LOYOLA COLLEGE (AUTONOMOUS), CHENNAI –600 034 B.com., DEGREE EXAMINATION - COMMERCE

advertisement

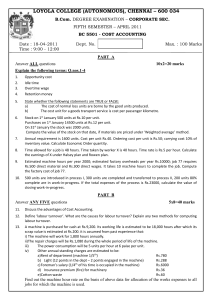

06.04.2004 1.00 - 4.00 LOYOLA COLLEGE (AUTONOMOUS), CHENNAI –600 034 B.com., DEGREE EXAMINATION - COMMERCE FIFTH SEMESTER – APRIL 2004 CO 5501/COM 506 - COST ACCOUNTING Max:100 marks SECTION - A (10 2 = 20 marks) Answer ALL questions 1. State whether the following statements are true or false. a) Cost Accounting is a branch of financial Accounting. b) Bin card is the same as stores ledger. c) Valuation of closing stock is same under FIFO and LIFO. d) Abnormal idle time wages are included in the cost of production. 2. Distinguish between idle time and idle capacity. 3. Distinguish between time-keeping and time-booking 4. What is machine hour rate? 5. What is the relevance of 'escalation clauses' provided in contracts? 6. What is Economic Batch Quantity. 7. Distinguish between joint product and by - products. 8. What is operation costing? 9. What is just in time of inventory management? 10. Explain Halsey incentive plan. SECTION - B Answer any FIVE questions (5 8 = 20 marks) 11. What is labour Turnover? What are its causes and Explain the effects of labour Turnover. 12. What is ABC Analysis? Describe its advantages. 13. "Cost Accounting is an unnecessary Luxury for business establishments". Do you agree with the statement. Discuss. 14. A consignment consisted of two chemicals A and B. The invoice gave the following data: Rs. Chemical A 4000 1bs. @ Rs.2.5 per lb 10,000 Chemical B 3200 1bs. @ Rs.3.25 per lb 10,400 Sales Tax 816 Railway freight 384 --------21,600 --------A shortage of 200 lbs in A and 128 lbs. in B was noticed due to breakage's. What stock rate would you adopt for pricing issue assuming a provision of 5% toward further deterioration? 15. In a factory group Bonus system is in use which is calculate on the basis of earnings under time rate. The following particulars are available for a group of 4 workers P,Q, R, and S. a) Output of the Group 16000 units b) Price rate per 100 units Rs.2.50 c) No of hours worked by P-90; Q-70; R-80; S-100 d) Time rate per hour for P - Re. 0.80, A-Re. 1.00, R- Rs. 1.20, S - Re. 0.80 Calculate total wages and bonus earned by each worker. 1 16. The following particulars related to a contract undertaken by Ajit; Material sent to site Rs.85,349; labour engaged on site Rs.74,375; plant installed at cost Rs.15,000; Direct expenditure Rs.3,167; Establishment charges Rs. 4,126; Materials returned to stores Rs.549; work certified Rs.1,95,000; cost of work not certified Rs.4,500; Materials in hand at the end of the year Rs.1,883; wages accrued due at the end Rs.2,400; Direct expenditure accrued due at the end Rs.240; Value of plant at the end of the year Rs.11,000; The contract price has been agreed at Rs.2,50,000; cash received from the contractor was Rs.1,80,000. You are required to prepare contract A/c showing profit. 17. Mrs. Ahuja runs a tempo service in the town and has two vehicle. He furnishes you the following data and want's you to compute the cost per running mile: vehicle A Vehicle B Rs. Rs. Cost of vehicle 25000 15000 Licensee per year 750 750 Salary p.a 1800 1200 Drivers wages per hour 4 4 Cost of fuel per litre 1.50 1.50 Repair and maintenance per mile 1.50 2.00 Tyre cost per mile 1.00 0.80 Garage rent p.a 1600 550 Insurance premium p.a 850 500 Miles run per litre 6 5 Mileage run during the year 15000 6000 Estimated life of vehicles 100000 miles 75000 miles Charge interest at 10% p.a on the cost of vehicle. The vehicles run 20 miles per hour on an average. 18. Following information to the manufacturing of a component X - 101 is a cost centre: Cost of materials 6 paise per component Operator's wages 72 paise an hour Machine hour rate Rs.1.50 Setting up time of the machine 2 hours 20 MINUTES Manufacturing time 10 minutes per component. Prepare cost sheet showing both products and setting up cost, total and per unit when a batch consist of ; a) 100 components b) 1000 components. SECTION - C Answer any TWO questions (2 20 = 40 marks) 19. From the following particulars extracted from the books of r ltd for the month of June 1998, prepare the following, a) Statement of Equivalent Production b) Statement of cost c) Process Account (i) Opening stock as on 1st June 200 units @ Rs.4.00 per unit. Degree of completion Materials 100% Labour and overheads 40% (ii) Inputs introduced during the month 1050 units. (iii) Output transferred to the next process 1100 units (iv) Closing stock 150 units Degree of completion Materials 100% Labour and overhead 70% (v) Other relevant information. Materials - Rs.3150; Labour - Rs.4500; Over head - Rs.2250. 2 20. Sympionic Ltd has three production department XYZ and two service department A and B. The following estimated figures for a certain period have been made available: Rs. Rs. Rent and Rates 10,000 Power 3,000 Lighting and electricity 1,200 Depreciation of machinery 20,000 Indirect wages 3,000 other expense 20,000 following are the further details available. X Y Z A B Floor space (Sq.fts) 2000 2500 3000 2000 500 light points (Nos) 20 30 40 20 10 Direct wages (Rs) 6000 4000 6000 3000 1000 Hours power of machine 120 60 100 20 cost of machinery (Rs.) 24000 32000 40000 2000 2000 working hours 4670 3020 3050 The expense of the service department A and B are to be allocated as follows: X Y Z A B A 20% 30% 40% 10% B 40% 20% 30% 10% you are required to calculate the overhead absorption rate per hour in respect of three production departments. What will be the total cost of an article with material cost of Rs.80 and labour cost of Rs.40 which passes through X, Y and Z for 2,3 and 4 hours respectively? 21. The following figures have been extracted form the financial accounts of V ltd for the first year of its operation: Rs. Direct material consumption 50,000 Productive wages 30,000 Factory overheads 16,000 Administrative overheads 7,000 selling and distribution overhead 9,600 Bad debts written off 800 Preliminary expenses written off 400 legal charges 100 dividend received 1000 interest received on bank deposits 200 Sales (12000 units) 1,20,000 Closing stock: Finished goods (400 units) 3200 work in progress 2400 The cost accounts for the same period reveal that direct material consumption was Rs.56,000. Factory overhead is recovered at 20% on prime cost. Administration overhead is recovered at 60 paise per unit of production, selling and distribution overheads at 80 paise per units sold. Prepare profit and loss A/c to find out profit as per financial records and ascertain profit as per cost accounts. Also reconcile the profits as per the two records. 3