Taking the Mystery out of Retirement Planning Financial Planning for Women September 2006

advertisement

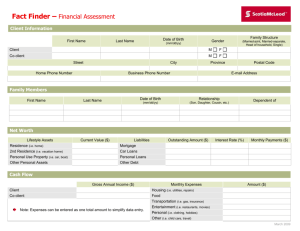

Taking the Mystery out of Retirement Planning Financial Planning for Women September 2006 Presented by Jean Lown, Tiffany Smith, & Karissa Berndt 1 September is College of Education & Human Services month • Who is affiliated with the College? – Give away personal finance books • Who is here for first time? – Welcome packet • Who brought someone new with them? – PF book 2 Personal Finance Action Plan handout • Make a commitment to yourself to take action as a result of today’s program • Anyone want to share about a personal finance action they took recently? 3 4 Workbook • for people who are 10 years from retirement, but still excellent for anyone to work through. • With this workbook you can stop worrying if you have enough saved and start planning to get to what you need. – If you don’t have enough saved now, you still have time and options to make it up. 5 Planning for a Lifetime • • • • Start NOW Pensions are a thing of the past. Prepare now for retirement. You don’t want to out live your savings. 6 Chapter 1: Tracking Down Today’s Money • Did any of your previous jobs have a 401(k) or pension that remained with the company? – You might have retirement investments you forgot about. 7 Tracking Down Today’s Money • Get statements from: – Your financial institution – Any place that you have money invested. 8 Tracking Down Today’s Money • Figure out your Home Equity (largest asset) – Current Market Value – Current Mortgage Balance – Home equity debt • Consult an Appraiser for current market value or look at sale prices of comparable homes in your neighborhood. 9 10 Ch. 2: Tracking Down Future Money at Retirement and After • Use the information from Ch. 1 to fill out worksheets to calculate how much your current investments will grow in 10 years. • The 10 year information will help you figure out a 30 year estimate. – Will you live more than 30 years? – Utahns live long lives! 11 Tracking Down Future Money at Retirement and After • Look at where your money is now. – Are you earning very low interest for guaranteed security? – Would you fare better in the long run with a higher risk investment for higher return? • These depend on your goals and how close or far away your retirement is. • Would you do better with a different asset allocation? (see FPW website for PPT) 12 Tracking Down Future Money at Retirement and After • Investing too much of your assets in one investment can be very risky. – If you’re invested in your employer’s stock what happens if the company goes under? • Remember Enron, WorldCom & Adelphia 13 Long-term Average Annual Returns • • • • Stocks = 10% Bonds = 6% Cash (CDs, Treasury bills) = 3% Inflation = 3.1% 14 15 Chapter 3: Tracking Down Future Expenses • What are your day-to-day expenses and how they will change over time? – Determine if the money you have saved will be enough to last through retirement. • Inflation is one of the biggest factors. – Historically the average inflation has been 3.1% – Use a higher number, 3.5% - 4% to be conservative 16 Tracking Down Future Expenses • Medical costs are an exception. – Medical expenses have risen faster than inflation for more than 20 years. • Medicare will not cover everything. – Currently additional Medicare part B insurance runs about $79 a month and will continue to rise. • Consider long term care insurance ONLY if you have adequate assets to cover estimated expenses. – 40% of 65 and older spend some time in a nursing home (mostly women) 17 Chapter 4: Comparing Income and Expenses • Now it’s time to compare! – Will your estimated income meet your estimated expenses? • Most people don’t have enough invested. • If your expenses outstrip your income then it’s time to make some changes. 18 Comparing Income and Expenses • Max out your contributions to your IRA. – See FPW website • Cut expenses. • Contribute as much to your 401(k) as your company will match; more if you can afford it. • You may have to work longer than anticipated • Figure out when to begin Social Security. • Invest to stay ahead of inflation! 19 Comparing Income and Expenses • Set up a budget for before & after you retire • 3 phases of retirement (Prosperous Retirement) – Go-go (expenses > income) – Slow-go – No-go (living expenses very low UNLESS long term care is needed) • Medical & LTC expenses are the BIG unknown 20 21 22 23 Chapter 5: Making Your Money Last • The whole point is to discover any gaps in your savings now, while you still have time to do something about them. • DON’T Take unsolicited advice on where to put your money. – If you want advice consult a financial professional that you choose. – Don’t be a target for scams! • Don’t forget about taxes. 24 Making Your Money Last • Choose what you want to withdraw from which savings vehicle. – Roth IRAs: you’ve already paid taxes so it is a good place to leave your money to grow. • Reverse Mortgage to stretch your money – essentially a bank loan based on the amount of home equity. – It can provide a monthly check, but at a cost. You are spending down the value of your home. – The loan does have to be repaid if your heirs want to keep the house. 25 Chapter 6: Tracking Down Help for Retirement Resources • In the past there weren’t a lot of choices in retirement, but that has changed dramatically. • It is up to you to choose how you want to live in retirement & work toward your goals. • Redo these worksheets at least once a year to make sure that you’re still on track. 26 27 28 29 30 Tracking Down Help for Retirement Resources • The workbook has a large list of resources to help you plan and save for retirement. • Late Savers Guide to Retirement – www.nefe.org/latesaver 31 Questions? • October 11 FPW: Who gets grandma’s yellow pie plate? A guide to passing on personal possessions. – Presented by Dr. Barbara Rowe, USU Extension Specialist • 12:30-1:30 Family Life 318 • 7-8:30 p.m. at the Family Life Center, 500N 700E 32