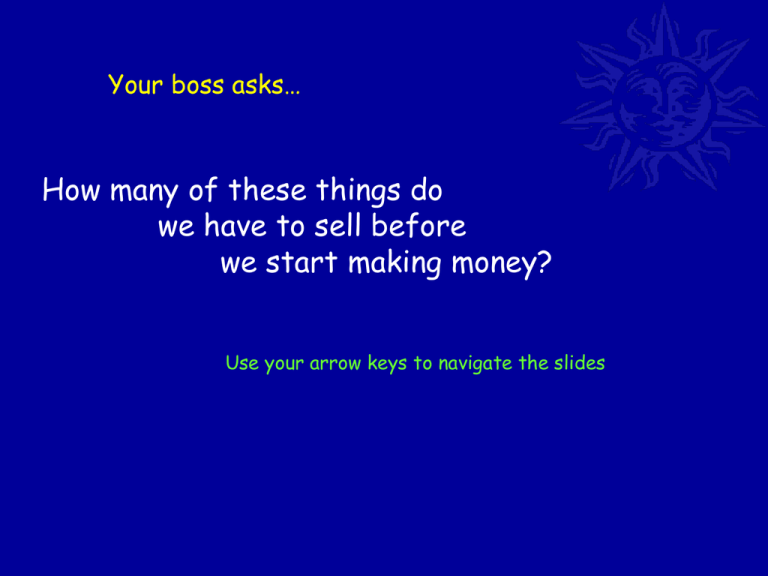

How many of these things do we have to sell before

advertisement

Your boss asks… How many of these things do we have to sell before we start making money? Use your arrow keys to navigate the slides Then your boss asks… If we sell 100,000 units, what will our profit be? Finally, your boss asks… How much do we make on one of these? Are you going to have the answers? Surprisingly, it is pretty easy to answer these questions... If you know how. In fact, those who become good at this can answer these questions in their heads. Here is how it is done… Here is the formula you can use to solve every break-even problem. SP -VC CM -FC NI Here is what “SP” means: SP = Selling Price -VC CM -FC NI Selling Price is usually stated on a per unit basis. For example, A football might sell for $25.00, a car might sell for $25,000, and a 50’ yacht might sell for $250,000. “VC” means: SP -VC = Variable Cost CM -FC NI There will be a more detailed discussion on variable cost, but for now… variable costs are costs such as labor to build or assemble the product and the materials used in the product. They are costs that increase or decrease in proportion to how many product units are made or sold. “CM” means: SP -VC CM = Contribution Margin -FC NI Selling price less the cost to make or buy the product equals the contribution margin. For example, suppose a company sells a football for $25.00 and it costs the company $15.00 to make the football. The contribution margin would be $10.00. “FC” means: SP -VC CM -FC = Fixed Costs NI Fixed costs are those costs that stay the same regardless of how many products are sold or made (within a reasonable range of sales or production). Some examples may include property taxes, administrator’s salaries, and insurance. “FC” means: SP -VC CM -FC NI = Net Income Net income is simply the contribution margin minus fixed costs. The break-even point is when net income equals zero. Here is specific info on how to solve these problems: SP -VC CM -FC NI List selling price on a per unit basis. Most of the time you will know what a product sells for. Sometimes you might you might be told that sales are expected to be $250,000 and it is expected that sales will be 10,000 units. With that information, it is easy to find the per unit sales price. If it is impossible to determine what the per unit selling price is, do not worry. It is still possible to solve these types of problems. Step #1: If possible, list the Selling Price (SP) on a per unit basis. For example, suppose our company makes high-end custom running shoes. The total sales is expected to be $1,000,000 and we expect to make 5,000 shoes. The selling price per unit = $200 per pair of shoes. SP -VC CM -FC NI $200 Step #2: If possible, list the Variable Costs (VC) on a per unit basis. In our running shoes example, suppose the cost of materials and the labor to make the 5,000 shoes totals $200,000. That would be $40 per pair of shoes. SP -VC CM -FC NI $200 40 Step #3: Calculate the Contribution Margin on a Per Unit Basis The contribution margin is simply Sales Price – Variable Cost. SP -VC CM -FC NI $200 40 160 Step #4: Include the Total Fixed Costs in the Formula Fixed costs must be listed on a grand total basis. Do not use fixed cost on a per unit basis. For example, in our custom running shoe example, the total fixed cost = $600,000 SP -VC CM -FC NI $200 40 160 600,000 Step #5: What We Have So Far Right now the numbers in the formula might look a little strange. Everything except Fixed Costs are listed on a per unit basis and so it would not make any sense to subtract $600,000 from $160. That would not tell us anything useful. However, the information in this format can tell us something very interesting: The Breakeven Point. SP -VC CM -FC NI $200 40 160 600,000 Step #6: Breakeven Point Finding the breakeven point is simple. You need to realize that each pair of shoes sold contributes $160 towards covering fixed costs and making a profit. In order to breakeven, you just need to cover your fixed costs. Here is how you figure it out. SP -VC CM -FC NI $200 40 160 600,000 The breakeven point = Total fixed costs divided by the contribution margin. $600,000 / $160 = 3,750 units This means, that if we make 3,750 pairs of shoes, the company will just cover its fixed costs and have a net income of zero. The company will just breakeven. It is important to know that the answer is in units and not $. How Many Do We Need to Sell to Make a $300,000 Profit? This is also easy. Include the $300,000 desired profit in