Professional conduct presentation Dealing with Discipline

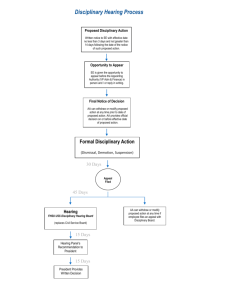

advertisement

DEALING WITH DISCIPLINE Presented By Roisin Bennett Reddy Charlton Solicitors 12 Fitzwilliam Place Dublin 2 Tel: 353 1 661 9500 Fax: 353 1 678 9192 Email: rbennett@reddycharlton.ie Web: www.reddycharlton.ie Outline • • • • • • Regulation of Accountants Overview of Disciplinary Process Disciplinary Committee Admissions and Licensing Committee Common Causes of Complaints New Areas of Complaint Regulation of Accountants • • • Not regulated by statute Various accountancy bodies within Ireland and various regimes in operation ACCA regulatory regime operated from London ACCA created Regulatory Board in 2008 ACCA Regulatory Board • ACCA Bye Laws • Code of Ethics and Conduct • Statutory Controls in Companies Acts and IFSRA • International Standards on Auditing • ISQCs ACCA Regulation Purpose - Protection of the public Overview of ACCA Regulatory Process Disciplinary Committee Admissions and Licensing Committee Deals with specific breaches in bye laws Deals with defective work practices and procedures Imposes orders and fines on members/firms to show public how serious conduct was Takes appropriate action for the future to protect public Has power to exclude members Has power to withdraw practising certificate of member Stage 1 Investigation Stage Overview of ACCA Regulatory Process Stage 2 Assessor Stage Stage 3 Referral to Disciplinary Committee Stage 4 Disciplinary Committee & Decision Stage 5 Appeals Sources of Complaints • Clients • Report from ODCE or Companies Office to ACCA • Following an unsatisfactory monitoring visit from ACCA Stage One - Investigation Stage • • • • • • Investigating Officer is appointed Correspondence issued Treat complaint seriously Co-operate with Investigating Officer Respond in a timely manner and accurately Take professional advice if required Critical stage in the process Admissions made at this stage often prove fatal Stage Two - Assessor Stage • Assessor makes decision whether matter should be referred to Disciplinary Committee or Admissions and Licensing Committee • Assessor’s report is sent to member for comment and to allow member to make written representations Important opportunity for member to engage and try to have matter dealt with Stage 3 – Assessor’s decision To refer or not to refer? Assessor can decide: • There is no case to answer • There is a case to answer and the matter is referred to the Disciplinary Committee • The matter can rest on file • The matter is referred to the practice monitoring department Stage 4 - Disciplinary Committee Hearing • Independent of ACCA • 5-6 people on panel • Majority are non accountants • Hearings are in public and are recorded • Case presenter appears for the ACCA Disciplinary Committee Hearing • Attendance is crucial • Shows you respect the importance of the role of the committee • Shows your commitment to your career and the profession • Gives committee an opportunity to evaluate your appearance and general demeanour To defend or not to defend? • This needs to be considered carefully • Take advice on the merits of defending • Increased costs in preparing for defence of the case for member and ACCA • If defence unsuccessful member responsible for both sets of costs • The committee has no jurisdiction to award costs against ACCA Has complaint been proven? Have the facts been proven against the member? Have the facts breached the relevant bye law referred to in the complaint? Pre Empting the Decision • Review guideline disciplinary sanctions • Consider what view committee likely to come to • Package a set of proposals in mitigation – – – – Highlight previous clear record Once off issue No loss to public Evidence of financial position Previous History • After plea in mitigation is made – Clerk will inform committee of any previous disciplinary orders made against member – Committee come to their decision Decision of Disciplinary Committee • Orders – – – – – No further action Admonishment Reprimand Severe Reprimand Exclusion/Removal from Register • Fine • Costs and publicity What happens next? • • Formal letter issues from disciplinary committee Statement of written reasons follows – • • This will include a form of application for permission to appeal There is a strict 30 day period for leave to appeal Right to appeal is only permitted if the Chairman of Appeals Committee grants leave to appeal Stage 5 - Appeal Committee • Uphill battle • It is not a re hearing of the matter • Must shows substantive grounds of appeal • Only witnesses permitted will be those with new evidence Overview of ACCA Regulatory Process Disciplinary Committee Admissions and Licensing Committee Deals with specific breaches in bye laws Deals with defective work practices and procedures Imposes orders and fines on members/firms to show public