FIN3140s.doc

advertisement

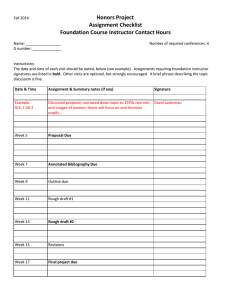

0 Finance 3140 PERSONAL FINANCE Fall 2002 TABLE OF CONTENTS I. General Information ............................................................................................................1 II. Academic Integrity Policies .................................................................................................3 III. Class Preparation /Projects/Homework ...............................................................................5 IV. Examination/Grading…..………………………………………………………………… …9 IV. Class Schedule…………………………………………………………………………... 10 Reserve Listing ..................................................................................................................12 1 TERM: Fall 2002 COURSE NUMBER: FIN 3140 COURSE TITLE: Personal Finance PREREQUISITES: none CATALOG DESCRIPTION: Survey of the problems and techniques of personal financial planning. Includes consumer credit, insurance, taxes, home ownership, personal investment, managing cash income, controlling expenditures, and estate planning. Students majoring in financial services or finance may not take this course for credit. INSTRUCTOR: Dr. Cheryl Frohlich OFFICE: 42/3210 OFFICE HOURS: Tu: 10:30-11:30 Tu Th: 7:15-9:00 and by appointment PHONE: 620-2630 (office); 223-7249 (home) CLASS TIME: Fin 3140 Section 009 Tu Th 3:05-4:20 Bldg. 42/ 2124 REQUIRED: PERSONAL FINANCE by Madura. PERSONAL Planning Workbook by Madura Suggested: Financial Calculator (Texas Instrument--BAII Plus) FEDERAL RESERVE TOUR: THANKSGIVING HOLIDAY: DROP DATE: November 28-30 Thursday, November 7, 2002 LAST DAY OF CLASS: Friday, December 6, 2002 FINAL EXAM: Fin 3140: Sec. 009: Tuesday, December 10, 3:00-4:50 p.m. 2 WHY TAKE PERSONAL FINANCE? Ever person must deal with their personal finances. At some point in our lives (usually sooner than later), we must be able to negotiate a loan (where should we apply for the loan, what will the lender be looking for in their analysis, and when would be the best time to apply), decide how much to save and where to place the funds (stocks, bonds, mutual funds), determine what type of insurance policy you need for your life, disability, health, property/casualty needs, examine the types of pensions offered when seeking employment, and handle an estate (parents'). Understanding your personal finances is essential for everyone, unless you wish to depend on another's determination of your needs. COURSE OBJECTIVE: The primary overall objective of this course is to broaden all of our horizons with respect to personal financial issues. More specifically, we will look at those common financial issues that will impact us throughout our lives. An overview of and the related issues involved in personal and family financial planning with an emphasis on financial recordkeeping, planning your spending, tax planning, consumer credit, making buying decisions, purchasing insurance, selecting investments, and retirement and estate planning will be discussed. Your tests integrate concepts. They are not homework problems with different numbers. The student will upon the successful completion of the course be able to understand the difference between debt and equity securities, understand the types of mutual funds, determine the best credit terms on loans, calculate a loan's payments, understand the difference in types of insurance offered, and able to evaluate various pension offers. TYPE OF FORMAT: Successful and enjoyable learning in this class begins with class participation. Thus, lecture is not intended to be the only dominant format in this course. The instructor will provide lectures and highlight important points in classroom discussion. As this is a topic that many of us have interesting and instructive experiences, it is important for all to be involved. Guest speakers may be used, depending on speaker availability and course time constraints. Student suggestions for potential speakers and topics are encouraged. I will expect each of you to remain abreast of current developments in financial markets and financial institutions in general. In order to accomplish this objective, the Wall Street Journal along with certain weekly publications such as BusinessWeek, Newsweek, or Forbes need to be read on a regular basis. WRITTEN COMMUNICATION REQUIREMENT: Project/Cases--See below ORAL COMMUNICATION REQUIREMENT: Oral presentation skills will be demonstrated through class participation. 