IMPORTANT GUIDANCE NOTE TO CHARGING POLICY

advertisement

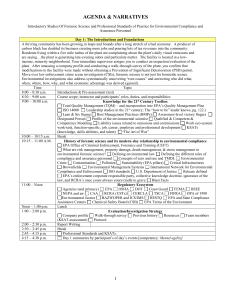

IMPORTANT GUIDANCE NOTE TO CHARGING POLICY Requests for credit /clarification of enforcement charges: Please note that: Only valid queries on enforcement charges will be considered (i.e. only if accompanying information is full and complete). Only one Clarification & one Credit Request /year/licensee will be assessed. Requests for clarification or credit will not delay enforcement actions to recover outstanding fees. The decision on a query/clarification is final. Your correspondence should be in the form of this completed note (electronically completed is sufficient –no need to sign or post a hard copy). Complete the following 3 steps: STEP 1 Please review and classify your communication in BOX A into either 1. Credit Request or 2. Clarification STEP 2 If a 'Credit Request' please classify into Types A-D & provide evidence outlined in Table 1. If this evidence is not provided the request will be considered invalid and not progressed further OR If a 'Clarification' complete Table 2. STEP 3 Submit your completed form to EDEN or by email to OEEChargeQUERIES@epa.ie Submit this completed form: Facility Name: Reg No: STEP 1 BOX A. Classify request as a: 1. Credit request Complete evidence requirement in Table 1 2. Clarification Complete information in Table 2 Yes/No (delete as appropriate) Yes/No (delete as appropriate) Note: Requesting clarification or credit request will not delay enforcement actions to recover outstanding fees and only 1/CR and 1 Clarification per year/license will be addressed Continued below……… Table 1 ‘Credit Request’ evidence requirement You must select one or more of 1A-D and provide evidence as outlined. STEP 2 1. Credit request basis Evidence A. An inappropriate enforcement category has been applied Provide specific reason as to why the RMBE category applied is inappropriate. This should refer specifically to RBME guidance, and to specific factual inaccuracies. General assertions that the RBME Category doesn’t suit the facility, or improvements have been made will not be sufficient. Provide the following detail from your RBME return: i. RBME file name: i. ii. iii. Worksheet #1-10 where error is: Question number where error is: Error explaination Your Enforcement Category is reviewed every year and will not be changed without specific evidence of significant factual errors. B. Certain emissions monitoring Provide evidence that monitoring has not been carried out. has been charged Air montoring carried out by EPA is MCERTS certified and for but not carried out alternate monitoring/cost comparisions will not be considered. All montoring is reviewed in detail each year and will not be changed without evidence of it being inappropriate C. The licensee has ceased to Provide whichever of the following details are appropriate: operate or surrendered its (i) Date of surrender application: licence during the relevant (ii) Date of surrender approval by EPA: charge period – or the nature of (iii) Are there environmental issues on site which may impact on the activity has substantially surrender? changed (iv) Have you been alerted to potential or actual remediation or contamination clean up costs? (v) When did the site cease activities? (vi) Have you notified the Company Registration Office of cessation of business activities? And if so, enclose copies of such notifications. (vii) Has an examiner/receiver been appointed? (viii) How does reduced/ceased activity result in a lesser impact to the environment D. The enforcement charge is Please submit three years pattern of financial information in resulting in a disproportionate support of your claim. burden on the activity. This may comprise of copies of audited accounts (for a limited company), or documentation from the Revenue Commissioners indicating nil tax liabilities, or trading losses over the period in question, or an Income Tax balancing statement, or other documentation to substantiate the financial situation outlined. Please note that management accounts will be viewed as having limited value. Table 2 ‘Charge Clarification’ Information requirement: You must review documentation referred to below and confirm that you have done so in 2(i), and you must then complete 2(ii). No credit will be assigned on foot of a clarification request. STEP 2 2. Charge Clarification (i) I undertake that I have reviewed the following guidance documents: The “EPA Licensing & Enforcement Charging Policy” here. RBME guidance RBME FAQ’s Enforcement charges FAQ’s (attached below) Yes/No (ii) (delete as appropriate) Please state your question and why the above documents do not clarify your question: Queries will not be addressed unless licensee states that they have reviewed the guidance documents linked. You are encouraged to read the attachments which have been produced specifically to clarify charging matters for licensees. Enforcement Charges FAQ’s How is the charge calculated? This is outlined in detail in section 4 of the EPA Licensing & Enforcement