LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

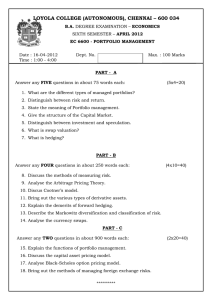

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.A., DEGREE EXAMINATION – ECONOMICS SIXTH SEMESTER – SUPPLEMENTARY – JUNE 2012 EC 6600 – PORTFOLIO MANAGEMENT Date : 27-06-2012 Time : 2:00 - 5:00 Dept. No. Max. : 100 Marks PART-A Answer any five in about 75 words each: (5×4=20 marks) 1. 2. 3. 4. What is an efficient portfolio? What are currency swaps? What is meant by hedging? How do you measure the variance of a portfolio consisting of two assets, if asset returns are correlated? 5. What do you mean by inflation risk? 6. What are options? 7. Define portfolio management. PART B Answer any four questions in about 300 words each: (4×10=40 marks) 8. State whether you agree or disagree with the following statement “An investor should be compensated for accepting unsystematic risk”. Give reasons in support of your answer. 9. Distinguish between investment and speculation. Is it possible to incorporate investment and speculation within the same security? Explain. 10. Explain the critical role of the correlation between assets in determining the potential benefits from diversification. 11. Explain Samuelson’s continuous equilibrium model. 12. Distinguish between future market and forward market. 13. Distinguish between systematic and unsystematic risks. 14. Consider the following kinds of information; indicate which form of the Efficient Market Hypothesis is supported if that information is reflected in security prices, a) Government released data on quarterly GDP b) A corporate quarterly earnings report c) A public release of information from SEBI on insider trading d) Confidential discussions of a corporate board of directors on dividend policy e) A history of stock prices. PART C Answer any two questions in about 900 words each: 15. Discuss Markowitz theory of portfolio selection. 16. Explain capital asset pricing model. 17. Explain Black-Scholes option pricing model 18. Explain arbitrage Pricing theory. $$$$$$$ ( 2 X 20 = 40 )