FINANCIAL STATEMENTS

advertisement

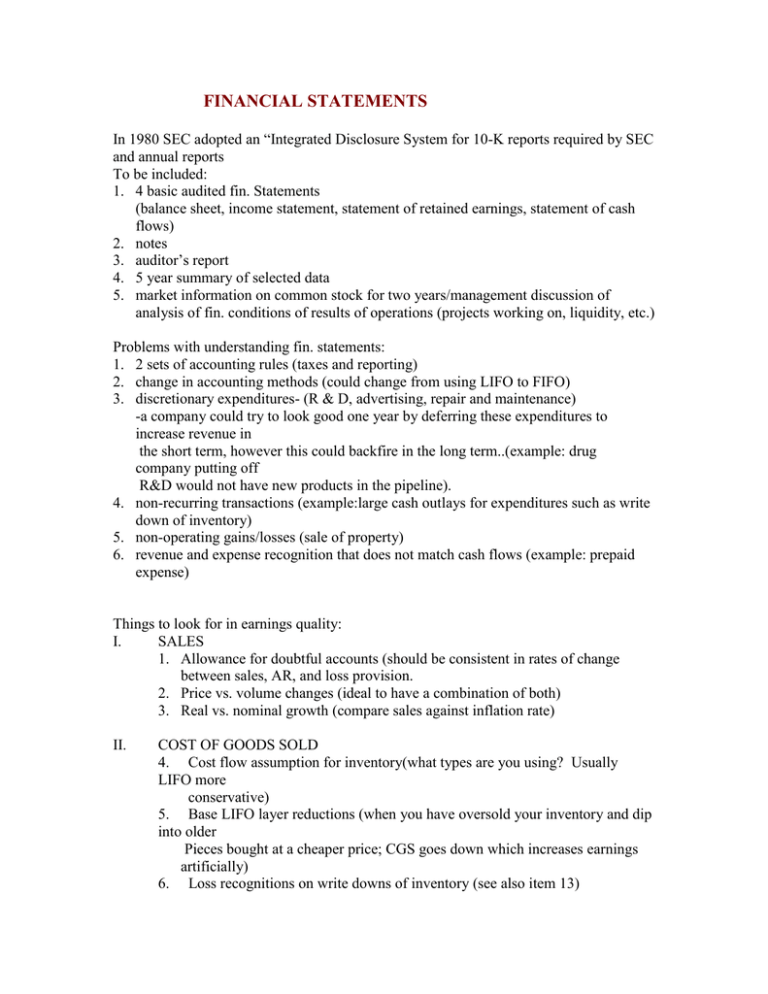

FINANCIAL STATEMENTS In 1980 SEC adopted an “Integrated Disclosure System for 10-K reports required by SEC and annual reports To be included: 1. 4 basic audited fin. Statements (balance sheet, income statement, statement of retained earnings, statement of cash flows) 2. notes 3. auditor’s report 4. 5 year summary of selected data 5. market information on common stock for two years/management discussion of analysis of fin. conditions of results of operations (projects working on, liquidity, etc.) Problems with understanding fin. statements: 1. 2 sets of accounting rules (taxes and reporting) 2. change in accounting methods (could change from using LIFO to FIFO) 3. discretionary expenditures- (R & D, advertising, repair and maintenance) -a company could try to look good one year by deferring these expenditures to increase revenue in the short term, however this could backfire in the long term..(example: drug company putting off R&D would not have new products in the pipeline). 4. non-recurring transactions (example:large cash outlays for expenditures such as write down of inventory) 5. non-operating gains/losses (sale of property) 6. revenue and expense recognition that does not match cash flows (example: prepaid expense) Things to look for in earnings quality: I. SALES 1. Allowance for doubtful accounts (should be consistent in rates of change between sales, AR, and loss provision. 2. Price vs. volume changes (ideal to have a combination of both) 3. Real vs. nominal growth (compare sales against inflation rate) II. COST OF GOODS SOLD 4. Cost flow assumption for inventory(what types are you using? Usually LIFO more conservative) 5. Base LIFO layer reductions (when you have oversold your inventory and dip into older Pieces bought at a cheaper price; CGS goes down which increases earnings artificially) 6. Loss recognitions on write downs of inventory (see also item 13) III. OPERATING EXPENSES 7. Discretionary: look at if they are increasing or decreasing. -research and development -repair and maintenance -advertising and marketing 8. Depreciation (depletion, amortization) -methods -estimates 9. Pension accounting-interest rates assumptions IV. NON-OPERATING REVENUES AND EXPENSES 10. Gains (losses) from sale of assets 11. Interest income 12. Equity income 13. Loss recognition’s on write-downs of assets (also see item 6) 14. Accounting changes 15. Extraordinary items V. OTHER ISSUES 16. Acquisitions and dispositions 17. Material changes in # of shares outstanding (if company buys back stock, increases EPS) FINANCIAL STATEMENTS Income Statement -presents revenues,expenses,net income and EPS for an accounting period Balance Sheet (Statement of Condition or Statement of Financial Position) -shows fin. condition or fin. position of a company on a particular date -summary of what a company owns and what it owes to others (liabilities) and to internal owners (stockholders) -includes comparative data (2 yr. Audited bal. Sheets/ 3 yrs. Income statements) Statement of Cash Flows –provides information about cash inflows and outflows Statement of Shareholder’s Equity -reconciliation in dollars and shares of all accounts from the stockholder’s equity section Accounting Results Can Be Counterintuitive Income isn't cash in hand E.g.: Receivables Depreciation A Conventional Income Statement Format Sales Cost of Goods Sold Gross Margin Expense Earnings Before Interest & Taxes Interest Expense Earnings Before Tax Tax Net Income $1,000 600 $400 230 $170 20 $150 50 $100 Sales - Revenue Proceeds from sale of product or service (only) COGS Spending on things closely related to production Material, labor, production overhead Gross Margin Profitability of production operations Often expressed as a percent of sales Expenses Other spending - Marketing, finance, personnel BALANCE SHEET ASSETS Cash Accounts Receivable Inventory CURRENT ASSETS $1,000 3,000 2,000 $6,000 Fixed Assets Gross $4,000 Accum Depr (1,000) Net $3,000 TOTAL ASSETS LIABILITIES Accounts Payable Accruals $1,500 500 CURRENT LIABILITIES $2,000 Long Term Debt Equity $5,000 2,000 TOTAL CAPITAL $7,000 TOTAL LIABILITIES $9,000 AND EQUITY $9,000 ASSETS = LIABILITIES + EQUITY Arrangement in order of decreasing liquidity ASSETS Current Assets Due within a year Cash Checking accounts + Currency Accounts Receivable Due from sales on credit Offset-Allowance for doubtful accounts (bad debt reserve) Writing off of uncollectibles Overstatement of receivables Inventory Raw Material, WIP, Finished Goods Offset - Inventory reserve Writing off bad inventory Overstatement of inventory Fixed Assets Long lived - depreciated Stated Net of Accumulated Depreciation If sold - cost is NBV Year Income Statement 1 Deprec Exp $2,500 Balance Sheet Gross Accum Depr Net $10,000 (2,500) $ 7,500 $10,000 (5,000) $5,000 2 Deprec Exp $2,500 Gross Accum Depr Net 3 Deprec Exp $2,500 Gross Accum Depr Net $10,000 (7,500) $2,500 4 Deprec Exp $2,500 Gross Accum Depr Net $10,000 (10,000) -0- LIABILITIES Current Liabilities Due within a year Accounts Payable Due from purchases on credit Terms of sale Stretching payables Understatements Notes Payable Current maturities on long-term debt Accrued LONG TERM DEBT Bonds and Loans Debt generates interest expense - Increases risk of failure EQUITY Direct Investment by owners paying for stock par value and paid in excess accounts Retained Earnings Example: 20,000 shares of $2 par sold for $8 Firm Earns $70,000 Pays dividends of $15,000 Common Stock ($2 x 20,000) $ 40,000 Paid in Excess ($6 x 20,000) 120,000 Retained Earnings ($70,000 - $15,000) 55,000 Total Equity $215,000 Accruals Recognizes incomplete transactions An example: A Payroll Accrual Thurs Fri Sat Sun Mon Tues Wed Thurs Payday Fri Sat Payday End of Month Close First Month Second Month Working Capital Current Assets - Current Liabilities Supports routine operations CAPITAL LONG TERM DEBT Bonds and Loans Debt generates interest expense - Increases risk of failure Leverage Amplifies return on investment - both ways EQUITY Direct Investment by owners paying for stock par value and paid in excess accounts Retained Earnings Example: 20,000 shares of $2 par sold for $8 Firm Earns $70,000 Pays dividends of $15,000 Common Stock ($2 x 20,000) $ 40,000 Paid in Excess ($6 x 20,000) 120,000 Retained Earnings ($70,000 - $15,000) 55,000 Total Equity $215,000 The Relationship Between Net Income and Retained Earnings Beginning Equity + Net Income - Dividends + Stock = Ending Equity Cash Flow Statements (sources & uses of funds) CASH FLOW Businesses run on cash, not on accounting profits. It's possible to go out of business while making a profit. THE STATEMENT OF CASH FLOWS (THE STATEMENT OF CHANGES IN FINANCIAL POSITION) Shows where money actually comes from and goes to Developed from the basic income statement and balance sheet Shows changes over time rather than absolute dollar amount of the accounts at a point of time Other Terminology for The Statement of Cash Flows Funds flow Sources and uses (applications) of cash or funds Statement of changes in financial position BASIC APPROACH Since balance sheet balances the changes in balance sheet account must balance ( changes in cash outflows = changes in cash