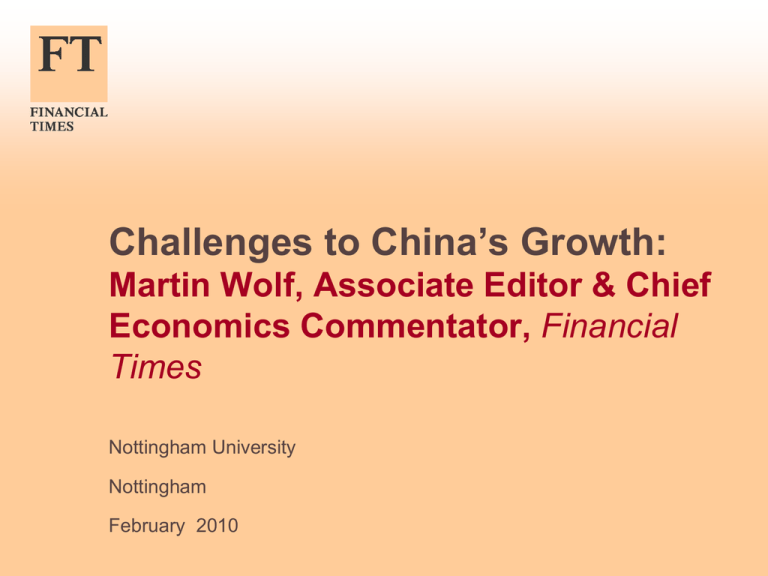

Challenges to China’s Growth: Martin Wolf, Associate Editor & Chief Economics Commentator, Times

advertisement

Challenges to China’s Growth: Martin Wolf, Associate Editor & Chief Economics Commentator, Financial Times Nottingham University Nottingham February 2010 Challenges to China’s Growth “In the case of China, there is a lack of balance, coordination and sustainability in economic development.” Wen Jiabao, Premier of the State Council of the People’s Republic of China, September 2010 2 Challenges to China’s growth • Potential • Model • Challenges • Policies 3 1. China’s potential • The simplest measure of the growth potential of an economy is its distance from the global productivity frontier. • This can be called its “catch-up potential”. • Despite more than 30 years of very fast growth, China is still far behind the frontier, with output per head, at common international prices (or “purchasing power parity), at a fifth of US levels. 4 1. China’s potential PATTERNS OF CATCH-UP GROWTH GDP PER HEAD RELATIVE TO US (2009 EK $s) 100.0% 10.0% 19 50 19 53 19 56 19 59 19 62 19 65 19 68 19 71 19 74 19 77 19 80 19 83 19 86 19 89 19 92 19 95 19 98 20 01 20 04 20 07 1.0% Japan 5 South Korea China India Brazil 1. China’s potential • China is still far behind the frontier, because it was extremely poor when rapid growth began after the shift to “reform and opening up”. • GDP per head, at PPP, was only 3 per cent of US levels in the later 1970s. • Today it is about the same ratio to US levels as that of Japan in 1950, before more than two decades of very fast growth. • So China may have up to another two decades of very fast growth in front of it. 6 2. Model • China is following what professor Michael Pettis of Peking University’s Guanghua School of Management calls a “souped-up” version of the “Asian model” pioneered by Japan and South Korea. • The characteristics of this production-oriented model are: high investment, transfers from households to industry (via low interest rates, suppressed wages and a depressed exchange rate), rapid growth of exports and high external surpluses. • China is, in many ways, “Japan plus”: with a higher investment rate, larger trade surpluses, lower consumption and much more currency intervention. 7 2. Model: fast growth CHINA’S REMARKABLE GROWTH RECORD GDP GROWTH 16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0 19 85 986 987 988 989 990 991 992 993 994 995 996 997 998 999 000 001 002 003 004 005 006 007 008 009 010 1 1 1 1 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 2 GDP growth 8 5-year moving average 2. Model: investment INVESTMENT AS THE DRIVER OF DEMAND COMPONENTS OF GDP GROWTH 25.0 20.0 15.0 10.0 5.0 0.0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 -5.0 Private consumption 9 Public consumption Investment GDP 2. Model: investment HOW INVESTMENT SOARED COMPOSITION OF CHINA'S FINAL DEMAND (per cent) 60 50 40 30 20 10 0 -10 78 9 1 80 9 1 82 9 1 84 9 1 86 9 1 Net exports 10 88 9 1 90 9 1 GFCF 92 9 1 94 9 1 96 9 1 98 9 1 Private consumption 00 0 2 02 0 2 04 0 2 06 0 2 Public consumption 08 0 2 2. Model: financial repression FINANCIAL REPRESSION NOMINAL GDP AND INTEREST RATES 14 45 40 12 35 10 30 8 25 6 20 15 4 10 2 5 0 0 93 994 995 996 997 998 999 000 001 002 003 004 005 006 007 008 009 010 9 