Metropolitan Community College Personal Finance (FINA 1200) Quiz 2 Study Guide

advertisement

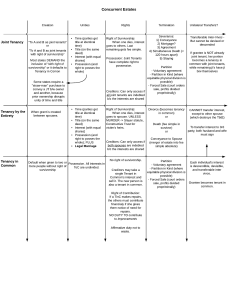

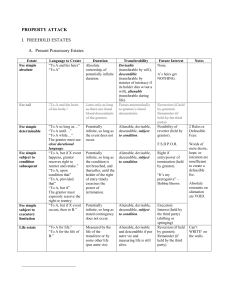

Metropolitan Community College Personal Finance (FINA 1200) Quiz 2 Study Guide Chapter 5: Understand benefit of checking, Savings & Certificate of Deposit when interest rates rise or fall (CD’s are better when rates are expected fall vs. Savings is better when rates rise.) Know the 3 types of joint ownership accounts (Right of Survivorship, Tenancy in Common, Tenancy by Entirety) Community property is classified as which type of ownership (Right of Survivorship – both spouses) Identify characteristics which distinguish demand deposit and timed savings accounts (interest rates paid, transaction limits, balance requirements) Know characteristics of Electronic funds Transfers (EFT) – electronic transfer, replaces checks, paperless, etc. Know 3 types of monetary assets (checking, saving and money market accounts) Know the limit of FDIC insurance per account holder ($250,000) Chapter 6: Know the rights of a borrower under the Fair Credit Reporting Act (Accurate, Relevant Info, Investigate disputed Info, access to credit file, etc.) Know the use of credit scoring developed by lenders (reduce subjectivity, avoid discrimination, etc.) Know which law requires standardized credit figures (Truth in Lending Act) Know characteristic of Open ended credit as a charge account (repeat borrowing without applying for credit each time needed) Chapter 7: Know which type of account allows a cash advance – Credit Cards ! Understand the requirement by lenders to disclose to credit applicants (interest rate, APR, finance charge dollars, etc.) Identify costs of credit (annual fees, interest, transaction fees, etc.) Know relationship of APR to cost of credit (Higher APR = Higher Credit Cost, etc) Understand declining balances method of how interest is calculated (outstanding balance) Know difference between Chapter 7 vs Chapter 13 (Chapter 7 = liquidation only, Chapter 13 = repayment plan) Chapter 8: Know the type of dispute resolution that is not legally binding – mediation Know the different types of financing options for a vehicle lease (balloon, etc.) Know pre-shopping research purpose (compare prices, secure financing, estimate trade in) Know the alternative name for a service contract on a vehicle (extended warranty) Know steps to avoid impulse buying (Prioritizing wants, research, budgeting, shopping, etc) Know what a rebate is for a vehicle purchase (refund of purchase price)