– III - Oye Money and finance in the 1930s and 1980s

advertisement

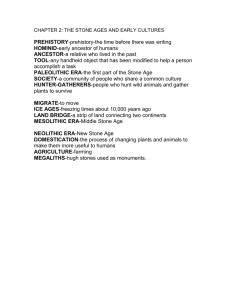

Oye – III Money and finance in the 1930s and 1980s © Randall W. Stone, 2002 Flexible exchange rates Pfc=$ S Exch. rate D Q Inflation Curr Acct Def Dfc Imp Curr Acct balance Devaluation Exp © Randall W. Stone, 2002 Fixed exchange rates Pfc=$ (fixed) Exch. rate D Q Decline in reserves Inflation Dfc Imp Real appreciation Exp Curr Acct deficit Reserves Decline © Randall W. Stone, 2002 Norms of the gold standard Deficit countries Primary Norms: Surplus countries •Defend parity •Deflate - ↑ int. rates - ↓ govt. spending •Ship gold Secondary Do not privatize: Norms: •Extend credits •Hold foreign reserves •Don’t sterilize gold inflows - Exchange controls - Loans - Sliding tariffs Simmons 1994 © Randall W. Stone, 2002 International lending in the 1930’s loans US surplus German WWI reparations UK, France Collapse: WWI debts • Run on the Austrian Schilling, 1931 • Run on the German RM 1931 > default, cancellation of reparations Discrimination: • UK - Sterling bloc: loans, markets, debts • Germany - service British banks - not US banks, bonds © Randall W. Stone, 2002 Breakdown and reestablishment Breakdown • UK 1931 • US 1933 • France 1936 © Randall W. Stone, 2002 Breakdown and reestablishment Reestablishment • Tripartite Agreement 1936, further French devaluation • Explanation: interests changed – costs of unilateral cooperation declined – US, UK preferred France’s devaluation to commercial discrimination – reserve holdings liquidated © Randall W. Stone, 2002 Objections • Circular – Infer interests from behavior – Explain behavior in terms of interests • Was there cooperation, harmony or mutual defection after 1936? © Randall W. Stone, 2002 1982 Debt Crisis--Origins • Rapid expansion of sovereign lending in the 1970s • Reaganomics – U.S. budget deficit → inflation, strong $ – High U.S. interest rates → strong $ → high ratio of debt service/net exports • 1979 oil price shock • Overcommited capital in money-center banks; no incentives for regional banks to lend • Expectations shift → credit dries up → default Contagion effect © Randall W. Stone, 2002 Managing the 1982 Debt Crisis IMF, IBRD, FED Banks Borrowers • 1985 Baker plan (private, IBRD, IMF); little private lending forthcoming • 1989 Brady plan • Conclusion: privatization is necessary © Randall W. Stone, 2002 Objections • Subsequent evidence: Resumption of portfolio investment in 1990s after successful domestic adjustment • Theoretical: the debt issue area is fundamentally different from trade – There is a basic commitment problem – Lending will dry up unless the commitment problem is resolved © Randall W. Stone, 2002 Macroeconomic coordination • Spillovers are public • 1978 Bonn Summit: any effects? – FRG delays a fiscal expansion • 1981-1985 Reagan’s non-contingent strategy – Contraction 1981-1982 – Expansion after 1982 • 1985 Plaza Accord to weaken the dollar – Japan refuses expansionary fiscal policy – Dollar declines because Fed lowers interest rates © Randall W. Stone, 2002