THE BASICS on Futures & Options Kansas City Board of Trade

advertisement

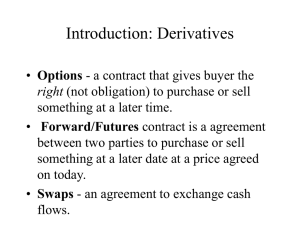

THE BASICS on Futures & Options Kansas City Board of Trade What are futures and options? A contract to make or take delivery of a product in the future, at a price set in the present In formalized futures and options trading on exchanges, standardized agreements specify price, quantity, and month of delivery Started in agriculture, but have expanded to a wide range of products Example If you agree in April with your Aunt Sue that you will buy two pounds of tomatoes from her garden for $5, to be delivered to you in July, you just entered into a futures contract! Why do futures and options markets exist? Risk Transfer Price Discovery How does trading futures and options work? Similar to stocks, gains and losses are the result of price changes How does trading futures and options work? Futures can be highly leveraged Options risks differ depending on position How does trading futures and options work? A number of factors to consider including account type, trading style Traded through a registered broker K.C. Isgreat: A simplified, hypothetical trading example Do your homework Choose a broker Enter into an agreement Make your first trade K.C. Isgreat: A simplified, hypothetical trading example The first trade…. K.C. Isgreat: A simplified, hypothetical trading example Futures Transaction Sell futures Buy back futures 950.00 939.00 Total Return 11.00 Sell futures Buy back futures 950.00 959.00 Total Return -9.00 11.00 x $100=$1,100 9.00 X $100 = -$900 THE BASICS on Futures & Options Ideas for portions of this presentation came from “Understanding Opportunities and Risks in Futures Trading,” a publication of the National Futures Association. To order that publication or other NFA materials, please call the NFA’s Information Center toll-free at 1-800-621-3570. This presentation is in no way intended to provide a complete futures education. Sources for additional information include the NFA, the exchanges where various products are traded, and your broker or advisor. Value Line is a registered mark of Value Line, Inc., a New York corporation that provides financial services and publications. Since 1982, the Kansas City Board of Trade has been licensed to use the Value Line mark in connection with its efforts to establish futures markets tied to the Value Line index. The Kansas City Board of Trade and Value Line, Inc. are not affiliated corporate entities.