Magazine article summarising the requirements of the Multi-Unit Developments Act 2011

advertisement

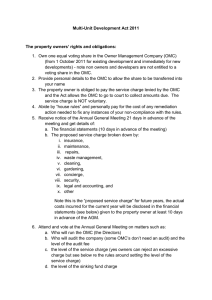

Multi-Unit Developments If you live or aspire to live in a multi-unit development; if you audit one; if you audit or advise a company that has build one; if you trade from a commercial unit or child care unit in a mixed multi-unit development; or most importantly if you want to sell or buy a unit in a multi unit development, estate or apartment block: read on, this affects you. The new legislation is called the Multi-Unit Development Act 2011 and it will regulate the, so called, Owner Management Companies (OMC) that own the common areas in a multi-unit development. The new requirements are onerous and all of the provisions have been commenced since 1 April 2011. There are different rules for 2-5 and 5 plus residential facilities. Mixed commercial and residential units have some additional requirements although childcare facilities are considered to be “residential. There is no restriction on having more than one OMC managing a development and anything with an exclusive own use bathroom and kitchen can be counted as a unit. The Act also allows for ownership of the common area by way of a co-operative, unincorporated body or group or partnership etc… and imposes a similar requirement on these as well. Multi Unit Developments are defined as 5+ units, but the Act also has requirements in respect of developments with between 2 and 5 units as well. Mixed, commercial and residential developments are required to have a “fair and equitable” split of common costs over the different classes of unit with “fair and equitable” voting rights attaching to each type of unit. Sale or purchase of units after the commencement of the Act No sale of a new unit may take place in a multi-unit development until the OMC has been established and the tiled to the common area transferred and the development has been certified as compliant with planning and building regulations and the developer has contractually agreed to complete the development. There are other requirements on the builder as well. For existing and 80% complete developments, the developer must transfer the common area to an OMC by 1 October 2011. The sale of second hand units is not affected by the legislation and newly completed or 80% (number of units sold as a % of the total number of units) complete multi-unit development have to have a OMC in place within 6 month. The OMC will then have a duty to assist in the transfer of title to the units to the respective purchasers and transfer of the ownership of the common areas to an OMC will not relieve the developer of the responsibility to finish the development. Membership and administration of OMC’s The Act allows for automatic transfer of membership of the OMC when ownership of a unit changes hands and imposes a duty for OMC’s to issue share certificates etc… and to cooperate with the transfer of ownership. A unit owner is under an obligation to provide the OMC with their details to facilitate the transfer. Transfer of common areas After transfer of the title to the common areas, the developer will still have right of access to the site to facilitate completion of the development and the developer will have to provide an indemnity on completion of the development and maintain adequate insurance in respect of all risks associated with the completion of the development. The developer will also have to minimise the disturbance of unit owners and allow reasonable access to the common areas, which must be kept clean and safe, during construction. Unit owners may not restrict assess by the developer to the site during the construction phase. If a part of the common area is actually owned by a unit owner, the Act facilitates the transfer of this to the OMC as well. The completion of the development Once the development stage of the multi-unit development is completed, the original owner or developer must make a statutory declaration to the effect that the beneficial ownership of the common areas and residual interest in any long leased vests with the OMC and this effectively merges the beneficial interest and legal title to the common areas with the OMC. Where the development is incomplete, the owners of 60% or more of the residential units in the development can require the transfer of title be affected unless the developer can show good cause not to do so and even then the residents can apply to court to direct the transfer. Rights of the OMC In certain circumstances the OMC may make repairs to an area of a multi-unit development which it not under their control if it is necessary to ensure safe enjoyment of the development. The OMC have rights of access to carry out this work and may recover the costs of such essential work from the developer or owner of the property. Rights owners of units in multi-unit developments In a new development (before any sale happens) each unit owner will be entitled to one equal voting share in the OMC, however that OMC is structured. No other person will be entitled to a share in the OMC. Existing residential multi-unit developments have similar rights; however where an existing arrangement allows a non-resident to vote, the non-resident will be barred from exercising that vote unless they apply to the Circuit Court for permission. Administration and governance of OMC’s No director may be appointed “for life” or for a term exceeding 3 years and any existing director, who was a life director or had a term exceeding 3 years was deemed as of 1 April to have vacated that office. An interesting legal issue arises when this happens, who signs the financial statements and in some cases, where there are issues with the development, there may not be anybody foolish enough to accept an appointment as a replacement director. Annual financial statements have to be prepared and an AGM will have to be convened annually. The financial statements will have to present a statement of assets and liabilities, a statement of income and expenditure, and details of a sinking fund, if they are required to have one. It must also include a statement of: the annual service charge and the basis of that charge; the projected service charge for the current period; a statement of planned expenditure on refurbishment or of a nonrecurring nature; A statement of the insured value of the development, the insurance premium, the name of the insurance company and a summary of the insured risks; Details of the fire safety equipment and arrangement for maintenance of this equipment; Details of any related party transactions with directors of the OMC. The AGM must he convened with 21 days notice , annual financial statements are required to be presented 10 days before the meeting. The meeting must be held in reasonable proximity to the development and at a reasonable time, unless an alternative is agreed by a 75% majority. These obligations are in addition to any normal companies Act requirements. Annual Service Charge The Act requires that a service charge be established to cover the costs of the OMC. The proposed service charge must be considered at the AGM or a special meeting convened for the