inflows) Preparation of Statement: Calculate the changes of all balance sheet accounts List changes as inflows or outflows Categorize flows as operating financing investing Inflows-Outflows=Change in Cash Free Cash Flows Net cash flow after reinvestments needed for growth and to replace worn-out equipment If free cash flow is negative, the firm must either borrow or raise more equity capital to be viable in the long run. CASH FLOW RULES Asset Increase Asset Decrease Liability Increase Liability Decrease = = = = Use (outflow) Source (inflow) Source (inflow) Use (outflow) CASH FLOW IN BUSINESS Organized into three activities Operating Activities Routine running of the company Sales, investment income, collections, inventories, wages, overhead, etc. Paying interest on debt Paying taxes Investing Activities Commitment of long term capital Usually buying or selling fixed assets Sale (purchase) of property, plant, equip Sale (purchase) of other companies’ debt or equity Repayment of loans to others Financing Activities Equity and long term debt transactions Selling (buying) company stock and paying dividends Borrowing and repaying loans--principal (Note: Interest payment in operating activities) Two Methods to Calculate & Present Cash Flows Direct Indirect BUILDING THE STATEMENT OF CASH FLOWS Belfry Company Balance Sheet For the Period Ended 12/31/00 Cash Accts. Receivable Inventory CURRENT ASSETS Fixed Assets Gross Accum. Depr. Net TOTAL ASSETS ASSETS 12/31/99 $1,000 3,000 2,000 12/31/00 $1,400 2,900 3,200 $6,000 $7,500 $4,000 (1,000) $3,000 $9,000 $6,000 (1,500) $4,500 $12,000 LIABILITIES $1,500 $2,100 500 400 $2,000 $2,500 $5,000 $6,200 2,000 3,300 $7,000 $9,500 Accts. Payable Accruals CURRENT LIABIL. Long-term debt Equity TOTAL CAPITAL TOTAL LIABILITIES AND EQUITY $9,000 $12,000 Belfry Company Income Statement For the Period Ended 12/31/00 Sales COGS Gross Margin $10,000 6,000 $ 4,000 Expense Depreciation EBIT Interest EBT Tax Net Income $ 1,600 500 $ 1,900 400 $ 1,500 500 $ 1,000 Cash Operating Operating 400 100 (1200) Investing Operating (2000) 500 Operating Operating 600 (100) Financing Financing 1200 1300 Cash Flow Statement Indirect Method: OPERATING ACTIVITIES Net income $1,000 Depreciation 500 Net changes in current accounts (600) Cash from operating activities $ 900 Detail of Changes in Current Accounts Account Source/(Use) Receivables $ 100 Inventory (1,000) Payables 600 Accruals (100) $ (600) INVESTING ACTIVITIES Purchase of fixed assets ($2,000) (Note: excludes cash) FINANCING ACTIVITIES Increase in long-term debt $1,200 Sale of stock 800 Dividend paid (500) Cash from financing activities $1,500 UNDERSTANDING THE EQUITY ACCOUNT Amount Activity Net income $1,000 Operating Stock sale 800 Financing Dividend (500) Financing Change in equity $1,300 Net Cash Flow $ 400 COMMON SIZE STATEMENTS Ratios of income statement line items to sales revenue Facilitates operating comparisons over time and between companies of different sizes COMMON SIZE STATEMENTS Example: Alpha Sales Revenue Cost of Sales Gross Margin Expenses EBIT Interest EBT Tax Net Income $ $2,187,460 1,203,103 $ 984,357 505,303 $ 479,054 131,248 $ 347,806 118,254 $ 229,552 * Operating differences worth investigating Beta % 100.0 55.0 45.0 23.1 21.9 6.0 15.9 5.4 10.5 $ $150,845 72,406 $ 78,439 39,974 $ 38,465 15,386 $ 23,079 3,462 $ 19,617 % 100.0 48.0 * 52.0 26.5 * 25.5 10.2 * 15.3 2.3 * 13.0 TAXES Tax Bases and Taxing Authorities Income - Federal, State, a few cities Wealth - Real estate taxes - Cities and counties Consumption - Sales and excise taxes - all The Total Effective Income Tax Rate State tax is deductible from