Slides for presentation to Investors Bank August, 2015

advertisement

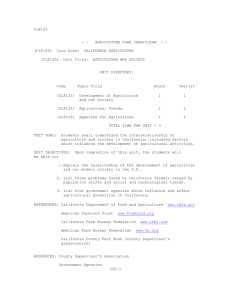

Status of the Wisconsin Farm Economy, 2015 Bruce L. Jones Director, Renk Agribusiness Institute College of Agricultural and Life Sciences UW-Madison (608)265-8508 Farm Income and Expenses Wisconsin 2012 2013 2014 Est Million $ Million $ Million $ Value of agricultural sector production Production Expenses 13,603.24 14,121.66 15,007.04 7,153.17 7,422.58 7,673.76 Gross value added Capital consumption Net value added 6,450.07 1,036.52 5,413.55 6,699.08 1,147.65 5,551.43 7,333.28 1,152.04 6,181.24 924.57 249.55 673.97 924.72 211.93 691.35 978.35 233.53 708.69 3,565.46 3,723.43 4,260.68 Hired labor and employee compensation Net rent received by nonoperator landlords Total interest expenses Net farm income United States 2013 Million $ Change 2014F Million $ Wisconsin 2013 2014 Est Million $ Million $ Change Value of crop production 233,628.95 200,600.85 -33,028.09 4,264.96 3,750.00 -514.96 Value of livestock production 182,114.77 206,552.30 24,437.53 8,050.02 9,587.49 1,537.47 5,541.49 1,717.72 6,775.00 1,996.22 1,233.51 278.50 1,806.68 1,669.55 -137.13 14,121.66 15,007.04 885.38 Dairy products, Milk Meat animals 40,276.93 49,685.17 92,087.09 107,017.55 Revenues from services and forestry 54,247.16 49,555.64 -4,691.52 Value of agricultural sector production 469,990.88 456,708.79 -13,282.09 Purchased inputs 244,083.79 257,791.78 13,707.98 Payments to stakeholders Hired labor and employee compensation Net rent received by nonoperator landlords Total interest expenses 1/ Net farm income 62,835.97 27,742.00 17,695.28 17,398.69 128,988.14 7,228.67 7,461.80 233.13 1,609.11 1,803.78 436.19 1,828.00 924.72 211.93 691.35 1,920.57 978.35 233.53 708.69 53.64 21.60 17.33 97,316.34 -31,671.81 3,723.43 4,260.68 537.25 66,685.05 29,351.10 19,499.06 17,834.88 @ 25% decrease @ 15% increase 28.39% 26.37% 26.21% 27.27% 19.97% 27.44% 23.61% 27.35% 21.48% 21.31% Variation In Wisconsin Net Farm Income Period 2008 - 2009 2014 – 2015 (Forecast)* Change in Net Farm Income Billion $ Percent -1.3 -1.9 @ -70% @ -45% * Assumes $7/CWT drop in milk price for 2015, all other factors at 2014 levels Farm Balance Sheets 2011 Million $ 817.90 2,805.22 435.98 77.08 67.99 2,347.61 6,551.78 2012 Million $ 829.79 2,829.66 592.26 103.93 75.18 3,892.10 8,322.93 2013 Million $ 916.35 2,143.94 514.36 75.11 74.27 2,325.56 6,049.51 361.21 7,364.91 3,103.22 52,530.01 63,359.35 354.24 8,790.67 3,020.15 51,906.54 64,071.52 401.36 8,544.20 3,166.52 55,725.21 67,837.36 69,911.13 72,394.46 73,886.87 Liabilities: Notes payable within one year Liabilities: Current portion of term debt Liabilities: Accrued interest Liabilities: Accounts payable Liabilities: Current 499.43 886.59 259.26 174.64 1,819.92 1,027.19 826.65 259.73 260.50 2,374.07 995.99 872.93 269.22 241.51 2,379.66 Liabilities: Nonreal estate Liabilities: Real estate Liabilities: Noncurrent 1,191.90 6,063.91 7,255.80 1,098.18 5,705.67 6,803.92 1,186.83 5,917.87 7,104.69 Farm liabilities 9,075.72 9,177.92 9,484.35 Farm equity 60,835.41 63,216.53 64,402.52 8,356.61 8,667.47 8,199.03 Wisconsin ARMS Balance Sheet All Farms: TOTAL Assets: Livestock inventory Assets: Crop inventory Assets: