Test Bank for final exam-FINA252-2016.docx

advertisement

Test Bank for Final Exam

Part-1: Multiple Choice

Future Value is also known as:

A. Single Period Value

B. Accumulation Value

C. Compound Value

D. Time Value

The current value of future cash flows discounted at the discount rate is:

A. future value

B. present value interest factor

C. compounding value

D. present value

Interest earned on only the original principal amount invested is:

A. present value interest

B. simple interest

C. time value of money

D. beginning interest

Present value is:

A. FV * (1+r)t

B. FV / (1+r)t

C. FV / (1-r)t

D. none of the given answers

The actual rate of interest to be earned or paid is known as:

A. stated interest rate

B. nominal interest rate

C. effective annual interest rate

D. interest on interest rate

EAR stands for:

A. earning annual rates

B. effective annual return

C. effective annual rates

D. none of the given answers

NIR is also known as:

A. effective annual rate

B. stated interest rate

C. normal interest rate

D. both stated interest rate and nominal interest rate

The difference between net cash inflow and net cash outflow is known as:

A. internal rate of return

B. discounted cash flow

C. net present value

D. capital budgeting

The discount rate that makes the NPV of an investment zero is known as the:

A. discounted rate of return

B. average rate of return

C. required rate of return

D. internal rate of return

An investment is accepted if the IRR exceeds the:

A. cost of capital (interest rate on load and equity)

B. expected rate of return

C. nominal rate of return

D. none of the above

An investment is accepted if the value of NPV is:

A. zero

B. negative

C. positive

D. none of the above

A project whose NPV equals zero:

A. should be rejected

B. should be accepted

C. should be indifference (may be accepted or rejected).

D. None of the above

Of the different methods used in evaluating projects, ______ is considered the best.

A. IRR

B. NPV

C. ARR

D. both IRR and NPV

The IRR is sometimes called:

A. the true rate of return

B. the overall rate of return

C. the DCF (Discount Cash Flow) return

D. the average return

Coupon rate is the:

A. annual coupon divided by the face value of a share

B. annual coupon divided by the face value of a debenture

C. annual coupon divided by the selling price of a debenture

D. annual coupon divided by the selling price of a share

All other things being equal, the longer the time to maturity:

A. the lower the coupon rate

B. the lower the price of a debenture

C. the higher the coupon rate

D. the greater the interest rate risk

Salvage value means

A. the face value

B. depreciated value

C. value after paying taxes

D. estimated value on its sale at the end of its useful life

All other things being equal, the lower the coupon rate:

A. the longer the time to maturity

B. the higher the price of the debenture

C. the lower the price of the debenture

D. the greater the interest rate risk

Periodic distributions of profit by a company to its shareholders are:

A. interest

B. coupon

C. dividends

D. both interest and coupon

The internal rate of return on a bond is known as the:

A. required rate of return

B. coupon rate

C. discount rate

D. yield to maturity

There is an inverse relationship between interest rates and:

A. coupon

B. bond prices

C. term to maturity

D. face value

The debt securities that issued and backed by the centre government is called:

A. treasuries

B. agencies

C. munis

D. corporates

The debt securities that issued by local government (Municipal corporation) is

called:

A. treasuries

B. agencies

C. munis

D. corporates

The debt securities that issued by corporations is called:

A. treasuries

B. agencies

C. munis

D. corporates

Four distinct categories of government bond is known as:

A. treasury bills, treasury notes, treasury bonds and treasury inflation protected

securities.

B. treasuries, agencies, minus and corporates

C. coupon payment, face value, maturity and coupon rate

D. none of the above

If the market interest rate is the same as the coupon rate, the bond’s value is:

A. less than the face value.

B. more than the face value

C. the same as the face value

D. none of the given answers

If the market interest rate rises above the coupon rate, the bond’s value:

A. rises above the face value

B. falls below the face value

C. equal the face value

D. none of the above

If the market interest rate falls below the coupon rate, the bond’s value:

A. rises above the face value

B. falls below the face value

C. equal the face value

D. none of the above

Total return has two components: one of them is the dividend yield and the other is:

A. required return

B. current price

C. capital gains yield

D. cash dividend rate

Coupon payment is ------ at the end of each term.