federal tax Taxable Income for State Tax $ 100 State tax @ 10% 10 Taxable Income for Federal Tax $ 90 Federal Tax @ 30% 27 Net After Tax $ 63 Total Tax $ 37 In general: TETR = Tf + Ts(1 - Tf) Progressive Tax Systems The U.S. federal tax system is progressive in that the tax rate increases with income. In a traditional progressive system a high income taxpayer retains the benefit of low rates on early income Tax Schedules (Tables) and Tax Brackets Hypothetical Example: Bracket 0 - $5,000 $5,000 - $15,000 over $15,000 Tax Rate 10% 15% 25% Brackets are ranges of income through which the tax rate is constant. Marginal and Average Tax Rates Marginal tax rate - the rate paid on the next dollar of income Average tax rate - the percent of total income paid in taxes The marginal rate is relevant for investment decisions because investments are generally made after basic needs are provided PERSONAL CAPITAL GAINS(and LOSSES) Income is either ordinary or capital gain/(loss) Historically, capital gains taxed at lower rates as an incentive to investment. Personal Capital gain rate is currently capped at: 28%.- Mid-term gains 20%- Long-term gains A maximum of $3,000 in capital losses can offset ordinary income in a year. PERSONAL TAX SCHEDULES (1998) Taxpaying unit is a household, usually a family Personal Tax Schedules Single Individuals Income Rate 0 - $25,350 15% $25,350 - $61,400 28% $61,400 - $128,100 31% $128,100 - $278,400 36% over $278,400 39.6% Married Couples Filing Jointly Income 0 - $42,350 $42,350 - $102,300 $102,300 - $155,950 $155,950 - $278,450 over $278,450 Rate 15% 28% 31% 36% 39.6% The Marriage Penalty Single people pay higher rates sooner, but a two income family pays more tax than two single people earning the same total income Exempt Income Exempt from taxation: Interest on municipal bonds Exclude from calculations Taxable Income Gross income less: exemption of $2,700 (in 1998) per person, and deductions of * mortgage interest * local taxes (income and property) * charitable contributions or a standard deduction CALCULATING PERSONAL TAXES Example: The Smith family had the following in 1998: Income: Deductions: Salaries: Joe $45,000 Mortgage Interest $12,000 Sue 42,000 Property Tax 1,800 Interest on savings acct 2,000 State income tax 3,500 Interest on IBM bonds 800 Charitable donations 1,200 Interest on Boston Bonds 1,200 Dividends - Gen Motors 600 Long-term Capital loss on property (3,000) Exemptions: 4 Long-term Capital gain on stock 2,000 Calculate their taxable income and tax liability. What are their marginal and average tax rates? Solution: Ordinary income: Salaries Interest Dividends $87,000 2,800 600 $90,400 Net capital gain or loss: Loss on property ($3,000) Gain on stock 2,000 Net capital loss ($1,000) Total Income $89,400 Deductions: Mortgage interest Taxes Charity Total deductions $12,000 5,300 1,200 $18,500 Exemptions: $2,700 x 4 = $10,800 Taxable Income $60,200 Use the married filing jointly schedule as follows: 15% of the entire first bracket $42,350 x .15 = $6,353 28% of the amount in the second bracket ($60,200 - $42,350) x .28 = 4,970 Tax Liability $11,323 Average tax rate: $11,323/$60,200 = 18.8% Marginal tax rate = bracket rate = 28% TAX RATES AND INVESTMENT DECISIONS If comparing corporate (interest taxable) and municipal (interest tax exempt) bonds then Must state rates on same basis. Multiply the corporate rate by one minus the investor's marginal tax rate Example: The Smith family (28% bracket) has a choice between an AT&T bond paying 11% and a Boston bond paying 9%. Solution: AT&T after tax = 11% x (1 – .28) = 7.92% < Boston = 9% Therefore prefer the