purpose. The proposed charge may be amended at the meeting by a vote of 60% of those present. Where 75% or more disapprove a proposed service charge, then the OMC will revert to the previous year’s service charge until an agreed service charge is adopted. Where there is disapproval of the charge and there was no previous service charge, a temporary 4 month scheme may be adopted by the OMC without the approval of the members. The estimate of service charge presented at the AGM must include the following breakdown: insurance, maintenance, repairs, waste management, cleaning, gardening, concierge and security, legal and accounting, and other. Prior to the sale of the first unit, the developer is entitled to set the first years service charge. The Act confirms that each unit owner, including a developer who owns a unit, has a legal obligation to pay the service charge. The developer is deemed to own a unit and be subject to a service charge once the first sale of another residential unit in the development is closed. The Act allows, by agreement, a tenant to be responsible for the service charge. The annual service charge may not be used to defray expenses of the developer unless agreed by 75% of the owners and the annual service charge must be considered at the AGM prior to being levied and 65% or more of the units have been transferred or sold to persons not connected with the developer and at least 3 years has elapsed after the common area has been transferred to the OMC. The OMC is entitled to recover these expenses from the developer directly afterwards. The service charge must be equitable and transparent. It must be based on projected expenditure, an excess or deficit in the service charge from one year is to be set against, or added to, the following year or used to build up a sinking fund. The OMC is obliged to maintain “sufficient and proper records of expenditure” to allow verification and audits to be undertaken. The minister has also been given the power to amend some of the requirements in respect of service charges by way of Regulation. Unpaid service charge and sinking fund contribution may be collected by an OMC as a simple contract debt through the courts. OMCs may not enter into a long term service agreement exceeding 3 years or a contract with a penalty clause for termination after three years. Sinking Fund The OMC will be obliged to establish a building investment fund or sinking fund to cover the cost of non-recurring items such as refurbishment or improvements. Each unit owner will be obliged to contribute to this fund and the contribution is set at €200 per year or any amount agreed to at the AGM. The fund must be established by the earlier of the 3rd anniversary of the first sale of a unit in the development or 1 September 2012. The sinking fund must be held in a separate account, accounted for separately and only used for non-recurring items. There are dispute resolution procedures for arguments over whether something is non-recurring or an ordinary expense and the Minister has the power to specify matter as being non-recurring by Regulation. In accounting terms this will be recorded as a separate “Sinking Fund” income and expenditure account, separate from the main income and expenditure account with its own separate “Sinking fund retained surplus” in the capital section of the balance sheet. For administrative purposes an OMC may issue one composite bill for the normal expenditure and the sinking fund contribution. House rules An OMC may make house rules for the development relating to the effective operation and maintenance of the development and to allow the quiet and peaceful occupation of the units. The OMC house rules will be binding on unit owners and tenants. The house rules must be consistent with existing covenants and conditions in existing documents of title. All house rules must be considered at an AGM or special meeting, notice for which was not less than 21 days and the notice must include a copy of the proposed rules. Each unit owner must be provided with a copy of any rules that are agreed. The house rules may be amended using the same procedure as above. It will be a term of every lease on a property that the tenant be bound by any house rules equally with owners. The OMC may recover costs for the remediation of any material breach of house rules from the unit owner. The Minister also has the power to issue Regulation to clarify any issues in respect to house rules. Dispute Resolution Section 24 of the Act contains a whole section on dispute resolution. An application to court can determine that for example, legal documentation be amended, how to deal with multi block developments and an issue with just one block, the merging or demerging of multiple OMC in one development, the use of funds in a sinking fund, directing a developer to perform certain works and other matters. The court may also direct the parties in dispute to use mediation and the Act has rules and procedure attaching to any mediation. Restoration of OMC to the Register of companies OMCs only have a legal persona while they are on the Register of companies. If annual returns are not made to Company Registration Office they will be struck off the Registrar and cease to exist and their assets transfer to the Minister for Finance. A struck off OMC would not be entitled to operate a bank account and unit holders may not be able to sell their properties. The Act provides that an OMC that has been struck off the register may now be restored administratively within 6 years of dissolution. An OMC that is within 12 months of its dissolution may file Form H1, provided that the application is being made by an officer of the company. Form H1-OMC, a more onerous process, is used to restore the company if it is more than 12 months since dissolution and requires a certified copy deed of transfer of common areas and a certificate of an accountant/solicitor. Outstanding annual returns and accounts are required in the case of the H1 and the H1-OMC. An OMC that is struck off for more than 6 years will need to apply to the courts for restoration, a process that can cost in excess of €5,000. Audit costs While not an issue dealt with in the legislation, OMC’s are usually formed as companies limited by guarantee and are therefore barred from availing of audit exemption. Occasionally they are formed as companies limited by shares and with some care in their formation, as companies limited by shares they can usually avail of audit exemption. There is no company law procedure to convert from a company limited by guarantee to a company limited by shares, however, a company limited by guarantee could dispose of their title to the common area to a new company limited by shares and the company limited by guarantee could then be dissolved. The company secretarial cost of this procedure will be about €1,000, to dissolve the old and create a new company. The common areas will be transferred at nil cost but may have a cost for stamp duty purposes and there will be a conveyance fee from a solicitor which will vary from solicitor to solicitor. Audit exemption should shave up to €1,000 off most OMC annual running costs compared to entities subject to audit.