PBGC & Pension Reform Douglas J. Elliott President Center On Federal Financial Institutions

advertisement

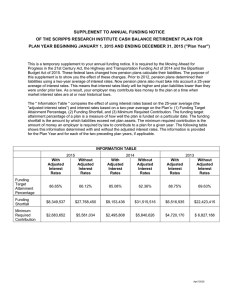

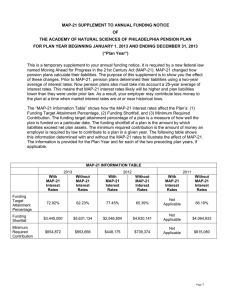

PBGC & Pension Reform Douglas J. Elliott President Center On Federal Financial Institutions August 9, 2006 What is PBGC? • Pension Benefit Guaranty Corporation insures credit of private DB pension plans • PBGC picks up pension obligation only if company can’t pay and pension trust is underfunded • PBGC does not cover everything – Cap on participant’s annual pension – No early retirement subsidy – Phase-in of recent benefit improvements COFFI (www.coffi.org) 2 There Are Two Programs • PBGC runs two distinct programs – Single-employer, with 34 million participants – Multiemployer, with 10 million participants • PBGC provides much less coverage for multiemployer plans – Annual caps are much lower – Employers share joint & several liability • I will focus today on Single-employer COFFI (www.coffi.org) 3 PBGC is Deep in Hole Financially • PBGC owed $23 billion more than value of its assets in 2005 • “True” number could be higher or lower – Discount rate matters a lot – “Probable losses” have a subjective element • But, no one appears to believe PBGC is solvent as it stands now COFFI (www.coffi.org) 4 Cash Could Run Out by 2022 • PBGC has plenty of cash and investments to pay claims for many years • But, cash should run out years before pensions are fully paid out • COFFI has only publicly available cash flow model for PBGC • Our base case estimate is that cash runs out by 2022, under current law COFFI (www.coffi.org) 5 Deficits Could Get Much Worse • There is a structural imbalance between premiums and risks • Most optimistic academic study found premiums covered half of historical risk • COFFI’s base case estimate is that PBGC would need a $92 billion rescue, in 2005 dollars, to cover next 75 years of operation, under current law COFFI (www.coffi.org) 6 CBO Study Is More Pessimistic • CBO’s model shows premiums do not nearly cover risk of next 20 years • Private insurer would demand $142 billion to cover existing deficit and expected losses from next 20 years of operation • Even without a $64 billion risk factor to reflect private sector nature, insurer would charge $78 billion through 2025 COFFI (www.coffi.org) 7 Congress Just Passed Pension Reform • Core goal is to reduce structural problems – – – • Funding rules would be tightened to reduce size and frequency of future claims on PBGC Benefit increases would sometimes be disallowed PBGC variable premiums would be increased There is debate on extent to which actual bill met these objectives, due to various compromises, multi-year transition periods, and special provisions for particular industries COFFI (www.coffi.org) 8 Pension Reform is Very Hard • The two key goals are in serious conflict – Avoidance of taxpayer bailout of PBGC – Encouraging firms to keep offering DB plans • PBGC’s finances cannot be helped without shifting cost and risk back to employers • Yet, many employers are already uncertain DB plans are worth the costs and risks • Striking the balance is hard and subjective COFFI (www.coffi.org) 9 Bill Is Unlikely To Restore PBGC Solvency • COFFI analysis of earlier bills suggested base case need for $92 billion bailout would be reduced to $40-50 billion • I now believe that a better estimate would be $60 billion • In any event, only extremely favorable financial market conditions would eliminate deficit, even with this new law COFFI (www.coffi.org) 10 COFFI Has 23 Reports on PBGC • Please see www.coffi.org • The New York Times highlighted those materials as “refreshingly understandable” and “without a hint of dogma or advocacy” • We also run a PBGC Listserv COFFI (www.coffi.org) 11