Estimating Supply Response in the EU

advertisement

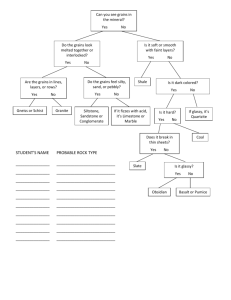

Estimating Supply Response in the EU Carlos Arnade, David Kelch, and Susan Leetmaa ERS Economists Introduction While models cannot represent all the complexities of the CAP, economic theory and statistical methods can determine the relative importance of prices and technology on agricultural production. We chose to model France, Germany, and the UK Objectives of the Study Estimate price elasticities of area and yields consistent with standard assumptions of economic theory Estimate technical change elasticities using the technological component of a Malmquist index as an explanatory variable Compare the short-run effects of technology and prices on crop production Determine if EU output growth in EU agriculture would continue despite lower prices The Results Include Price and technology elasticities of supply and input demand Price and technology contribution to supply changes Components of crop supply elasticities- yield and acreage The Method Price and technology elasticities estimated from a twostep profit function (Chambers and Just) with first step profit function conditional on acreage allocation Technology represented by the technology component of a lagged Malmquist index Multicollinearity- estimated four separate profit functions (grains, roots and tubers and sugar, fruits and vegetables, livestock index) with additional corrections for grains Estimated each component of uncompensated elasticity: shadow price equations for allocated area Countries, Crops, and Data Grains- all countries: wheat, barley, rapeseed, & other grains. France has corn and Germany has oats Other crops- fruits and vegetables, livestock, roots, tubers and sugarbeets(a fixed output) Variable input demand for fertilizer, labor, and pesticides Quasi fixed factors exogenous- technology, animal stocks, and tractors DATA from 1973-1997(SPEL) Model Estimation Naïve relative price expectations: lagged normalized output prices Crop categories for the four profit functions- 1) grains and oilseeds 2) roots, tubers, and sugarbeets, 3) fruits and vegetables, 4) livestock 1) Reverse two-step correction procedure- term from first model accounts for short term disequilibrium; 2) Imposes symmetry conditions among prices and area allocations, and between area allocations and the relevant variables in the shadow price equations 3) Imposed parameter restrictions to insure symmetry of area price response Model Results Compared technology and price effects on output. Took average annual change in price and technology and multiplied by appropriate coefficient. UK- technology the dominant factor France- mixed results with technology reducing output of other grains, rapeseed, and pulses Germany- technology dominant in f&v and roots & tubers; price dominates output of all grain except “other grains” Some crops are area substitutes but yield complements Other Salient Features of Results Two results consistent across all three countries Technology has a significant positive impact on wheat production; France .71, Germany 1.22, UK 1.03 Technology has a positive impact on pesticide use; France 1.89, Germany .05, UK 4.42 DK hypothesis- UK became a member in 1973 so high guaranteed CAP prices available to relatively large farms allowed new technology to be adopted over this period Summary Technology most important in UK; prices in France and Germany France- area elasticities important; UK- yield elasticities; Germanymixed Adoption of new rapeseed variety and oilseed policy likely affected results Price and Technology Comparison:Germany 1000.00 800.00 600.00 400.00 200.00 0.00 -200.00 Wheat Grain Barley Rape Oats Price Pulse Tech O-root Vegetable Fruit Price and Technology Comparison:France 2500.0 2000.0 1500.0 1000.0 500.0 0.0 -500.0 Wheat o-Grain Maiz Barely Rape Price Tech Pulse Vegetable Fruit Price and Technology Comparison:UK 400.00 350.00 300.00 250.00 200.00 150.00 100.00 50.00 0.00 -50.00 -100.00 Wheat Grain Barley Rape Pulse Price Tech Root-Cr Veg Fruit