how serious conduct was Takes appropriate action for the future to protect public Has power to exclude members Has power to withdraw practising certificate of member Admissions and Licensing Committee • Complaints originate with Professional Conduct Department or Practice Monitoring Department • Audit and insolvency work referred to Regulatory Assessor Regulatory Assessor • The Regulatory Assessor can: – Say no action is necessary – Impose conditions on holder of a certificate – Refer the case to the admissions and licensing committee • The Regulatory Assessor cannot withdraw or suspend a certificate. Admissions and Licensing Committee Hearing • Independent of ACCA • Same format as disciplinary committee • Hearings are in public and are recorded Admissions and Licensing Committee Formulate proposals showing: – How incident was a once off or on one file – Plan for the future that this will not happen again – Previous good record – How public are not at risk Admissions and Licensing Committee The following options are available: – No order – Order placing conditions on firms or individuals certificates – Suspension or withdrawal of firm’s or individual’s certificate or licence Appeal from Admissions and Licensing • Same format as appeal from disciplinary committee • 30 day period for leave to appeal • Most appeals are unsuccessful Common Complaints Audit Work • Admissions and Licensing – Deficiencies in audit work • Disciplinary – Failure to report Indictable Offences Under Section 194(5) of the Companies Act 1990 – Failure to make reports in respect of regulated entities under Financial Services Acts Common Complaints Deficiencies in Audit Work • Usually very basic errors giving rise to problems • Poor systems on pre planning, documenting and concluding audits • Recognising the risk involved in audit work • Recognising the risk with certain audit engagements Common Complaints Failure to Report Only arises when and only when: • Auditor forms an opinion • During the course of an audit • That there are reasonable grounds • That the company has committed an indictable offence Common Complaints Section 31 Companies Act 1990 • Member liable to disciplinary action for breach of fundamental principle of competence and care and misconduct for delay in filing a report with ODCE • complex piece of legislation • Knowledge of directors no longer relevant • Guidance from ODCE says they are monitoring cases of post July 2009 intercompany loans Section 31 Is the offence an indictable one? If not then no obligation to report Held in this case that member had no case to answer Common Complaints Reporting of Section 202 Offences • Complaint from ODCE to ACCA • Auditor disciplined as a result of Section 202 Report because previous audit reports had been qualified but no report made to ODCE • Complaint from ODCE sought to look back at earlier years • Early intervention in this case resolved the matter New Complaints Conflict of Interest Cases • Growing number of complaints in this area • Signing audit report when ineligible to do so • These are treated very seriously by Disciplinary Committee – guideline order is exclusion New Complaints Breach of Undertaking • Undertaking given to Practice Monitoring Department/Professional conduct department • Undertaking not adhered to e.g. hot reviews • Member/firm liable to disciplinary action • Treated very seriously by disciplinary committee New complaints Complaints by Liquidators • This is a new area of complaint as a result of recession • Obligation on auditor to furnish books and records to liquidator • Complaint of no cooperation by auditor New Complaints - Insolvency of Companies • Reports by liquidators to ODCE where they uncover failure to report in previous years by auditors • Fraudulent trading • Books and records • Non holding of EGMs New Complaints - Insolvency • In the UK a number of complaints arising where accoutant is acting in management of a creditor’s IVA • Proposed Personal Insolvency Bill • Role of accountant as personal trustee • Liabilities of personal trustee Summary • Post celtic tiger now living in a regime of increased regulation • More demands being put on professionals • Business is down • Important not to compromise standards as a result Summary • If faced with a complaint take advice immediately • A problem shared is a problem halved • Formulate a solution • Procrastination makes things worse Tel: (01) 6619500 Email:rbennett@reddycharlton.ie Disclaimer This information is for guidance purposes only. It does not constitute legal or professional advice. Professional or legal advice should be obtained before taking or refraining from any action as a result of the contents of this publication. No liability is accepted by Reddy Charlton for any action taken in reliance on the information contained herein. Any and all information is subject to change.