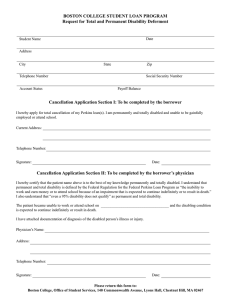

DisabilityAppendixFeb2013.doc

advertisement