Whats the H-O Model Like?

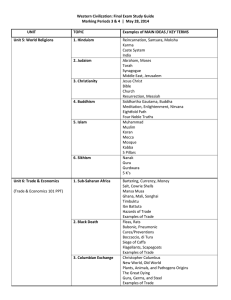

advertisement

The Heckscher-Ohlin Model: Features, Flaws, and Fixes I: What's the H-O Model Like Alan V. Deardorff University of Michigan Themes of the 3 Lectures The HO Model is largely well behaved in 2 dimensions, even when you include trade costs • In higher dimensions, it is not so well behaved, especially when you include trade costs • Various modifications and extensions of the HO model offer some promise of making it behave better Nottingham I 2 Outline of Lecture I • Overview of the H-O Model • The 2×2 Model – Without trade costs – With trade costs • The 2×2×2 Model • Conclusions from the 2×2(×2) Model Nottingham I 3 H-O Overview • The Heckscher-Ohlin (H-O) Model Assumptions – Homogeneous goods and factors – Perfectly competitive market equilibrium throughout (goods and factors) – Production functions • Constant returns to scale • Non-joint – Factors • Perfectly mobile across industries • Perfectly immobile across countries – Countries differ in factor endowments – Industries differ in factor intensities Nottingham I 4 H-O Overview • The Heckscher-Ohlin (H-O) Model Implications – Countries export goods that use intensively their abundant factors (H-O Thm) – Trade draws factor prices closer together across countries, becoming equal in certain circumstances (FPE Thm) – Trade changes real factor prices (S-S Thm) • Benefiting owners of abundant factors • Hurting owners of scarce factors – Rybczynski Thm (output effects of factor accumulation) Nottingham I 5 The Textbook 2×2 H-O Model • • • • • Goods X, Y Factors K, L X is K-intensive Goods are final goods Trade is – Free and frictionless, or – Subject to simple, constant trade costs per unit (perhaps “iceberg”) Nottingham I 6 The Textbook 2×2 H-O Model • Analysis: Expanded Lerner Diagram shows – Production – Factor allocations – Factor Prices – Trade • Thus for given – Goods prices – Factor endowments Nottingham I – Full solution for small open economy – Dependence on prices for large economy 7 Lerner Diagram K 1/wK0 1/wL0 Nottingham I L 8 Lerner Diagram K E0 X0 1/wK0 Y0 1/wL0 Nottingham I L 9 Lerner Diagram K Export E0 X0 1/wK0 EC = EW XC YC Y0 Import 1/wL0 Nottingham I L 10 The Textbook 2×2 H-O Model • Behavior – If Endowments inside Diversification Cone • Both goods produced • Factor prices independent of endowments – If Endowments outside Diversification Cone • One good produced • Factor prices depend on endowments Nottingham I 11 The Textbook 2×2 H-O Model • Sensitivity – All variables (outputs, trade, factor prices) are uniquely determined and depend smoothly on • Endowments • Prices – Adding trade costs vis a vis a single other country • Creates range of world prices for which country does not trade • Outside that range, all variables depend smoothly on trade costs Nottingham I 12 The Textbook 2×2 H-O Model • Summary – With free and frictionless trade: S I S I ( EK , EL , PX / PY ), I X ,Y DI DI ( EK , EL , PX / PY ), I X ,Y TI ( S I DI ) TI ( EK , EL , PX / PY ), I X , Y wJ w j ( EK , EL , PX , PY ), Nottingham I J K, L 13 The Textbook 2×2 H-O Model • Summary – With iceberg trade costs, t: S I S I ( EK , EL , PX / PY , t X , tY ), I X ,Y DI DI ( EK , EL , PX / PY , t X , tY ), I X ,Y TI ( S I DI ) TI ( EK , EL , PX / PY , t X , tY ), I X , Y wJ w j ( EK , EL , PX , PY , t X , tY ), Nottingham I J K, L 14 Effects of Increasing Capital Endowment, EK K 1/wK0 EK cone 1/wL0 Nottingham I L 15 Effects of Increasing EK SX SX Rybczynski Thm: SX/EK, rises with EK EK cone Nottingham I 16 Effects of Increasing EK SY SY Rybczynski Thm: SY Falls with EK EK cone Nottingham I 17 Effects of Increasing EK DX, DY DX DY EK cone Nottingham I 18 Effects of Increasing EK TX, TY TX EK TY cone Nottingham I 19 Effects of Increasing EK wK wK0 wK EK wL wL wL0 EK cone Nottingham I 20 Effects of Increasing Labor Endowment, EL K 1/wK0 Effects are mirror image of increasing EK EL 1/wL0 Nottingham I L 21 Effects of Increasing Price of X, PX K 1/wK0 1/wL0 Nottingham I L 22 Effects of Increasing Price of X, PX K 1/wK0 1/wL0 Nottingham I L 23 Effects of Increasing Price of X, PX K 1/wK0 1/wL0 Nottingham I L 24 Effects of Increasing Price of X, PX SX SX (cone) Nottingham I PX 25 Effects of Increasing Price of X, PX SY SY (cone) Nottingham I PX 26 Effects of Increasing Price of X, PX DX, DY DY DX (cone) Nottingham I PX 27 Effects of Increasing Price of X, PX TX, TY TX PX TY (cone) Nottingham I 28 Effects of Increasing Price of X, PX wK wK Stolper-Samuelson Thm: wK/PX, wK/PY rise with PX (cone) Nottingham I PX 29 Effects of Increasing Price of X, PX Stolper-Samuelson Thm: wL/PX, wL/PY fall with PX wL wL (cone) Nottingham I PX 30 Effects of Increasing Price of Y, PY • Effects are mirror image of increasing PX Nottingham I 31 Effects of Presence of Trade