'How Financial Integration Today Differs from that of a Century Ago'

advertisement

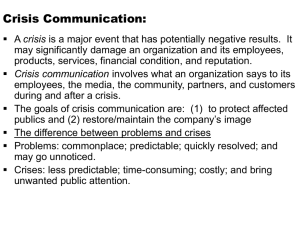

How does financial integration today differ from that of a century ago? Martin Wolf, Chief Economics Commentator, Financial Times Leverhulme Centre for Research on Globalisation and Economic Policy, School of Economics, Nottingham University April 30th, 2003 Financial integration then and now • Why is financial integration so controversial? • How has financial integration evolved? • What are the big differences between the financial globalisation of the late 19th century and today’s? • What are the big issues, especially for developing countries? 2 1. Why is financial globalisation so controversial? • International capital flows are unstable and associated with crises • They are also associated with constraints on policy makers • This is the “trilemma”: one can have only two of capital mobility, a fixed exchange rate and domestic monetary autonomy • Governments want all three. Since they cannot do so, the history of the past 120 years has been one of big shifts in the two they have chosen 3 1. Why is financial globalisation so controversial? NET PRIVATE CAPITAL FLOW TO DEVELOPING COUNTRIES ($bns) $350.0 $300.0 $250.0 $200.0 $150.0 $100.0 $50.0 4 2003f 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 2002f Source: IIF 1979 1978 $0.0 1. Why is financial globalisation so controversial? THE UPS OF EQUITY INVESTMENT IN DEVELOPING COUNTRIES ($bns) $180.0 $160.0 $140.0 $120.0 $100.0 $80.0 $60.0 $40.0 $20.0 $0.0 f f 78 979 980 981 982 983 984 985 986 987 988 989 990 991 992 993 994 995 996 997 998 999 000 001 02 03 9 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 2 2 20 20 Source: IIF 5 1. Why is financial globalisation so controversial? COMPOSITION OF EQUITY INVESTMENT IN DEVELOPING COUNTRIES ($bn) $180.0 $160.0 $140.0 $120.0 $100.0 $80.0 $60.0 $40.0 $20.0 $0.0 -$20.0 1990 Source: IIF 6 1991 1992 1993 1994 1995 1996 Net direct investment 1997 1998 1999 Net portfolio investment 2000 2001 2002f 2003f 1. Why is financial globalisation so controversial? UPS AND DOWN OF NET LENDING ($bns) $250.0 $200.0 $150.0 $100.0 $50.0 $0.0 -$50.0 f f 78 979 980 981 982 983 984 985 986 987 988 989 990 991 992 993 994 995 996 997 998 999 000 001 02 03 9 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 2 2 20 20 Source: IIF 7 1. Why is financial globalisation so controversial? COMPOSITION OF NET LENDING ($bns) $250.0 $200.0 $150.0 $100.0 $50.0 $0.0 -$50.0 -$100.0 f f 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 19 20 20 20 20 Source: IIF 8 Net commercial banks Net nonbanks 1. Why is financial globalisation so controversial? UPS AND DOWNS OF CURRENT ACCOUNT IN DEVELOPING COUNTRIES ($bns) $60.0 $40.0 $20.0 $0.0 -$20.0 -$40.0 -$60.0 -$80.0 -$100.0 -$120.0 f f 78 979 980 981 982 983 984 985 986 987 988 989 990 991 992 993 994 995 996 997 998 999 000 001 02 03 9 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 2 2 20 20 9 1. Why is financial globalisation so controversial? THE IMPACT OF CRISES ON CURRENCIES (exchange rate to the dollar) 120.0 100.0 80.0 60.0 40.0 20.0 Ja nM 95 ay -9 Se 5 p9 Ja 5 nM 96 ay -9 Se 6 p9 Ja 6 nM 97 ay -9 Se 7 p9 Ja 7 