p3 4 keeping

advertisement

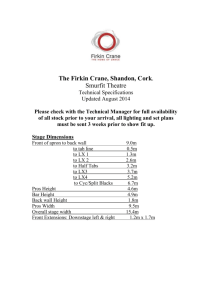

Keeping Tabs On Your Cash Keeping Tabs On Your Cash Lesson Goals: • Entrepreneurs will learn: – – – – Basic elements of a record keeping system Records needed to meet tax requirements How to track business profitability in a timely manner The importance of maintaining a record keeping system Keeping Tabs On Your Cash Records Provide Information • • • • • About profitability To make sound business decisions To set profitable prices To alleviate financial errors To complete your tax forms Keeping Tabs On Your Cash Keys to an Effective Recordkeeping System • • • • • • Simple Easy to understand Reliable Accurate Consistent Provide information on a timely basis Keeping Tabs On Your Cash Checkbook Period beginning balance Funds deposited Bank Statement Checks written Ending balance If the checkbook’s ending balance agrees with the bank statement’s ending balance, then you are ready to reconcile. Keeping Tabs On Your Cash Elements to Include in Your Financial Records • • • • • • Incoming Merchandise/Supplies Outgoing Merchandise or Services Incoming Money (receipts) Outing Money (payments) Equipment purchases and depreciation records Reports Keeping Tabs On Your Cash Incoming Merchandise & Supplies • Copies of purchase orders • Verified packing lists or receiving logs • Inventory sheets or records Keeping Tabs On Your Cash Outgoing Merchandise/Services • • • • Sales slips Return receipt records Work order Credit customers billing Keeping Tabs On Your Cash Incoming Money • Cash report • Checking deposits • Credit customers accounts Keeping Tabs On Your Cash Outgoing Money • Check register/canceled checks • Petty cash vouchers • Invoices (accounts payable) Keeping Tabs On Your Cash Reports • Daily cash report • Income statement • Balance sheet