3 COMPUTER APPLICATIONS: CD Rom included with Financial Planning Workbook. Some excel usage possible to calculate retirement issues. INTERNATIONAL COVERAGE: None ENVIRONMENTAL ISSUES COVERED: None ETHICAL ISSUES COVERED: Ethics will be discussed as it pertains to the use of finance in managerial decisions and its impact upon the organization. ACADEMIC INTEGRITY POLICIES ETHICS AND CODE OF CONDUCT In today's environment, ethics has become an extremely important topic. These characteristics are not bestowed upon you at graduation but are developed over time. The College of Business Administration has published an undergraduate handbook which includes a Code of Conduct. All items listed will be strictly enforced. Any student violating any aspect of the code of conduct will be penalized and receive a grade of `F' for the course and referred to the proper authorities for expulsion from the University. Specific items that relate directly to this course are: Cheating Intentionally using or attempting to use unauthorized materials, information, notes, study aids or other devises in any academic exercise. This definition includes unauthorized communication of information during an academic exercise. This includes, but is not limited to the following: (1) Computer assignments must be done independently. (2) Copying or allowing copying by another student or students constitutes cheating. Multiple Submissions The submission of substantial portions of the same academic work for credit more than once without authorization. (1) Computer assignments must be done independently. Abuse of Academic Materials Intentionally or knowingly destroying, stealing, or making inaccessible library or other academic resources such as: (1) Solution manuals. (2) Instructor's overheads. 4 Complicity in Academic Dishonesty Intentionally or knowingly helping or attempting to help another to commit an act of academic dishonesty (1) Providing answer(s) to a later class. (2) Asking other student(s) or class(es) for answer(s). DISABILITY ACT: If you have a disability, as defined by the American with Disability Act (ADA), which requires a classroom accommodation or auxiliary aid(s), please inform me of your needs during the first week of class so that I may take appropriate action. Individuals who require reasonable accommodations must contact the Office of Disabled Services Programs at Founders Hall, Building 2, Room 2120, 904-620-2769 as soon as possible. CLASSROOM PROTOCOL Success in business requires much more than adequate technical training. Some of the factors that you should have developed by now include: (1) dependability (e.g., attend class regularly) (2) punctuality (e.g., class starts on time) (3) courtesy (e.g., pay attention, don't pack up early) (4) motivation (e.g., be adequately prepared for class) If you need to leave class early, please notify the instructor and sit towards the back near or on the end seat of the row. POLICY ON LATE WITHDRAWALS The University policy for dropping a course after the last official drop date, is as follows: UNF students are not allowed to drop a course after the official withdrawal date unless there are unusual circumstances that are clearly beyond the student's control. When such cases exist, the student should file a petition with attached documentation. The instructor does not approve or disapprove, but assigns a grade of WP or WF. The instructor may also recommend an action to be taken or write a note explaining unusual circumstances connected with the course. This policy means that students do not have the right to drop a course after the official university deadline simply because they have a passing grade at that time. 5 CLASS PREPARATION/PROJECTS/LOTUSNOTES/HOMEWORK Attendance/Participation: Attendance will be taken and are part of the grade for the course. Students will be called upon at random in class to discuss in class. If a student is unprepared for the class they will lose points in the following schedule Absences Points 0 -1 20 2 10 3 5 4 0 Unprepared 0 -1 2 3 4 Points 20 15 5 0 Projects: Two copies of the rough draft of your paper(s) will be due on the first due date. If the rough drafts are not submitted on the appointed dates (March 6 and March 29 respectively) the student will lose 10% of the possible points for the paper. The paper(s) will be given to fellow students to read and critique. The critiqued papers will be due the following class period ( March 8th and April 3, respectively). If the critiqued papers are not returned on the appointed dates by the critiquing student-10% of the possible points on the critiquing students paper will be lost. STOCK-PORTFOLIO: Due Date: Rough Draft November 5th---Final Paper November 12th The student has $100,000 (play money (sorry!)) to invest. The student will invest the money in 3 stocks, 2 bonds, and 3 mutual funds. These investments will occur as follows: The student will purchase 2 stocks common stocks (one on the New York Exchange and one on the NASDAQ). In addition, the student will purchase one preferred stock. A Treasury and corporate bond will also be purchased. Three mutual funds (one