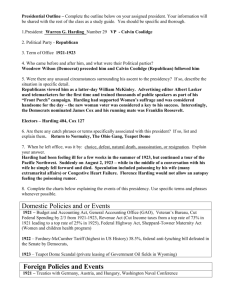

Political Changes of The 1920's

advertisement

Political Changes of The 1920's 1890's - 1910 "The Progressive Era" Era of Regulations and Reforms Increase taxes and decrease tariffs Wilson: Underwood Tariff Act (1913) - decreased tariff rates to lower consumer prices and increase competition. Clayton-Anti-Trust Act (1914)- Stronger anti-trust act to be enforced on business monopolies Federal Trade Commission (1914) -Investigates + regulates business practices Federal Reserve System- Regulates the money supply to stabilize the economy Amendments: 16th- Graduated Income Tax 17th- Direct Election of Senators Depression of 1893 (1853-1873-1893-1907-none a/c WWI----1930) 1920' s "Conservative Politics" -Era of Laissez Faire (less regulations) -Decrease taxes, increase tariffs 1. Warren G. Harding (1920 - 1923) "Return to Normalcy" -a return to quieter times before WWI + Woodrow Wilsons Progressive politics. Harding died in 1923 of an embolism-blocked blood vessel. 2. Calvin Coolidge (1923 - 1928) "The business of America is business" -the principle regulatory agencies of the Progressive era (ICC, FRB, FTC) were run by bureaucrats who reflected a laissez faire attitude. *Even the Supreme Court announced that it would apply the “rule of reason” in anti-trust prosecutions. This meant it adopted a more lenient attitude toward business activities. 3. Herbert Hoover (1928 - 1932) “Trickle Down Theory Economics" -(Govt. loans $ to businesses, who create jobs, which increases demand) *October 1929 there was a decrease in the economy a/c the stock market crash which led to the Depression. Hoover did not realize the extent and thought America could ride it out like earlier recessions. He was disconnected from peoples suffering. 4. High Protective Tariff Acts a. Ford- McCumber Act (1922)-- 38.5% b. Hawley-Smoot Act (1930)—60% Protective tariffs were implemented to protect American manufacturering while recovering after World War I, but it backfired because European and Japanese reciprocated with their own tariffs against American goods. 5. Tax Reduction (Ideas of Andrew Mellon- millionaire financier and Secretary of the Treasury under both Harding & Coolidge) Reduction of corporate tax in order to stimulate business and a reduction of personal income tax in order to stimulate consumer spending. 6. Amendments 18th- Prohibition (1919) No sale or manufacturing of alcohol in the United States 19th- Women’s Suffrage As Americans cared less about reforms laws and more towards laissez faire and prosperity; the watchful eye of the press and public waned and special interest groups got their way. A number of scandals arose during the Harding administration. The most famous being the Teapot Dome Affair. “Bribery”= govt. officials provided with gifts and money by private businesses who are given exclusive govt. contracts over others. a. 1921-22 Harding’s Secretary of the Interior, Albert B. Fall, secretly gave oil drilling rights on Govt. oil fields in Elk Hill, California and Teapot Dome, Wyoming to two private oil co’s. b. Fall received over $300,000 in illegal payments and gifts disguised as loans. c. He later went to jail, Harding died before the investigation was completed.