Financial Evolution, Regulatory Reform and Cooperation in Asia Doowon Lee

advertisement

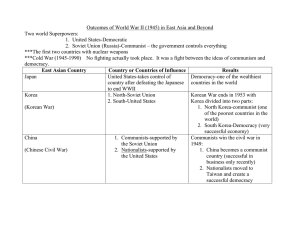

Financial Evolution, Regulatory Reform and Cooperation in Asia Session 3: Asian Financial Cooperation Doowon Lee Financial Sector in Korea: Competitiveness & Problems • Relatively Weak Competitiveness Index • Low Productivity • Growing Size Ranks of Korean Economy and Financial Market 0 10 20 30 40 Rank 50 60 70 80 90 2006-2007 2007-2008 2008-2009 GCI 2009-2010 2010-2011 Financial Market Development 2011-2012 2012-2013 China 0 20 40 60 80 100 120 140 GCI Financial Market Development Japan 0 10 20 30 40 50 2006-2007 2007-2008 2008-2009 2009-2010 2010-2011 2011-2012 2012-2013 GCI Financial Market Development Disadvantage Rank 0 10 20 30 40 50 60 Commercial access 58 Banking system stability 52 Financial sector liberalization 43 Currency stability 42 Corporate governance 34 Taxes 34 Size index 70 31 Advantage Rank 0 Securitization 5 15 2 Insurance 3 Equity Market development 3 IPO Activity 10 6 Financial Information disclosure 8 Infrastructure 8 Efficiency index 10 Human capital 10 20 25 30 Labor Productivity by Sector 2010 Value added labor productivity USA Korea Japan 600 500 400 300 200 100 0 Total Agriculture & Fishery Manufacturing Construction Doowon Lee, School of Economics, Yonsei University Services Retail Sales & Food & Insurance & Accomodation & Communication & Transportation Financial Intermediation Financial Freedom & Financial Development Index in East Asia 6 5 Japan FDI 2012 4 Korea Malaysia China Hongkong Singapore Thailand 3 Indonesia Vietnam Philippines Bangladesh 2 1 0 0 10 20 30 40 50 60 Financial Freedom 2012 70 80 90 100 Financial Inter-relations Ratio(FIR) 25.00 20.00 15.00 10.00 5.00 0.00 1987198819891990199119921993199419951996199719981999200020012002200320042005200620072008200920102011 Korea Japan U.S.A. U.K. Asian Financial Cooperation • 2008 Global Financial Crisis and Korea • Need for Financial Cooperation in East Asia • Ways to Promote Financial Cooperation in East Asia Exchange Rate Fluctuation (won/$) 1,500 1,400 1,300 1,200 1,100 1,000 900 800 Source : Bank of Korea 700 600 Growth Rates of OECD Countries 8.0 6.0 4.0 France Germany Japan Korea United Kingdom United States 2.0 0.0 -2.0 -4.0 -6.0 -8.0 2006 2007 2008 2009 2010 2011 2012 Arguments on Economic Integration of East Asia • Why does East Asia need Economic Integration? • Steps for Economic Integration • Current Status of Economic Integration : Trade, Investment, Finance • Problems of Economic Integration • Decoupling of East Asian Economies from ROW Problems for FTA in East Asia • • • • • • • • • Diversity in economic size, structure, income level and etc. Free trade in agriculture sector Non-tariff trade barrier Proportion of intra-trade (decoupling with developed countries) Labor and capital movement Concern for Industrial Hallowing-Out Absence of political leadership: Rivalry bet China and Japan Chronic trade imbalance Relatively Weak Financial Cooperation Progress of Financial Cooperation & Integration • Failure of AMF (Asia Monetary Fund) in 1998 (a.k.a. Miyazawa Plan) • Chiang Mai Initiative (CMI) in 2001 : small size, bilateral ($7 bil) • Expansion of CMI in 2010 : big size, multilateral agreement ($120 bil) • Tasks to establish AMF - Contribution Ratio & leadership problem - Supervision of members and Loan conditions - Relationship with the IMF - Gap of economic level and structure between members Web of Bilateral Deals New Structure of CMI ($120 bn, %, 2010) Contribution Draw Vote Ways to Promote East Asian Financial Cooperation • Establishing Financial Safety Net in East Asia • Promote Intra-Regional Links: Bond Market • Reduce Financial Market Volatility in East Asia: Capital control and Internationalization of Asian Currencies • AMF Capital Control Policies • Need for Capital Control: Dangers of Uncontrolled capital flow • Examples of Capital Control: - Malaysia (1989-1995, 1998-2001) - Colombia (1993-1998) - Chile (1989-1998) - Brazil (1992-1998, 2009) - Indirect: India, China - Thailand (2010) - Korea (2011) • Conditions for Successful Capital Control: International Coordination of Policies The Incompatible Trinity Capital Control in Korea • 3 Kinds of Foreign Exchange Regulation - Restore taxes on interest income and transfer gains from foreigners’ bond investment - tighter regulations on banks' foreign exchange (FX) derivatives positions. - levy on foreign loan Developing Korean Won into International Transacted Currency • Lessons from financial crisis and cases of developed countries • Condition for International Key Currency - Stable value of currency (Balanced BOP) - Increasing demand for Korean won (Trade settlement, etc. ) - Active international transaction of Korean Assets (Real Estate, Stock, Bond) - Complete Convertibility & free flow