A. the stated interest payment

B. the principal amount payment

C. the salvage value

D. depreciated value

Bonds/shares are issued when an organisation/company wishes

to borrow money from

A. to donate to the society

B. to pay money to the public

C. to borrow money from the public

D. none of the above

The compounding period could be

A. yearly only

B. quarterly only

C. monthly only

D. yearly, semi-annually, quarterly, monthly, weekly, and daily

Total return (r) can be shown as:

D

A. r 0 g

B. r

C. r

P0

D1

P0

D1

P0

g

D. none of the above

The formula to calculate Bond value isA.

B.

C.

D.

C

1

1/ 1 r t

F

r

1 r t

C

1

1/ 1 r t

F

1 r

r

C

1

1/ 1 r t

F

r

r - g t

1

1/ 1 r t

F

r

1 r t

A share’s cash dividend divided by its current price is known as:

A. dividend growth rate

B. dividend Yield

C. coupon payment

D. total return

The formula to calculate Share price with zero growth dividend isA.

P0

D1

r -g

B.

P0

D

r

D

g

D. none of the above

C.

P0

The formula to calculate Share price with constant growth dividend isC.

P0

D. P0

C. P0

D.

D (1 g )

0

r -g

D

r

D

g

none of the above

D (1 g )

The model P0 0

r -g

that determines the current share price of a share is the

A. growth model

B. valuation model

C. cash flow model

D. constant dividend growth model

When an asset is sold at a price (salvage value) different from the book value of the

asset, you will have a(n):

A. loss on sale

B. gain on sale

C. gain or loss on sale

D. opportunity cost

When an asset’s salvage value more than the book value of the asset, you will have

a(n):

A. loss on sale

B. gain on sale

C. gain or loss on sale

D. opportunity cost

When an asset’s salvage value less than the book value of the asset, you will have

a(n):

A. loss on sale

B. gain on sale

C. gain or loss on sale

D. opportunity cost

True/False

The amount of an investment worth after one or more periods is known as

compound value.

A. True

B. False

PV stands for Present Value of Investment.

A. True

B. False

Discount rate is the interest rate that reduces a given future value to an equivalent

present value.

A. True

B. False

The actual rate of interest to be earned or paid is the effective annual interest rate.

A. True

B. False

A simple way of amortising a loan is to have the borrower pay the interest each

period plus some principal amount.

A. True

B. False

An investment should be rejected if the NPV is positive and accepted if the NPV is

negative.

A. True

B. False

(Correct answer: accepted, rejected)

An investment is acceptable if its calculated IRR is less than the cost of capital

(interest rate on loan and equity).

A. True

B. False

(Correct answer: more)

A dollar received today is more value than a dollar received in the future.

A. True

B. False

The process of diversification can reduce risk.

A. True

B. False

The market value and the book value are always the same.

A. True

B. False

(Correct answer: could be more or less)

Maturity is the specified date at which the principal amount of a bond is paid.

A. True

B. False

Dividend on a preference share has zero growth and is constant through time.

A. True

B. False

Under the assumption that the dividend has a zero growth rate, the per share value

is given by P0 = D / r.

A. True

B. False

The number of years until the face value is paid is called the bond’s time to

maturity.

A. True

B. False

When an asset is sold at a different price to the book value, you must have a gain on

sale of the asset.

A. True

B. False

(Correct answer: may gain or loss)

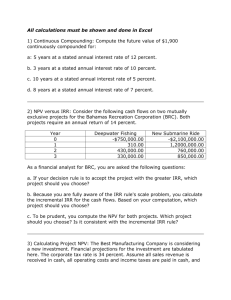

PROBLEM SOLUTIONS

Q1.

