Karan Bokil Prof Q. 67-250 January 21, 2016

advertisement

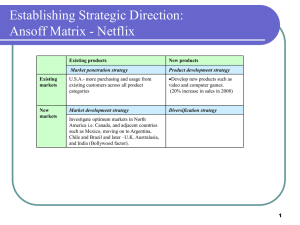

Karan Bokil Prof Q. 67-250 January 21, 2016 HW #2 Porter’s Five Forces Framework Netflix is an excellent example of a profitable company to study because of its various ups and downs throughout its development and transition from DVD-by-mail to streaming technology. The obstacles in its way in the past and still up to this day can be summarized by Porter’s Five Forces – a framework that explains the considerations successful companies take to effectively run their business with profits. The first of these forces is the group of buyers the business is catering to. Netflix’s buyers, like all buyers, expect to pay less and get more for their money. As a video content provider, Netflix tried to provide more content to its user base by offering two $8 price plans, one for Netflix as a standard DVD-by-mail provider, and one for Qwikster, a new streaming service that Netflix had developed a separate brand for. The problem with this strategy was that Netflix provided more, but consumers also had to pay more, which inevitably caused a huge dip in their stock value. Consequently, they ameliorated the conflict by raising the total cost to stream and use DVD-by-mail by $1 and grandfathered existing DVD-bymail into a 2 year streaming subscription. Thus, they were able to provide more content whilst having their buyers pay relatively less for the huge library available at their disposal. The second of the forces is the suppliers – the same organizations that provide Netflix with its content. Suppliers desire to be paid more while delivering less content. Netflix has responded to this need by attempting to create exclusive streaming agreements with certain content creators. Thus, studios would only need to provide one streamer their show rather than multiple companies: “A studio would rather accept a $200 million check from Netflix than three $50 million checks from smaller players” (Gallaugher 4.3). The third force is the group of substitutes that could challenge Netflix if treated as a non-apparent rival. Netflix has kept the major substitute of cable networks in mind throughout its business operations. It even considers HBO as its greatest competitor, rather than Amazon Prime Video or Hulu: “The goal is to become HBO faster than HBO can become us” (Gallaugher 4.3). However, it has gained competitive advantage over HBO because it has the ability to analyze customer’s viewing habits through the data sent over the internet. Thus, it can cater shows to viewers better than HBO can and create a customer loyalty to its service in the process since switching over would eliminate the data they’ve inputed. The fourth force is the group of new entrants. Blockbuster and Walmart were once newcomers to the DVDby-mail industry; nonetheless, Netflix had already acknowledged newcomer potential to overthrow their business before, which is why they created a massive library content and consumer base before newcomers could arrive. Thus, Walmart was unwilling to pay for the infrastructure and dropped out, and while Blockbuster invested the money to create their mail system, 23 million people had already subscribed to Netflix. Thus, the measly 1.3 million subscribers of Blockbuster made them bankrupt and Netflix weeded out its newcomers by arriving first and expanding fast. The final force is the group of existing rivals that Netflix has to acknowledge and keep ahead of. These include the other streaming services like Amazon, Hulu, Vudu, Blockbuster On Demand, Crackle, Comcast Xfinity Streampix and others. Netflix attempts to compete with them by having a long-enough tail which does not have all the content in the world, but enough to satisfy all customers. Furthermore, their data analytics to cater to each individual viewer provides it an advantage over other streamers. It also took a software distribution platform over a hardware, so it could be available on every device. Through the use of technology and other business strategies, Netflix has thus far kept the five forces at bay, enabling its profitability up to this point and potentially into the far future.