stock, one equity and one international) will be purchased. The prices of the securities will be recorded at least once a week (on the same day). Securities may be sold after holding the security for two weeks. The entire $100,000 must always be invested somewhere (even if in a savings account). Accrued interest and declared dividends must be accounted for in the portfolio. Returns will be calculated on the investments. It is required that upon completing the stock portfolio-simulation, the student write a two page paper 6 double-spaced on what they learned about the process of investing. As a minimum, the student will discuss what type of strategies on investing they employed (does not have to be financially sound), what they observed and learned from trading in the various markets, how they monitored their portfolio, and any overall observations on the market. A spreadsheet which will list the securities purchased, the date purchased, the price paid for the security, dividends/ interest paid or accrued, the date the security was sold, the selling price, the return on the security, and the overall portfolio return must be included as an attachment. The paper will be graded upon writing skills (i.e. Introduction, body, conclusion, spelling, sentence structure, etc.), displaying an understanding of the investment concepts, and following the directions of the project. The project is not graded upon the performance of the investment portfolio. Two copies of the rough draft of your paper will be due on the first due date. If the rough drafts are not submitted on the appointed dates (November 5th) the student will lose 10% of the possible points for the paper. The paper will be given to fellow students to read and critique. The critiqued papers will be due the following class period (November 7th ). If the critiqued papers are not returned on the appointed date by the critiquing student-10% of the possible points on the critiquing students paper will be lost. Economic Indices Paper: Due Date: Rough Draft Due October 22nd----Final Paper Due October 29th Current Indices and implications for forecast: Record the annualized percentage changes on the following economic indices: the real GDP, CPI, unemployment rate, housing starts, consumer confidence index, consumer credit, business inventory levels, the balance of trade, and money supply (M-2). These indices are either monthly or quarterly updated. You will collect twelve months data prior to the start of the semester (August 2001- August 2002) on those indices that are monthly and eight quarters of data (the second quarter 2000 through 2nd quarter 2002) on those indices that are quarterly. During the semester, you will collect the current information on these indices. Current movement of market and interest rates: Also, collect and record 12 prior months (August 2001- August 2002) of annualized returns on the market return (use the market index: NYSE.), short-term interest rates (Treasury Bill), and long-term interest rates (30 year T-Bonds). During the semester, you will collect the current information on these indices. It is required that upon completing the indices project, the student write a two page paper doublespaced on the changes in the indices, what they measure, and the implications of the aggregate changes seen during the collection period. As a minimum, the student will discuss what each index measures and the implications the changes that occurred in the indices have on the overall economy. In addition, a summary on the changes seen during the collection period in the indices and the 7 overall forecast for the economy based upon the changes in indices (economy is expanding or contracting) and the resulting interest rate movement. A spreadsheet which includes the indices listing their prices or rates and the rate of change on the indices must be included as an attachment. The paper will be graded upon writing skills (i.e. Introduction, body, conclusion, spelling, sentence structure, etc.), displayed understanding of the economic concepts, and following the directions of the project. Two copies of the rough draft of your paper will be due on the first due date. If the rough drafts are not submitted on the appointed dates (October 22nd) the student will lose 10% of the possible points for the paper. The paper will be given to fellow students to read and critique. The critiqued papers will be due the following class period (October 24th). If the critiqued papers are not returned on the appointed date by the critiquing student-10% of the possible points on the critiquing students paper will be lost. WRITTEN COMMUNICATION REQUIREMENT: INDIVIDUAL and GROUP CASES The case method presents real world situations as closely as possible to the manner in which you would face them. Unlike the usual