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 2 nnnnnnnnnnnnnnnnnnu u u u u u u u u u u u u u u u u u J J J J J J J J J J J J J J J J J J China: 1-Year Deposit Rate (%) 11 China: Lending Rate: 1-Year (%) Nominal GDP (annual % change) 2. Model: exchange rate THE MANAGED EXCHANGE RATE VALUE OF THE RENMINBI 140 4.5 130 5 120 5.5 6 110 6.5 100 7 90 7.5 80 8 70 8.5 60 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 99 199 199 199 199 199 199 199 199 199 200 200 200 200 200 200 200 200 200 200 201 201 1 1/ 1/ 1/ 1/ 1/ 1/ 1/ 1/ 1/ 1/ 1/ 1/ 1/ 1/ 1/ 1/ 1/ 1/ 1/ 1/ 1/ 1/ /0 1/0 1/0 1/0 1/0 1/0 1/0 1/0 1/0 1/0 1/0 1/0 1/0 1/0 1/0 1/0 1/0 1/0 1/0 1/0 1/0 1/0 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 JP MORGAN TRADE WEIGHTED REAL 12 CHINESE RENMINBI TO US $ 2. Model: exchange intervention CHINA’S FOREIGN CURRENCY INTERVENTION INCREASE IN RESERVES (January 2000 - October 2010, $bns) $3,000 $2,605 $2,500 $2,000 $1,500 $1,000 $776 $444 $500 $406 $274 $241 $237 $212 $173 $153 Taiwan Brazil India Korea Hong Kong Algeria $0 China 13 Japan Russia Saudi Arabia 2. Model: exchange intervention CHINA’S FOREIGN CURRENCY INTERVENTION INCREASE IN RESERVES (FEBRUARY 2009 - OCTOBER 2010, $bn) $900 $849 $800 $700 $600 $500 $400 $300 $200 $91 $100 $90 $90 $88 $86 $79 $57 $54 $30 $0 C na hi il az r B H 14 g on n Ko g iw Ta an a re o K R a si us n pa a J e or p a ng i S nd la i a Th a di In 2. Model: trade CHINA’S OPEN ECONOMY CHINA'S TRADE (as a share of GDP) 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 -5.0 -10.0 82 983 984 985 986 987 988 989 990 991 992 993 994 995 996 997 998 999 000 001 002 003 004 005 006 007 008 009 010 9 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 2 Trade balance 15 Exports Imports 2. Model: trade CHINA’S OPEN ECONOMY TRADE OVER GDP, 2008 (per cent) 120% Source: World Bank, World Development Indicators 100% 18% 15% 80% 7% 60% 40% 19% 92% 14% 8% 73% 7% 59% 41% 20% 41% 7% 46% 32% 24% 0% South Korea Germany China UK Merchandise 16 India Services Russia Japan US 3. Challenges • So what might prevent China from sustaining the high growth model for two or more decades? • Answers lie in: – Productivity; – Investment; – Finance; – Resources; – External demand; and – Geo-politics. 17 3. Challenges: productivity • First challenge – raising productivity: – Further increases in the investment rate seem implausible. – That will make economic growth relatively more dependent on rising productivity. – There is some evidence that the rate of growth of whole economy productivity is slowing. – The lowering of the rate at which labour is transferred from rural activities to the modern sector will lower productivity growth. – So raising productivity growth will become ever more important. 18 3. Challenges: productivity INVESTMENT AS DRIVER OF SUPPLY SOURCES OF CHINA'S GROWTH 16.00 14.00 12.00 10.00 8.00 6.00 4.00 2.00 0.00 2000 2001 2002 2003 2004 2005 2006 2007 2008 Total Factor Productivity Growth (ln difference, percent) Contribution of non-ICT Capital Services Growth in GDP Growth (percent) Contribution of ICT Capital Services Growth in GDP Growth (percent) Contribution of Labor Quality Index to GDP Growth Growth 19 3. Challenges: investment • Second challenge – managing investment: – China’s economic growth has been pushed by an extraordinary savings and investment effort. – Astonishingly, the country has emerged as both the largest investor, relative to gross domestic product, in the world and the largest exporter of capital, in absolute terms. – While a source of very rapid growth, this growth pattern also creates significant vulnerabilities. 