Another Lap for the Irish Hare?

advertisement

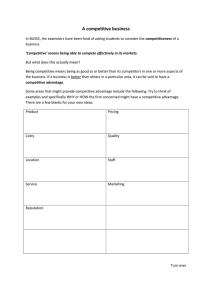

Another Lap for the Irish Hare? Patrick Honohan, Trinity College Dublin, June 2008 Overview • The dangers of misunderstanding the process that has occurred • The delayed convergence hypothesis (HonohanWalsh, 2002) suggests the rapid expansion is unlikely to be repeated, but that scale growth could continue… • …after an inevitable adjustment. (This adjustment is potentially rather severe, given the excesses of the housing market.) NB: Cover painting: http://www.wendyfwalsh.com/pages/shop2.htm The delayed convergence hypothesis • asserts that Ireland’s convergence to the leading-edge of EU economic performance was delayed – by a 25-year long cycle caused largely by inappropriate fiscal policy beginning just after EU membership in 1973. • emphasizes traditional virtues at three frequencies: – long term (institutions, structural policies, human and fixed capital formation); – medium-term (fiscal sustainability; helped ); – short term: (wage competitiveness and asset market stability). The delayed convergence hypothesis (2) The fundamentals were in place… …when the recovery phase arrived, it was facilitated by: – the timeliness of the flow of structural funds, – competitiveness gains from exchange rate movements and (of course) – the famous wage restraint of the social partnership Celtic Tiger period was not just an artefact of inward FDI boom and the low company tax rate (or even the structural funds) – these helped smooth the way, and have shaped important features of the economy today, but convergence to frontier living standards is more like the norm for an EU country given the traditional virtues. Stylized fact 1 The hare* has run its course (?) *Cf. Aesop’s Fables The hare has run its course • While many discussions focus on growth rates, the dynamics of unemployment are key to understanding what the Irish economy has done and can do. • We note the long business cycle 1973-2000 using the internal and external balance map. The Celtic Tiger period coincides with a recovery phase: exaggerates the long-term sustainable trend growth. Since 2000 the economy has remained close to the balance zone (also experienced in the 1960s)—though emerging BOP deficit is noted. • Now pessimism has set in (as evidenced from survey data). Is this warranted? 18 16 Unemployment rate 14 12 10 8 6 4 2 0 60 65 70 75 80 85 90 95 00 05 The 25-year business cycle delays the catch-up 18 1987 Unemployment rate % (ILO basis) 16 1993 14 12 1990 10 1997 1981 8 1975 6 1979 4 2006 2000 1974 1961 2 0 -6 -3 0 3 6 9 BOP Current a/c deficit as % GNP 12 15 18 ESRI Consumer Sentiment Index Feb 96-May 08 135 125 115 105 95 85 75 65 55 45 end-97 end-99 end-01 end-03 end-05 end-07 Stylized fact 2 No productivity miracles There is no productivity miracle to explain • There is no productivity miracle to explain • Forget about double-digit growth. Unadjusted data flatters what was a very good performance. MNC profits are one element calling for adjustment, Terms of Trade changes another. Netting these shows a good but not miraculous productivity growth. • (Nevertheless, income growth per head of population in the peak Celtic Tiger period years was excellent) Aggregate productivity growth 5 4 3 2 1 0 75/70 80/75 GDP/Empl 85/80 90/85 95/90 GDP less MNC profits/Empl 00/95 06/00 Growth in living standards 8 7 % per annum 6 5 GNP/Pop GNDI Adj ToT/Pop Personal Cons/Pop 4 3 2 1 0 -1 75/70 80/75 85/80 90/85 95/90 00/95 06/00 Stylized fact 3 Employment growth is still astonishing The miracle (if there is one) is in employment growth Not only sweeping in the unemployed… …but catering to increasing participation… …and attracting large-scale immigration. Distribution of population change by economic status 100 non-ag employment ag. employment thousands per annum 80 60 40 unemployed 20 0 non-active -20 Over 64 -40 Under 15 -60 61-71 71-86 86-91 91-01 01-06 Distribution of population change by economic status 100 thousands per annum 80 non-ag employment ag. employment 60 40 unemployed 20 0 non-active -20 Over 64 -40 Under 15 -60 61-71 71-86 86-91 91-01 01-06 Participation rates 56 75 54 74 52 73 50 72 48 71 46 <-- Female 44 70 Male --> 20 07 20 06 20 05 20 04 20 03 20 02 20 01 68 20 00 40 19 99 69 19 98 42 Employment in nonAg as % Population 50 45 40 35 30 25 20 15 10 5 0 1961 1971 1986 1991 2001 2007 Components of population change Net migration thousands (annuak average) 80 Natural increase 60 40 20 0 -20 -40 61-71 71-86 86-91 91-01 Components of population change Net migration thousands (annuak average) 80 Natural increase 60 40 20 0 -20 -40 61-71 71-86 86-91 91-01 01-06 Net migration 1930-2007 (000s) 80 60 40 20 0 -20 -40 -60 -80 30 40 50 60 70 80 90 00 Stylized fact 4 Distribution is stable Income distribution/poverty The benefits extend through most of the income distribution… …But, especially recently, incidence of acute poverty (“basic deprivation”) has not fallen