accumulation plans and thus less restrictions imposed on the use of the monies Defined Benefit versus Defined Contribution Plan Model Defined Benefit Plans are always pension plans, in which benefits are calculated according to a formula (e.g., percentage of pay and related to service) Defined Contribution Plans can be designed as either a pension plan or profit sharing plan, in which contributions are allocated to individual accounts 4 Choice of Retirement Benefits Confusing under Code Choices Vary by Type of Employer Taxable Employers can choose §401(a) Qualified Plans and §409A Nonqualified Plans, which can be either Defined Benefit or Defined Contribution Plans Employees can make pre-tax deferrals under a §401(k) profit sharing plan Employees can make pre-tax deferrals under §409A nonqualified plan (but these are unsecured and unfunded) For Certain Other Employers, the Code offers alternatives: Tax-Exempt §501(c)(3) Employers and Public School Systems may offer §403(b) Tax Deferred Annuities Government and Tax-Exempt Employers may offer eligible §457(b) and ineligible §457(f) Deferred Compensation Plans Small Employers may offer SIMPLE Plans under §408 For Individuals: Choices are solely Defined Contribution Plans IRA under §219 – deductible & nondeductible depending on pay Nondeductible Roth IRAs under §408A Spousal IRAs under §219 5 Shift from Defined Benefit Model to Defined Contribution Model Provides a Variety of Choices In 1974, Typical Plan Model – Noncontributory Defined Benefit Plan – fairly simplistic in plan design Number of Defined Benefit Plans peaked in 1983 at 175,143 declining to a total of 56,405 in 1998 In 2005, Typical Plan – Contributory Defined Contribution Plan Model Number of Defined Contribution Plans in 1998 at 673,626, almost half offering employees a deductible §401(k) feature ($14,000 in 2005) Variety of different choices Money purchase & target benefit (which are pension plans) and profit sharing or stock bonus (which are profit sharing plans) Types of tax-deferred features: §401(k); §403(b); §457(b) Small employers: SIMPLE IRAs Individuals: IRAs, Roth IRAs, Rollover IRAs, and Spousal IRAs 6 Example of Confusion Facing Small Employers Adopt §401(k) Plan Adopt SIMPLE IRA Plan Pre-tax Contribution Amount $14,000 in 2005 $10,000 in 2005 Catch-Up Amounts $4,000 in 2005 $2,000 in 2005 Employer Matching May be matching and/or nonelective Either a full match on elective contributions up to 3% of pay or 2% nonelective contribution Matching not limited to 3% and match may be less than full dollar for dollar; no limit on nonelective contributions Yes Nonelective contributions limited to 2% of pay Vesting schedule may be added Full vesting of employer contribution May be required Not Required Plan Loads Permitted Not permitted Other Plans May adopt other qualified plans May not sponsor any other SIMPLE plan or qualified plan Pooling of Plan Assets May pool §401(k) contributions into a single trust invested by trustee Individual assets within IRAs invested by employees Eligibility Eligibility may exclude employees with less than 1,000 hours of service Eligibility must include employee who earns $5,000 or more during calendar year Protects benefits from creditors Not applicable Form 5500 annual filing No Form 5500 filing Nonelective Contributions Discrimination Testing Vesting Top Heavy Contributions ERISA Applicability Required Return No Cost of Employee Benefits For Employers/Employees Retirement benefits continue to be the dominant type of benefit that employees receive Of all benefit dollars, 47% provide retirement benefits (virtually unchanged from 1970) Major growth has occurred in health benefits, which has increased from 21% of all benefit dollars in 1970 to 30% in 1999 Employers have increased the relative proportion of compensation spent on employee benefits between 1970 to 1999 (wages and salaries decreased 4% while spending on benefits increased 4% ) Workers are spending proportionately more on both retirement and health benefits Retirement income accounted for 25% of personal spending in 1970, compared to 46% in 1999 – reflective of the demographics Health benefits accounted for 9% of personal spending in 1970, compared 27% in 1999 8 Need for Simplification of Defined Contribution Plans Although Defined Contribution Plans can be designed as pension or profit sharing plans, EGTRRA ’01 eliminated the disparity in the maximum employer contribution levels for Defined Contribution pension versus profit sharing plans As a result, employer adopting new plans will choose the flexibility of a profit sharing plan Suggestions Provide a single type of Defined Contribution Plan – a new Savings Plan with the same flexibility as permitted under profit sharing plans, thereby eliminating the restrictions under Defined Contribution pension plans Provide a single §401(k) tax-free feature regardless of type of employer – eliminating alternatives and §403(b) and §457(b) features Make choices between a Qualified §401(k) and SIMPLE IRA simpler for small businesses 9 Health Benefits Provided under the Code Employment-based health plans provide coverage to nearly two-thirds of nonelderly individuals in the US Health Benefits are ranked as the most important by workers For Code purposes: Health insurance premiums paid by the employer are deductible by employers and completely tax-free to the employee (IRC §105) Flexible spending accounts (FSA under §125) permit employees to pay for health care expenses (e.g., deductibles and coinsurance) with pretax dollars Self-employed individuals may deduct 100% of the amount paid for health insurance Individuals without employment-based health coverage may deduct total health care expenses only to the extent they exceed 7.5% of adjusted gross income 10 Skyrocketing Health Care Costs Health care costs have increased 59% over the past 5 years, leaving all employers with the dilemma of how to pay for such costs Cost drivers: demographic aging population, costs of prescription drugs, research and technology, and medical malpractice premiums Employers have adopted a number of approaches: Shift more costs to employees Foster greater consumerism among employees regarding choices Adopt disease management, wellness programs, non-smoking plans 11 Congressional Initiatives Health Care FSAs (Flexible Spending Accounts): Pre-tax employee deferrals under a §125 cafeteria plan to fund deductibles/coinsurance “Use it or lose it” feature forfeits unused amounts at year end Irrevocability of elections make it difficult to adjust mid-year Period of coverage extends 12 months HRAs (Health Reimbursement Accounts under Rev. Rul. 2002-41): Employer funded accounts to reimburse employees for medical expenses Can be, but need not be, coordinated with a High Deductible Health Plan (HDHP) MSAs (Archer Medical Savings Accounts under IRC §220): 1996 Temporary Initiative for small employers ≤ 50 employees HSAs (Health Savings Accounts under IRC §223): 2004 initiative requires employers to provide HDHP coverage, with pre-tax employee and/or employer deferrals to pay for deductibles and coinsurance on a tax-favored basis Employees with the least discretionary income have the least to defer under the HSA and will not be covered under the HDHP until the deductible kicks in 12 Concluding Thoughts Pension Benefits Simplification of the Code’s Defined Contribution Plan model could easily be made Making employer choices simpler Reducing administrative costs Unfortunately the Code’s Defined Benefit Plan model is out of date Public policy concerns Since Defined Contribution models shift mortality and investment risk to employees, greater education is necessary Health Benefits Reform existing Code provisions or dramatically change the Code’s models to help curb costs Importance of consumer education regarding health care choices Incentives to adopt disease management, wellness, and similar programs? 13 Additional References EBRI Research Highlights: Retirement Benefits Special Report SR-42 (June 2003), available at http://www.ebri.org/ibpdfs/0603ib.pdf EBRI Research Highlights: Health Data Issue Brief #229 (January 2001), available at http://www.ebri.org/ibpdfs/0101ib.pdf 14