20 3. Challenges: investment – Assume the incremental capital output ratio is near to 4. – Then a decline in the growth rate from 10 per cent to 5 per cent would reduce China’s warranted investment rate by 20 per cent of GDP. – If abrupt, that decline would generate a collapse in demand. – This does not seem to be imminent. But such a sharp adjustment is likely in the next 20 years. – When this happens, China must either shrink savings dramatically or increase its current account surplus enormously, if it is to balance its economy. – Otherwise, it would risk prolonged Japan-style recession. 21 3. Challenges: finance • Third challenge – containing finance: – China’s growth has been driven by rising ratios of credit and money to GDP and heavy taxation of savers. – As the marginal returns on capital fall and bubbles become frequent, large banking sector losses become plausible. – Higher interest rates, to support household incomes and improve efficiency in the use of capital, would further squeeze the margins of the banking sector. – A move to open up the capital account, perhaps to support the internationalisation of the renminbi, would make the financial sector vulnerable to a severe crisis. 22 23 M2 (% of GDP) Quasi money (% of GDP) Oct-2010 May- Dec-2009 Jul-2009 Feb-2009 Sep-2008 Apr-2008 Nov-2007 Jun-2007 Jan-2007 Aug-2006 Mar-2006 Oct-2005 May- Dec-2004 Jul-2004 Feb-2004 Sep-2003 Apr-2003 Nov-2002 Jun-2002 Jan-2002 Aug-2001 Mar-2001 Oct-2000 May- Dec-1999 3. Challenges: finance MONETISATION OF CHINA MONETISATION OF THE CHINESE ECONOMY (12-month moving aveage, per cent of GDP) 180.0 160.0 140.0 120.0 100.0 80.0 60.0 3. Challenges: resources • Fifth challenge – managing resources: – China’s size means that, at any given level of development, it needs vastly more resources than other countries, except India. – This means that it shifts the terms of trade against itself, as it grows. – It also means that it has to secure vast quantities of resources. – If, for example, China were to have as many vehicles per head as Japan, its fleet would increase fifty-fold and world consumption of oil would almost have to double. 24 3. Challenges: resources IMPORTS OF THE “WORKSHOP OF THE WORLD” SHARES IN WORLD MERCHANDISE IMPORTS 2008 (per cent) 30.0% 27.8% Source: World Bank, World Development Indicators 25.0% 22.6% 20.0% 17.0% 15.0% 13.3% 13.3% 13.1% 10.0% 10.0% 7.6% 6.4% 5.0% 6.2% 7.2% 5.0% 0.0% Agricultural Raw materials Ores and metals Manufactures China 25 Food US Fuels Total 3. Challenges: resources IMPORTS OF THE “WORKSHOP OF THE WORLD” CHINA'S SHARE IN WORLD COMMODITY IMPORTS (2009 estimates) 60.0% 55.0% 48.0% 50.0% 40.0% 30.0% 30.0% 25.0% 20.0% 20.0% 20.0% 8.0% 10.0% 0.0% Iron ore 26 Soybean Cotton Copper Nickel Palm Oil Oil 3. Challenges: resources COMMODITY BOOM Source: IMF WEO, October 2010 COMMODITY PRICES 600 500 400 300 200 100 0 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Fuel and Non-Fuel Non-Fuel ncludes Food and Beverages and Industrial Inputs Industrial Inputs Price Index includes Agricultural Raw Materials and