problems in textbooks, cases may be longer, provide more information on the financial issue(s) represented, and present many of the uncertainties facing decision-makers in an actual situation. You will seldom know what the answer is or should be. Rather, you can only identify what you perceive to be the problem(s), analyze alternative solutions, and select the approach most appropriate for the particular set of facts in the case. You should concentrate on the problem but only after a thorough analysis of the facts. Great significance will be placed on (1) your ability to reach sound decisions that are consistent with your analysis and research and (2) your ability to communicate your analysis in an effective manner. The case problem must be stated with a listing of any constraints and a brief background of the case. Homework/Quizzes: Homework and attendance are essential parts of the learning process. It is the student's responsibility to have read the assigned chapter(s) or cases before coming to class. Problems must be attempted before class or Help Sessions. Assignments should be prepared and are due on the dates indicated by the instructed. There will usually be a one-week turnaround time on homework. Late homework will not be accepted. Late is defined as the day I return the homework in class. There will be quizzes/homework throughout the semester. Absolutely no makeup quizzes will be given. If the quiz is announced and you must be out of town, you will need to coordinate taking the quiz prior to your departure. Only the highest five homework/quizzes/cases will count towards the final grade. 8 EXAMINATIONS AND GRADING Examinations: There will be three hourly tests. The professor leaves an option to dropping a test depending on how the class progresses. If a test is dropped the percentages will be adjusted accordingly. The last test may be comprehensive. If you do have to miss a test, clear it with the professor PRIOR (PRIOR DOES NOT MEAN AN HOUR BEFORE) to the exam. Exams may be taken early but as a general case NO MAKE-UP's are given. Exams are to remain in control of the professor. FAILURE TO RETURN AN EXAM RESULTS IN AN AUTOMATIC ZERO FOR THAT TEST. FORMULA SHEETS Formula sheets may be used during quizzes and tests. Only the formula may be written on a sheet of paper. Examples or directions on how to use the formula cannot be on the sheet. All Formula sheets must be cleared with the Instructor before the test begins and attached to the test upon completion. 9 GRADING: Grading schedule is subject to change given class progress—Notification will be provided prior to change. Test 1 Test 2 Final Participation Attendance Portfolio Project* Interest Project* Cases Quizzes/Homework (Top five) TOTAL 100 points 100 points 100 points 20 points 20 points 20 points 10 points 20 points 60 points 450 points Two copies of the rough draft of your paper(s) will be due on the first due date. If the rough drafts are not submitted on the appointed dates as listed above for the respective papers the student will lose 10% of the possible points for the paper. The paper(s) will be given to fellow students to read and critique. The critiqued papers will be due the following class period. If the critiqued papers are not returned on the appointed dates as listed above for the respective papers by the critiquing student-10% of the possible points on the critiquing students paper will be lost. A B C D F Percentage 90-100% 80-89% 70-79% 60-69% 0-59% A student must have earned at least 90% of the total possible course points (maximum 100) to obtain an 'A' for the course. Similar requirements for letter grades, B, C, and D are indicated on the schedule above. Instructor reserves the right to assign + or -. Although, quite often the final grades are curved, this is not a certainty. Therefore, the most conservative approach will be to use the above percentages for grading during the semester. 10 CHAPTER OUTLINE Chapter 1 Overview of a Financial Plan Chapter 2 Planning with Personal Financial Statements Chapter 3 Applying Time Value Concepts Personal Investing: Chapter 10 Basics for Investing in Stocks Chapter 11 Valuation and Analysis of Stocks Chapter 12 Buying Stocks Test* Chapter 13 Investing in Bonds Chapter 14 Investing in Mutual Funds Chapter 15 Asset Allocation Personal Financing: Chapter 9 Purchasing & Financing a Home Chapter 8 Personal Loans Chapter 4 Tax Strategies Test* Managing Your Liquidity: Chapter 5 Banking & Interest Rates Chapter 6 Managing Your Money Chapter 7 Managing Your Credit 11 Protecting Your Wealth: Chapter 16 Auto, Homeowner, & Health Chapter 17 Life Chapter 18 Retirement Planning Chapter 19 Estate Planning *Test *Test may be moved depending on progress of class 12 Reserve Listing Financial Planning Workbook Personal Finance by Madura