Financial Crises East Asia 1997, Russia 1998, Brazil ?

advertisement

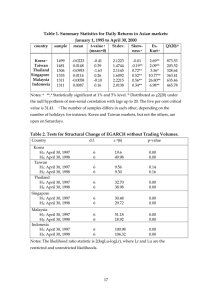

Financial Crises East Asia 1997, Russia 1998, Brazil ? Background to 1997 East Asian crisis • Fundamentalist view • Contagion view Three factors: • Macro policy in OECD • Domestic mismanagement • Investor panic Exchange Rates Thailand Malaysia Indonesia Philippines Hong Kong S. Korea Taiwan Singapore Goldstein 1998 6-12.97 -48.7% -35 -44.4 -33.9 0.0 -47.7 -14.8 -15 1-5.98 24.7% 2.1 -53 1.3 0.0 21.9 1.2 4.0 Stock Markets Thailand Malaysia Indonesia Philippines Hong Kong S. Korea Taiwan Singapore Goldstein 1998 6-12.97 -29.3% -44.8 -44.4 -33.5 -29.4 -49.5 -9.3 -23.0 1-5.98 3.7% -2.4 8.2 18.2 -6.2 -.9 .3 -7.1 IMF Growth Forecasts for 1998 May ’97 April ’98 Change Indonesia 7.4 -5.0 -12.4 Thailand 7.0 -3.1 -10.1 S. Korea 6.3 -0.8 -7.1 Malaysia 7.9 2.5 -5.4 Philippines 6.4 2.5 -3.9 Singapore 6.1 3.5 -2.6 Hong Kong 5.0 3.0 -2.0 China 8.8 7.0 -1.8 Taiwan 6.3 5.0 -1.3 Goldstein 1998 External Causes • Credit boom in the 1990s – Low interest rates in the U.S. and Japan – Expansion of portfolio funds – $420 billion net flows to Asian emerging markets • Deteriorating current account – Overvalued real exchange rates – Slowing exports and increasing competition External Sector Real Ex Rate Current Acct Overvalued (% GDP) Thailand 6.7% -7.9% Malaysia 9.3 - 4.9 Indonesia 4.2 -3.3 Philippines 11.9 -4.7 Hong Kong 22.0 -1.3 S. Korea -7.6 -4.9 Taiwan -5.5 4.0 Singapore 13.5 15.7 Goldstein 1998 Financial Market Vulnerabilities Capital inflows concentrated: – Real estate (30-40% of bank lending) – Equities – Borrowing in foreign currencies w/ short maturities Why? Financial Market Supervision • Weak banking sectors—high ratios of nonperforming loans • Lack of transparency, sound accounting procedures • Inadequate loan-loss reserves • Corrupt lending • Banks as quasi-fiscal agents Precipitating event • Thailand—CB reserves depleted, rolling over government debt • S. Korea—rolling over foreign-currency denominated bank liabilities • Indonesia—corporations attempt to hedge their currency positions Contagion • Trade linkages? – Hard to explain contagion from small countries to large ones • Competitive devaluation? – Same objection • Goldstein’s “wake-up call” hypothesis – Do capital markets sleep? – Rational buffalo Russia 1998 • Fixed exchange rate, overvalued in real terms • Incentive to run a fiscal deficit – Election of 1996 – Collapse of tax revenues • • • • Nominal debt High interest rates Central Banking dilemmas Bail-out of 1998 Why not Brazil in 2002? • • • • • • Public debt to GDP: 60% Of which, linked to the dollar: 40% Spread over U.S. treasuries: 18% Devaluation: >40% in 2002 $30 billion IMF program in August Luiz Inacio Lula da Silva (Lula) elected in October First Steps • Reaffirm primary surplus goal of 3.75% of GDP, an IMF condition • Propose legislation to strengthen Central Bank’s independence • Conservative appointments • Postponing populist agenda Discussion Do IMF rescue packages help countries that face financial crises?