Charging Policy Can I get a breakdown of my charges? A breakdown is provided along your annual invoice. No further breakdown will be provided. It consists of the following: Description Compliance Assessment Levy Enforcement Support Services Audits and Inspections Levy Sampling & Analysis of Emissions Standing Charge Levy Animal Health Sentinal Scheme (where applicable) Charge €xxxx €xxxx €xxxx €xxxx €xxxx What are the criteria for reducing enforcement charges? This is governed by the EPA Licensing & Enforcement Charging Policy and more specifically 4 criteria: Why has my charge changed from last year? The answer to this question varies, however if you look at your invoice cover letter it may provide you with further information in relation to your charge. The main reasons for significant changes in charges include: changes in the enforcement category for your facility and/or changes in EPA check-monitoring requirements. If the OEE Inspector doesn’t visit my facility as often as is suggested in the charges will I get a credit? No. These costs are apportioned as levies on a burden sharing principle. Note the extract from the charging policy below What happens if I decide not to pay my annual enforcement charges? You will receive a number of reminder letters from the EPA. After this the EPA will commence debt collection/enforcement action and subsequently the debt will be pursued through the courts. It is open to the EPA to pursue these matters through the commercial courts as a debt collection matter, or through the criminal courts since non-payment of the charges is a breach of the licence conditions. If I submit a clarification request can I get an enforcement charge credit? No. No credits will be issued on the basis of a clarification. If you feel that you are entitled to a credit, you must sate this and submit your correspondence as a Credit Request’ and provide the evidence to support your claim (on the above form). I will pay my enforcement charges but times are tough – can the EPA make any allowances for payment plans? Yes. If you suggest a reasonable payment plan as part of your ‘Credit Request’ then the EPA will try to accommodate you. However, you must provide evidence/information to support such a request. Can I provide a Purchase Order Number? The EPA has ceased the practice of routinely requesting a purchase order in respect of annual enforcement charges. If there are special and exceptional circumstances for your organisation, a request must be made to the EPA using the email address purchaseorders@epa.ie, outlining the reasons why it is necessary that your charge notice should include a purchase order number. When do EPA normally send out enforcement charges invoices? After completion of the RBME process (see RBME guidance and RBME FAQ’s) in Q3 this information is then used to feed into the charging process. Charges are normally approved and issued in Q1 of the following year. Who should I send queries on my annual enforcement charges to? If you have a clarification of the specific charge of credit request relating to your charges you must submit your correspondence via EDEN or on the above form. You should then submit your completed application to OEEChargequeries@epa.ie . If you have a question/issue regarding accounts, PO Numbers, account balance etc. contact accountspayable@epa.ie What year do my charges relate to? Charges relate to a calendar year and are based on the RBME return provided during the previous year. The RBME draws its information from the most recent full calendar year of enforcement information. Can I have my RBME category changed? Licensees are required to submit their RBME return annually. You are advised to review this carefully and ensure it is factually correct. The EPA reviews these returns and pays particular attention to increases and decreases in individual categories. If the EPA disagrees with your proposed category it will be changed. If you feel your RBME category is inappropriate you must submit your query as a ‘Credit Request’ and provide the evidence to support your claim (on the above form). Your Enforcement Category is reviewed every year and will not be changed without specific evidence of significant factual errors. What if I don’t agree with my RBME category? As above see also RBME guidance and RBME FAQ’s If all piggeries and poultry facilities are assigned the enforcement category P-P then why do the charges vary? The standard RBME process is not carried out on pig and poultry facilities – nevertheless certain factors are taken into account when setting annual enforcement charges. The cost for air monitoring carried out by EPA seems high. Can it be reduced? The air monitoring carried out on behalf of the EPA is carried out to a high standard and is MCERTS compliant. Comparing this cost to monitoring carried out by non-certified 3rd parties is not a valid comparison. The EPA reviews this cost on a regular basis and makes significant efforts to keep it as low as possible. EPA charges this directly to licensees – i.e. there is no ‘mark-up’.