the formula. SP -VC CM -FC NI $200 40 160 600,000 300,000 Instead of just covering fixed costs, we want to make an additional $300,000. This means that we need a total of $900,000. Here is how you calculate the number of pairs of shoes that need to be sold. $900,000 / $160 = 5,625 units If the company can sell 5,625 units, it will make a profit of $300,000. Other Ways of Saying the Same Thing Sometimes a problem might specify percentages rather than dollars. If that is the case, Selling Price is always listed as 100%. SP -VC CM -FC NI 100% 20% 80% 600,000 Everything still works the same. If you want to find the breakeven point, just divide fixed costs be the Contribution Margin. $600,000 / 80% = $750,000 This time the breakeven point is listed in $ and not units. Other Ways of Saying the Same Thing Sometimes problems will be given in a combination of dollars and percentages. Usually the problems are still easy to figure out. For example, from the information given, can you figure out the contribution amount in either % or $? SP $400 -VC 30% CM ? -FC NI If the Variable Costs are 30%, the Contribution Margin will be 70%. It all needs to add up to 100%. Also, the Variable costs are 30% of the Selling Price and so variable costs = $120. The Contribution Margin must equal $280. From there it is simple to find the breakeven point. A closer Look At Variable Costs As you can see, the math is simple. The tricky part for students is recognizing variable costs. Once you see how to do it, it is pretty simple. The Key: If a cost goes up proportionally with increased sales or production, the cost is probably a variable cost. Of course the opposite is true also. Costs that go down proportionally with decreased sales or production are also probably variable costs. Let’s take the custom running shoe as an example. As more running shoes are made and sold the following costs are going to go up… Leather and fabric Rubber for the bottom of the shoes Shoestrings Shoe boxes Labor to make the shoes Electricity to run the shoe machines Glue to hold parts of the shoe together Sales person commission if paid according to the quantity sold Etc. (You might be able to think of more variable costs.) Variable Costs on a per Unit Basis In order to solve breakeven problems, you need to be able to recognize variable costs and then be able to assign variable costs on a per unit basis. For example: if a business plans on spending $60,000 on shoe leather and fabric, and at the same time, plans to make 5,000 shoes, the cost of shoe leather and fabric would = $12 per shoe. Getting the variable cost on a per unit basis is important. That is how the formula in all of the previous slides works. Adding Up Variable Costs So now you know that shoe leather and fabric is $12 per shoe. For each variable cost you need to find the variable cost per unit and then add up them up for a grand total. (each cost is per pair of shoes basis) Leather and fabric Rubber for the bottom of the shoes Shoestrings Shoe boxes Labor to make each pair of shoes Electricity to run the shoe machines Glue to hold parts of the shoe together Sales person commission if paid according to the quantity sold Total Variable Cost per pair of shoes $12.00 1.00 .50 .50 20.00 .50 .50 5.00 $40.00 You would use $40 as “VC” in the formula to find the breakeven point. Just as we have been doing in the previous examples. A Fixation on Fixed Costs Fixed costs remain relatively unchanged as sales and production increases or decreases. For example: the custom running shoe factory produces between 4,000 and 8,000 shoes a year. This range is the normal operating range of the factory. As for fixed costs, take property taxes on the factory building. Each year the property taxes are $5,000. It does not matter if production is slow or fast. The property taxes remain the same (fixed). Another example might be the president’s salary. The president has a salary of $100,000 per year. The president’s salary is set by the board of directors and does not change as production changes. Any cost that does not change as sales and production increases or decreases, is called a fixed cost. A fixed cost should stay relatively the same as long as the business is operating in its normal operating range. Make sure you find the Total Fixed Costs and not the fixed cost per unit. In order to make the formula work correctly, you need to have a grand total of fixed costs. The total fixed costs is usually a pretty big number. The End Click the “Back” button once or twice to end this Power Point Slide Show SP -VC CM -FC NI