Purchased inputs Assets: Cash invested in growing crops Assets: Prepaid insurance Assets: Other Assets: Current Assets: Investment in cooperatives Assets: Farm equipment Assets: Breeding animals Assets: Land and buildings Assets: Non-current Farm assets Assets: Operators dwelling D/A =12.8 13.0 12.7 12.8 11.0 D/A =12.1 11.9 10.7 Distribution of Farms, Farm Income, and Wealth For Wisconsin Source: ERS-USDA ARMS Source: ERS-USDA ARMS Source: ERS-USDA ARMS Dairy Situation and Outlook, 2015 Mark Stephenson Director of Dairy Policy Analysis College of Agricultural and Life Sciences UW-Madison (608) 890-3755 U.S. All Milk Price MPP Ration Cost Strong Profits Encourage Output Farms Retained Cows Number of Cows Milk per Cow World Agricultural Supply and Demand Estimates World Agricultural Outlook Board Grain and Livestock Situation and Outlook World Agricultural Supply and Demand Estimates World Agricultural Outlook Board World Agricultural Supply and Demand Estimates World Agricultural Outlook Board World Agricultural Supply and Demand Estimates World Agricultural Outlook Board World Agricultural Supply and Demand Estimates World Agricultural Outlook Board World Agricultural Supply and Demand Estimates World Agricultural Outlook Board World Agricultural Supply and Demand Estimates World Agricultural Outlook Board World Agricultural Supply and Demand Estimates World Agricultural Outlook Board Farm Production Costs Bruce L. Jones Director, Renk Agribusiness Institute College of Agricultural and Life Sciences UW-Madison (608)265-8508 Short-Term Energy Outlook Forecast Corn Nitrogen Rate Calculator Finding the Maximum Return To N and Most Profitable N Rate A Regional (Corn Belt) Approach to Nitrogen Rate Guidelines http://extension.agron.iastate.edu/soilfertility/nrate.aspx $6 to $5: -5.26% $6 to $4: -7.02% $6 to $3: -12.28% Dairy and Cropping Benchmarks Farmland Values Annual Growth in Farmland Values Wisconsin Minnesota 1950-1999 Illinois Iowa 5.95 5.62 5.44 4.96 1974-1980 17.74 21.05 21.47 20.76 1980-1989 -6.08 -11.10 -8.82 -13.22 6.80 9.46 8.55 12.35 2000-2014 Supply and Ownership of Midwest Farmland Determinants of Farmland Values Land Valuation Model (1 g ) V R (r g ) V = Value of Land R = Return From Land g = Annual Growth in Return (R) r = Opportunity Cost of Capital Annual Growth in Gross Farm Income Period Illinois Iowa Minn Wisc 1970-1999 2.44 2.69 3.50 3.84 2000-2013 10.02 10.06 9.34 6.33 Annual Growth in Net Farm Income Period Illinois Iowa Minn Wisc 1970-1999 1.75 3.05 0.28 1.24 2000-2013 15.71 13.24 17.66 6.19 Annual Growth in Cash Rents Period Wisconsin Minnesota Illinois Iowa 1967 - 1973 4.85 2.77 2.92 5.39 1974 - 1981 9.59 10.84 11.10 9.67 1982 - 1987 -5.17 -8.26 -6.08 -8.12 1988 - 2005 2.58 2.57 1.94 1.90 2006 - 2014 8.57 10.04 7.44 8.75 Land Valuation Model (1 g ) V R (r g ) V = Value of Land R = Return From Land g = Annual Growth in Return (R) r = Opportunity Cost of Capital Current interest rates Interest rates in early 1980s Farmland Affordability: Purchasing and Leasing Cash Rent Equivalent Present Value (PV) Purchase Cost = PV Rents PV Purchase Cost a) Down-payment b) PV P&I mortgage payments (After-tax) c) Less: PV Net Sale (Sale – Loan Balance) (After-tax) PV Rents Rent * (1-t) * USPVr,Y (After-tax) Rent Equivalent * (1-t) = PV Purchase Cost / USPVr,Y Rent Equivalent For Farmland Purchase Bruce L. Jones, Director Renk Agribusiness Institute UW-Madison CALS June 2015 Taxes Ordinary Income Capital gains Years to hold Opportunity Cost of Capital (%) Current Market Value of Land Expected Annual Growth in Land Value Mortgage Life Years Loan Rate (%) Percent Down Rent per Acre (Before tax) Rent per Acre (After tax) Mortgage Payment 28 15 5 7 5000 2 30 6 20 234.11 168.56 290.60 Cash Rent Equivalents Down-Payment Percentage Expected Annual Percent Growth in Land Value -2 0 10 20 30 40 403.27 421.42 439.56 457.71 475.86 0 304.65 322.80 340.94 359.09 377.24 2 197.82 215.97 234.11 252.26 270.40 Potential Investor Interest in Farmland 1970 -2014 Inflation 10-year T. Bond S&P 500 Farmland Minnesota Wisconsin Illinois Iowa Mean Std Dev Coef Var 4.27 7.90 11.84 2.88 9.63 17.02 0.68 1.22 1.44 14.58 12.60 11.74 9.25 0.81 0.73 12.79 15.36 10.79 12.76 0.84 0.83 Simple Correlation 1970 - 2014 Inflation 10-year T. Bond S&P 500 Minn Wisc Illinois Iowa Inflation 1.0000 10-year T. Bond -0.0627 1.0000 S&P 500 -0.1192 -0.0232 1.0000 Minnesota 0.5537 -0.2701 -0.1389 1.0000 Wisconsin 0.5685 -0.2416 -0.2881 0.7845 1.0000 Illinois 0.3865 -0.2883 -0.2142 0.8668 0.6792 1.0000 Iowa 0.3879 -0.2491 -0.1710 0.9043 0.6592 0.9348 1.0000 1970-1995 1989-2014 Mean Std Dev Coef Var Mean Std Dev Coef Var Inflation 5.67 3.01 0.53 2.71 1.13 0.42 10-year T. Bond 9.31 10.00 1.07 7.36 9.21 1.25 S&P 500 12.99 15.79 1.22 11.91 17.80 1.49 Minnesota 14.78 14.81 1.00 13.73 4.88 0.36 Wisconsin 13.45 10.83 0.81 10.85 5.84 0.54 Illinois 12.96 13.19 1.02 12.48 5.54 0.44 Iowa 14.86 15.76 1.06 15.58 6.35 0.41 Farmland Simple Correlation 1970 - 1995 Inflation 10-year T. Bond S&P 500 Minn Wisc Illinois Inflation 1.00 10-year T. Bond -0.35 1.00 S&P 500 -0.16 0.40 1.00 Minnesota 0.67 -0.38 -0.20 1.00 Wisconsin 0.64 -0.45 -0.31 0.86 1.00 Illinois 0.46 -0.42 -0.30 0.89 0.80 1.00 Iowa 0.51 -0.40 -0.22 0.94 0.81 0.95 Iowa 1.00 Simple Correlation 1989 - 2014 Inflation 10-year S&P T. Bond 500 Minn Wisc Illinois Inflation 1.00 10-year T. Bond 0.44 1.00 S&P 500 -0.23 -0.22 1.00 Minnesota 0.41 0.10 0.00 1.00 Wisconsin 0.17 0.17 -0.20 0.32 1.00 Illinois 0.29 0.08 0.00 0.60 0.09 1.00 Iowa 0.28 0.24 0.01 0.58 -0.03 0.81 Iowa 1.00 Capital Asset Pricing Model Risk / Return Trade-off Capital Asset Pricing Model RA Under-performing Asset Capital Asset Pricing Model RA Over-performing Asset Capital Asset Pricing Model For US Farm Real Estate Variable Intercept (Alpha) Market (Beta) Barry (AJAE 1980) 1950 - 77 4.78 (t=2.53) 0.19 (1.70) Inflation R2 0.26 Irwin, Forster, Sherrick (AJAE 1988) 1950 - 77 1947 - 84 7.80 4.40 (4.25) (1.73) 0.15 (0.78) 0.25 (1.49) 0.60 (0.96) 0.86 (2.37) 0.28 0.55 Capital Asset Pricing Model For Midwestern Farmland Market Risk Excess Inflation R2 Premium (Beta) Wisconsin 11.12 -0.05 2.00 0.44 (t = 5.61) (-1.05) (4.02) Minnesota 16.21 -0.004 3.36 0.58 (7.50) (-0.07) (5.81) Illinois 13.56 -0.06 2.95 0.48 (6.09) (-0.85) (4.84) Iowa 18.12 -0.02 3.82 0.58 (7.19) (-0.28) (5.65) For 1968 – 2014 period, using S&P 500 as measure of market return and 10 year Treasury Bond as risk free rate State Intercept (Alpha) Where Are We Headed?