Boston bond if risks are similar. If marginal tax rate is 15% 11% (1 – .15) = 9.35% then prefer AT&T High bracket taxpayers tend to be more interested in tax exempt bonds than those with lower incomes. CORPORATE TAXES Income is the business's revenue. Deductions are costs and expenses. Personal exemptions don't exist Taxable income is Earnings Before Tax (EBT) Income per financial books vs tax income CORPORATE CAPITAL GAINS (and LOSSES) Corporate capital losses are deductible only against capital gains. Net capital losses may be carries back and applied against net gains in the prior three years. Any remaining net capital losses may be carried forward for five years and applied against gain in those years. Capital gains tax rate is the same as the ordinary. Corporate Income Tax Schedule Income 0 - $50,000 50,000 - $75,000 $75,000 - $100,000 $100,000 - $335,000 $335,000 - $10,000,000 $10,000,000 - $15,000,000 $15,000,000 - $18,333,333 over $18,333,333 Rate 15% 25% 34% 39%* 34% 35% 38% * 35% Tax Calculation $0 + (15% x amount over $0) $7500 +(25% x amount over $50,000) $13,750 +(34% x amount over $75,000) $22,250 + (39% x amount over $100,00) $113,900 +(34% x amount over $335,000) $3,400,000 + (35% x amount over $10,000,000) $5,150,00 +(38% x amount over $15,000,000) 35% x taxable income The benefits of the 15 percent and 25 percent rates are phased out by imposing an additional 5 percent tax on taxable income between $100,000 and $335,000. The benefit of the 34% rate on taxable income between $335,000 and $10,000,000 is phased out by imposing an additional 3% on taxable income between $15,000,000 and $18,333,333. The effect of these provisions is that corporations with taxable incomes in excess of $18,333,333 pay a flat rate of 35% on all taxable income. Notice the up and down rates. Is the system progressive? Goals of the system: 1. Progressive: income under $10M taxed at 34% income over $10M taxed at 35%. 2. Lower rates on incomes up to $75,000. 3. Higher income taxpayers pay the targeted rates on their whole incomes. Surtaxes of 5% and 3% take away the benefit of low early rates as income increases Corporate Tax Examples Example : Tax for a corporation making EBT of $280,000 Solution: 50,000 .15 $25,000 .25 $25,000 .34 $180,000 .39 = = = = $ 7,500 6,250 8,500 70,200 $92,450 Corporate Tax Examples Example: Tax for a corporation making EBT of $500,000. Solution: Between $335,000 and $10 million, the overall tax rate is 34%. ($500,000-$335,000) x .34 + $113,900 = $170,000 Corporate Tax Examples Example : Tax for a corporation making EBT of $16 million Solution: The system recovers those benefits to an overall 34% rate up to $10 million. $10,000,000 .34 = $3,400,000 $5,000,000 .35 = 1,750,000 $1,000,000 .38 = 380,000 $5,530,000 Over $18,333,333, calculate a flat 35% 3 TAXES AND FINANCING The U.S. tax system favors debt financing because interest is tax deductible and dividends are not. DEBT EBIT $120 Interest 20 EBT $100 Tax @ 30% 30 EAT $ 70 Dividends Net RE add $70 EQUITY $120 $120 36 $ 84 20 $ 64 DIVIDENDS PAID TO CORPORATIONS Tiered ownership can result in multiple taxation PREFERRED DIVIDENDS PAID TO CORPORATIONS Ownership Exemption <20% 20% - 80% >80% 70% 80% 100% TAX LOSS CARRY BACK AND CARRY FORWARD YEAR 1 2 3 4 EBT $100 $100 ($250) $100 Tax (30%) 30 30 30 EAT $ 70 $ 70 ($250) $ 70 ($100) Adjusted EBT Tax EAT $0 0 $0 ($100) $0 0 $0 Total $50 90 ($40) ($50) $0 0 $0 $ 50 15 $ 35 $50 15 $35 Tax Loss Carry Forward and Carry Back Over the four year period paying $90 tax on earnings of $50 - impossible. Losses can be carried back two years and carried forward twenty (fifteen) years.