Poverty in Ireland (Absolute/Consistent and Relative Concepts) 25 15 Below 60% of median income 10 Experiencing basic deprivation 5 2001 2000 1997 0 1994 % of population 20 Poverty in Ireland (Absolute/Consistent and Relative Concepts) 25 15 Below 60% of median income 10 Experiencing basic deprivation 5 2006 2005 2004 2001 2000 1997 0 1994 % of population 20 Nolan (2004), CSO (2007) Stylized fact 5 Some financial vulnerability is evident Financial vulnerability? Export-led growth was replaced after about the rune of the millennium by a housing boom with several causes (important at different times): EMU interest rates, increasing savings/wealth and confidence, housing demand boosted by migration, increased bank competition. Created a dangerous over-dependence on housing construction—and on foreign financing of this boom. But this period is now over: house prices are falling, demand and supply of credit have shrunk, construction is sharply down, employment in construction is down. Irish Real New House Prices 1970-2008 4 Index, 1970=1 3.5 3 2.5 2 1.5 1 0.5 1970 1975 1980 1985 1990 1995 2000 2005 Real interest rates 1983-2007 deflated by 4-quarter future inflation 20 15 10 5 0 -5 83 85 87 89 91 93 95 97 99 01 03 05 07 Real domestic credit & house prices rolling 3-month growth rate 1997-2008 14 12 10 8 credit house prices 6 4 2 0 -2 -4 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 -6 Real domestic credit & house prices rolling three-month growth rate 1997-2008 mortgage credit 12 house prices 10 8 6 4 2 0 -2 -4 08 20 07 20 06 20 05 20 04 20 03 20 02 20 01 20 00 20 99 19 98 19 19 97 -6 Net position of credit institutions in Ireland vis-a-vis Irish residents 60 Apr % of GDP 50 40 30 20 10 0 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 Ireland: Credit Supply and Demand -- Enterprises Ireland: Credit demand & Supply -- House purchase (Change from previous quarter) (change from previous quarter) 4 4 3.5 3.5 3 3 2.5 2.5 Standards Standards Demand Demand 2 1.5 2003Jan 2 2004Jan 2005Jan 2006Jan 2007Jan 2008Jan 1.5 2003Jan 2004Jan 2005Jan 2006Jan 2007Jan 2008Jan Employment in construction as % of total employment, 1990-2007 (April) 14 13 12 11 10 9 8 7 6 5 90 95 00 05 Ireland: Employment in construction as % of total employment 1997-2008 14 13 12 11 10 9 8 97 98 99 00 01 02 03 04 05 06 07 Housing Completions, 1970-2007 no. of dwelling units completed 100,000 90,000 80,000 70,000 60,000 50,000 40,000 30,000 20,000 10,000 0 1970 CSO 1973 1976 1979 1982 1985 1988 1991 1994 1997 2000 2003 2006 Discussion 1 Competitiveness worries: Is the mechanism broken? Competitiveness worries • But this depends on old-fashioned wage competitiveness being maintained • And there are indications that the social partner mechanism that delivered wage restraint since 1986 is no longer ensuring international competitiveness. Ireland: real bilateral exchange rates 1979-2008 155 145 135 125 115 GBP 105 USD DEM/EUR 95 85 75 65 80 To March 2008 82 84 86 88 90 92 94 96 98 00 02 04 06 08 cpi-weighted 125 Wage competitiveness 2000 Total employment (rhs) 120 115 1800 110 1600 105 100 1400 95 1200 90 85 1000 75 80 85 90 95 00 05 125 Wage competitiveness 2000 Total employment (rhs) 120 115 1800 110 1600 105 100 1400 95 1200 90 85 1000 75 80 85 90 95 00 05 Discussion 2 Scale growth could resume Scale growth could resume • Tiger period will not return (growth in employment rate reached plateau) • After a housing correction… …and with restored wage competitiveness… • scale growth could continue The steady state Convergence of employment ratio is at an end Wage competitiveness has to improve Housing prices: ST falls back to shoulder Employment in nonAg as % Population 50 45 40 35 30 25 20 15 10 5 0 1961 1971 1986 1991 2001 2007 125 Wage competitiveness 2000 Total employment (rhs) 120 115 1800 110 1600 105 100 1400 95 1200 90 85 1000 75 80 85 90 95 00 05 Irish Real New House Prices 1970-2008 4 Index, 1970=1 3.5 3 2.5 2 1.5 1 0.5 1970 1975 1980 1985 1990 1995 2000 2005 The steady state Convergence of employment ratio is at an end Wage competitiveness has to improve (10–15%?) Housing prices: ST falls back to shoulder (25% real) But scale growth could continue – depending on wider “competitiveness” aspects… …partly a political issue Scale growth could resume (2) Depending on wider competitiveness issues: including – Population/land density still low – Dependency ratios favourable for many years – Investment still insufficient Age-dependency rate 44 42 40 38 36 34 32 30 60 65 70 75 80 85 90 95 00 05 Age dependency (with projections) 44 42 40 38 36 34 32 30 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 2020 2025 Gross domestic fixed capital formation 35 30 as % GDP 25 Agriculture 20 Industry 15 Residential Other 10 5 0 75 80 85 90 95 00 05 Gross domestic fixed capital formation 35 30 Non-market services Other market services as % GDP 25 Manufacturing 20 Agriculture 15 Energy Roads 10 Building 5 Residential 0 75 80 85 90 95 00 05