Metals Commodity Fuel includes Crude oil (petroleum), Natural Gas, and Coal 27 3. Challenges: resources ENERGY INTENSITY OF THE CHINESE ECONOMY ENERGY EFFICIENCY OF THE ECONOMY (2005 GDP, at PPP $s, per kg of oil equivalent) Source: World Bank, World Development Indicators 12 10 9.9 7.9 8 7.4 5.5 6 4.9 4 3.4 2 0 UK 28 Japan Brazil US India China 3. Challenges: world demand • Sixth challenge – managing external demand: – China is already the world’s largest exporter and has the world’s largest current account surplus. – It also has had unsustainably rapid growth of exports. – Natural forces will tend to drive the economy into current account deficit, since export growth will be constrained by the growth of world trade, while import growth will be linked to the growth of the domestic economy. – This shift needs to be welcomed, since it will defuse tension and enhance the level of welfare at home. 29 3. Challenges: world demand EXPORTS OF THE “WORKSHOP OF THE WORLD” SHARES IN WORLD MERCHANDISE EXPORTS, 2008 Source: World Bank (per cent) 14.0% 12.0% 10.0% 11.5% 11.4% 9.3% 8.9% 8.1% 8.1% 8.2% 8.0% 5.6% 6.0% 4.4% 4.0% 3.8% 1.8% 2.0% 0.0% 0.0% Manufactures Ores and metals Food China 30 Fuels US Agricultural Raw materials Total 3. Challenges: world demand CHINA’S SOARING TRADE GROWTH OF VOLUME OF MERCHANDISE EXPORTS AND IMPORTS, 2000-08 30% Source: World Bank, World Development 25% 20% 15% 10% 5% 0% China Russia South Korea India Export 31 Brazil Import US Japan UK 3. Challenges: world demand CHINA RISES TO THE TOP OF THE SURPLUS LIST CURRENT ACCOUNT BALANCES ($bn) $500.0 $400.0 $300.0 $200.0 $100.0 $0.0 -$100.0 2000 2001 2002 2003 2004 2005 China 32 2006 Germany 2007 Japan 2008 2009 2010 2011 2012 3. Challenges: geopolitics • Seventh challenge – a premature superpower – China is a developing country and is also likely to remain a relatively poor country for decades, in terms of incomes per head. – But, by virtue of its size, it has a gigantic impact. Indeed, it is on its way to becoming a superpower. – As a result, it is one of the few countries – arguably one of two or three (if the European Union is viewed as one) – that must take account of the impact of its actions on the world economy. – China cannot just “import order”. It must “export order”, too. 33 3. Challenges: geopolitics CHINA’S LEAP TO THE TOP GDP OF THE TEN BIGGEST ECONOMIES (ranked in 2015, at PPP) $70,000 Source: IMF WEO $60,000 $50,000 $40,000 $30,000 $20,000 $10,000 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 $0 United States 34 China India Japan Germany Russia Brazil United Kingdom France 4. Policies • China has the potential to develop rapidly for another two decades, or more. But if it is to succeed it will have to: – Shift towards growth driven by domestic consumption. – Manage a decline in the investment rate. – Accelerate innovation. – Rebalance the economy away from growth of exports. – Further reduce the current account surplus. – Sustain an open world economy. – Increase resource efficiency. – Secure resources at manageable prices. – Help maintain a peaceful world. 35 4. Policies • As the economy becomes bigger and more complex and its impact on the world grows, all this will become much harder. • The premier has correctly defined the challenges. • We all wait to see how the next generation rises to meet them. 36