nM 98 ay -9 Se 8 p9 Ja 8 nM 99 ay -9 Se 9 p9 Ja 9 nM 00 ay -0 Se 0 p0 Ja 0 nM 01 ay -0 Se 1 p0 Ja 1 nM 02 ay -0 Se 2 p0 Ja 2 n03 0.0 Argentinian Peso 10 Brazilian Real Indonesian Rupiah South Korean Won 1. Why is financial globalisation so controversial? THE IMPACT OF CRISES (year-on-year growth, per cent) 15.0 10.0 5.0 0.0 -5.0 -10.0 -15.0 1996 1997 1998 1999 Argentina 11 2000 Indonesia 2001 Korea 2002 2003 1. Why is financial globalisation so controversial? • Extraordinary instability in capital flows • Leads to many twin crises • These crises are costly 12 2. How has integration evolved? • The three periods of international economic integration • The rise, decline and rise of capital market integration 13 2. How has integration evolved? PERFORMANCE IN THE THREE MOST SUCCESSFUL PHASES IN THE CAPITALIST EPOCH (annual average compound growth rate of GDP per head) 1950-73 1973-98 1870-1913 Golden Age Neo-Liberal Order Liberal Order Western Europe 4.08 1.78 1.32 Western Offshoots 2.44 1.94 1.81 Japan 8.05 2.34 1.48 Resurgent Asia 2.61 4.18 0.38 Advanced capitalist 2.93 1.91 1.36 Faltering Economies 2.94 -0.21 1.16 World 2.93 1.33 1.30 and resurgent Asia Source: Maddison (2001) 14 2. How has integration evolved? Source: Obstfeld and Taylor FOREIGN ASSETS OVER WORLD GDP (per cent) 70.0% 62.0% 60.0% 49.0% 50.0% 40.0% 36.0% 30.0% 25.0% 19.0% 20.0% 18.0% 11.0% 10.0% 8.0% 7.0% 5.0% 6.0% 1945 1960 0.0% 1870 15 1900 1914 1930 1938 1980 1985 1990 1995 2. How has integration evolved? GROSS VALUE OF FOREIGN CAPITAL STOCK IN DEVELOPING COUNTRIES OF AFRICA, ASIA AND LATIN AMERICA, 1870-1998 $3,500.0 35.0% $3,030.7 $3,000.0 30.0% $2,500.0 25.0% Source: Maddison (2001) $2,000.0 20.0% $1,500.0 15.0% $1,000.0 10.0% $495.2 $500.0 5.0% $235.4 $63.2 $40.1 $0.0 0.0% 1870 1914 Stock in 1990 prices ($bn) 16 1950 1973 Stock as share of developing country GDP 1998 2. How has integration evolved? CORRELATION BETWEEN DOMESTIC INVESTMENT AND SAVINGS SINCE 1870 Source: Taylor (1996) 1.2 1.0 0.8 0.6 0.4 0.2 0.0 187079 17 188089 189099 190009 191019 192029 193039 194049 195059 196069 197079 198089 2. How has integration evolved? CAPITAL FLOWS SINCE 1870 (average absolute value of current account as per cent of GDP) UK Argentina Australia Canada France Germany Italy Japan 18701889 4.6 0.7 18.7 8.2 7.0 2.4 1.7 1.2 0.6 18901913 4.6 1.0 6.2 4.1 7.0 1.3 1.5 1.8 2.4 19191926 2.7 1.7 4.9 4.2 2.5 2.8 2.4 4.2 2.1 19271931 1.9 0.7 3.7 5.9 2.7 1.4 2.0 1.5 0.6 19321939 1.1` 0.4 1.6 1.7 2.6 1.0 0.6 0.7 1.0 19471959 1.2 0.6 2.3 3.4 2.3 1.5 2.0 1.4 1.3 19601973 0.8 0.5 1.0 2.3 1.2 0.6 1.0 2.1 1.0 19741989 1.5 1.4 1.9 3.6 1.7 0.8 2.1 1.3 1.8 19891996 2.6 1.2 2.0 4.5 4.0 0.7 2.7 1.6 2.1 Source: Taylor (1996) 18 USA 2. How has integration evolved? • The stock of foreign capital is now higher than ever before, in relation to world GDP • Most of the foreign capital is short term • Reliance on domestic capital also seems greater than before 1914 • Net capital flows across borders are relatively small 19 3. What are the big differences? • Shift from UK to US as hegemon and US move into deficit • Marginalisation of developing countries • Rise of multi-nationals • Frequency of crises • Move to floating exchange rates (and