Costs • Assume iceberg trade cost t−1>0, equals fraction of each good that disappears in transit to world market (must ship t for 1 to arrive) • Implication for domestic prices if world prices are PXw, PYw: – If country exports X: PX=PXw/t; PY=tPYw – If country exports Y: PY=PYw/t; PX=tPXw – If country does not trade: (PXw/PYw)/t2 ≤ PX/PY ≤ t2(PXw/PYw) Nottingham I 32 Presence of Trade Costs 1/wKw X=1/PXw K EC Y=1/PYw 1/wLw Nottingham I L 33 Presence of Trade Costs 1/wKw X=1/PXw K If country exports X …which it will if endowment is above this line ECX EC Y=1/PYw 1/wLw Nottingham I L 34 Presence of Trade Costs 1/wKw X=1/PXw K EC ECY If country exports Y …which it will if endowment is below this line Y=1/PYw 1/wLw L Nottingham I 35 Presence of Trade Costs If country exports X K 1/wKw X=1/PXw autarky ECX EC ECY If country exports Y Y=1/PYw 1/wLw Nottingham I L 36 Effects of Increasing EK in Presence of Trade Costs If country exports X K 1/wKw X=1/PXw autarky ECX EC ECY If country exports Y Y=1/PYw 1/wLw Nottingham I L 37 Effects of Increasing EK in Presence of Trade Costs PX/PY autarky t2PXw/PYw PXw/PYwt2 Y-export X-export cone Nottingham cone I EK 38 Effects of Increasing EK in Presence of Trade Costs SX autarky Y-export X-export cone Nottingham cone I EK 39 Effects of Increasing EK in Presence of Trade Costs SY autarky Y-export X-export cone Nottingham cone I EK 40 Effects of Increasing EK in Presence of Trade Costs TX, TY autarky TX EK TY Y-export X-export cone Nottingham cone I 41 Effects of Increasing EK in Presence of Trade Costs wK autarky wK EK wL wL Y-export X-export cone Nottingham cone I EK 42 Effects of Increasing PXw/PYw in Presence of Trade Costs SX,SY autarky SX (ρA =PXA/PYA = autarky price) ρA Y-export X-export cone Nottingham cone I SY ρw =PXw/PYw 43 Effects of Increasing PXw/PYw in Presence of Trade Costs DX,DY autarky ρA Y-export X-export cone Nottingham cone I DY DX ρw =PXw/PYw 44 Effects of Increasing PXw/PYw in Presence of Trade Costs TX,TY autarky TX ρA ρw =PXw/PYw TY Y-export X-export cone Nottingham cone I 45 Effects of Increasing PXw/PYw in Presence of Trade Costs wK/PY autarky wK/PY ρA Y-export X-export cone Nottingham cone I ρw =PXw/PYw 46 Effects of Increasing PXw/PYw in Presence of Trade Costs wL/PY autarky wL/PY ρA Y-export X-export cone Nottingham cone I ρw =PXw/PYw 47 Effects of Increasing Trade Costs • As trade cost, t, rises from zero, Y-export cone and the X-export cone move further apart, and the “autarky” range of factor endowments and world prices gets larger • For any given endowment and world prices, a rise in t reduces the volume of trade and moves other variables in the direction of their autarky values. Nottingham I 48 Effects of Increasing Trade Costs • Example: – Consider a country whose factor endowments have it completely specialized in good X at world prices Nottingham I 49 Effects of Increasing Trade Costs: Example SX,SY autarky SX SY X-export coneNottingham I t 50 The World Market: The Textbook 2×2×2 H-O Model • To model the world economy, add a second country (country “*”) • Solve for world (relative) price that clears the world market TX ( EK , EL , PX / PY ) T ( E , E , PX / PY ) * X Nottingham I * K * L 51 The World Market: The Textbook 2×2×2 H-O Model • Results S I S I ( EK , EL , EK* , EL* ), I X ,Y DI DI ( EK , EL , EK* , EL* ), I X ,Y TI TI ( EK , EL , EK* , EL* ), I X ,Y wJ w j ( EK , EL , EK* , EL* , PY ), J K , L with analogous expressions for the other country Nottingham I 52 The World Market: The Textbook 2×2×2 H-O Model • Depictions of world equilibrium – Offer curves (Meade) – Integrated-world-economy diagram (Dixit-Norman) – Sufficient (but not elegant) to use supply and demand of just one of the goods Nottingham I 53 World Equilibrium TX, −TX* TX (PX/PY)w PX/PY −TX* (cone) (cone)* Nottingham I 54 Conclusions from the 2×2(×2) H-O Model • Equilibria are well defined • Equilibrium quantities are unique • Equilibrium prices are unique up to a numeraire Nottingham I 55 Conclusions from the 2×2(×2) H-O Model • Includes three types of equilibria – Autarky (when there are trade costs) – Diversified – Specialized • Determinants of equilibrium type are mostly clear • Several relationships between variables depend importantly on type of equilibrium Nottingham I 56 Conclusions from the 2×2(×2) H-O Model • Classic “Theorems” are clear and precise • Countries specialize, but only if endowment differences are large • Prices and quantities vary continuously with exogenous changes in – Endowments – Trade costs • In particular, trade responds sensibly to – Prices and – Trade costs Nottingham I 57 What’s Next? • My point in the next lecture will be that some of these attractive properties are lost in higher dimensions – i.e., especially when there are more than 2 of goods and countries Nottingham I 58