the meaning of the euro) 20 3. What are the differences? The hegemon SHARE OF UK AND US ASSETS IN WORLD FOREIGN ASSETS (per cent) 90.0% 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% 1825 1855 1870 1900 1914 1930 1938 UK assets 21 1945 US assets 1960 1980 1985 1990 1995 3. What are the differences? The hegemon • The UK’s foreign assets were three times GDP in 1914 • The US’s net foreign liabilities are a quarter of GDP today • The UK was the world’s largest creditor • The US is the world’s largest debtor 22 3. What are the differences? Emerging markets Source: Obstfeld & Taylor THE MARGINALISATION OF DEVELOPING COUNTRIES (liabilities as a share of world liabilities) 50.0% 45.0% 40.0% 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% 1900 23 1914 1938 1960 1980 1990 1995 3. What are the differences? Emerging markets DID CAPITAL FLOW TO POOR COUNTRIES? Share of World Stock of Foreign Capital 50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% less than 20 per cent 20-40 per cent 40-60 per cent 60-80 per cent per capita incom e range of receiving regions (US = 100) Source: Maurice Obstfeld & Alan Taylor 24 1913 1997 more than 80 per cent 3. What are the differences? The rise of MNCs RISE AND RISE OF MULTI-NATIONAL COMPANIES (Selected Indicators of FDI and International Production – billions of dollars and percentages) 1982 FDI inward stock 1999 594 1,761 4,772 2,462 5,503 13,564 Gross product of foreign affiliates 565 1,419 3,045 Exports of foreign affiliates 637 1,165 3,167 GDP at factor cost 10,611 21,473 30,061 Exports of goods and non-factor services 2,041 4,173 6,892 Sales of foreign affiliates Source: UN (2000) 25 1990 3. What are the differences? Crises FREQUENCY OF CRISES IN INDUSTRIAL COUNTRIES 50 44 45 40 36 35 29 30 25 21 21 20 15 13 11 10 5 12 9 6 4 0 2 1 7 0 0 Banking Crises Source: Bordo & Eichenreen 26 Currency Crises 1880-1913 1919-1939 Tw in Crises 1945-1971 1973-1997 All Crises 3. What are the differences? Crises FREQUENCY OF CRISES IN EMERGING MARKET ECONOMIES 95 100 90 80 70 57 60 50 40 30 20 10 21 17 11 7 16 6 0 25 13 17 8 3 3 1 0 Banking Crises Source: Bordo & Eichengreen 27 Currency Crises 1880-1913 1919-1939 Tw in Crises 1945-1971 1973-1997 All Crises 3. What are the differences? Crises • Crises are more frequent, but not more severe • They are more than twice as prevalent as before • The chief reason, suggests Eichengreen and Bordo has been the fragility of soft currency pegs (NBER Working Paper 8716) • Banking problems were rarer before 1914 – so there were fewer twin crises – because exchange rates did not collapse 28 3. What are the differences? Exchange rates Resolution of trilemma - countries choose to sacrifice Activist policies Capital mobility Fixed exchange rate Notes Gold standard Most Few Few Broad consensus Interwar Few Several Most Capital controls Bretton Woods Few Most Few Float Few Few Many Source: Obstfeld and Taylor 29 4. What are the big policy issues? • Global macro-economics and the US deficit • Exchange rate regimes - the law of the excluded middle • “Original sin” and foreign currency borrowing • Capital controls and prudential regulation of the financial system • Sovereign bankruptcy and debt workouts 30