A local bank is offering 5% interest per year on savings accounts. If you

deposit $700 today how much will you have in two years? How much will

you have in 3 years?

Answer:

Manual Solution

FV = 700*(1.05)2 = $771.75

FV = 700*(1.05)3 = $810.34

By Using SHARP Financial Calculator

700 PV, 2 N, 5 I/Y, COMP FV

=> -771.75

700 PV, 2.5 N, 5 I/Y, COMP FV => -810.34

Q2.

$771.75

$810.34

A local bank is offering 5% interest rate on savings accounts and

compounded semi-annually. If you deposit $700 today how much will you

have in two years? How much will you have in 3 years?

Answer:

Manual Solution

Formula: FV = PV x (1 + r)t

(Here, 2 years (t) = 2 x 2 = 4 half-years, interest rate (r) = (52)/100 = 0.025)

FV = 700 x (1.025)4 = $772.67

If duration is 3 years then ‘t’ = 2 x 3 = 6 half-years

FV = 700 x (1.025)6 = $811.79

By Using SHARP Financial Calculator

700 PV, 2x2 N, 52 I/Y, COMP FV

700 PV, 3x2 N, 52 I/Y, COMP FV

Q3.

=> -772.67

=> -811.79

$772.67

$811.79

An investment is expected to return $10,000 in two years’ time. If the cost

of capital (interest rate) is assessed to be 12% per annum what is the

present value of the investment?

Answer:

Manual Solution

FV

The formula: PV = --------(1+r)t

(here FV = $10,000, r = 12% = 0.12, ‘t’ = 2)

10000

10000

PV = ------------- = ------------- = $7971.94

(1+0.12)2

(1.12)2

By Using SHARP Financial Calculator

10000 FV, 2 N, 12 I/Y, COMP PV,

Q4.

=>

-7,971.94

$7971.94

An investment is expected to return $10,000 in two years’ time. If the cost

of capital (interest rate) is assessed to be 12% per annum and

compounded quarterly. what is the present value of the investment?

Answer:

Manual Solution

FV

The formula: PV = --------(1+r)t

(here FV = $10,000, r = 12/4 % = 3% = 0.03, ‘t’ = 2x4 = 8)

10000

10000

PV = ------------- = ------------- = $7894.09

(1+0.03)8

(1.03)8

By Using SHARP Financial Calculator

10000 FV, 2x4 N, 124 I/Y, COMP PV, =>

Q5.

-7,894.09

$7894.09

If you get a loan from Samba Bank with 10% per annum nominal interest

rate (NIR) and compounded semi-annually, what is the effective rate

(EAR)?

Answer:

Manual Solution

NIR

EAR 1

m

m

1

(Here, m = 2 (sami-annually), nominal interest rate = 10/100 = 0.10)

2

EAR = 1

1 0.1025 10.25%

2

0.10

By Using SHARP Financial Calculator

2(x,y) 10 2ndF →EFF{PV}, => 10.25%

Q6.

A company is considering developing a new product. Net cash flows over

the next five years are estimated below. If the cost of capital (interest rate)

is 16% is this project worthwhile?

Year

0

1

2

3

4

Net

Cash Flows

-420,000

-105,000

71,000

420,000

240,000

Answer:

Manual Solution:

-420,000

-420,000 -420,000

PV of year 0 cash flow = --------------- = ------------- = ----------------- = -420,000

(1+0.16)0

(1.16)0

1

-105,000

-105,000

-105,000

PV of year 1 cash flow = --------------- = ------------- = ------------------ = -90,517.24

(1+0.16)1

(1.16)1

1.16

71,000

71,000

71,000

PV of year 2 cash flow = --------------- = ------------- = --------------- = 52,592.59

(1+0.16)2

(1.16)2

1.35

420,000

420,000

420,000

PV of year 3 cash flow = --------------- = ------------- = ----------------- = 269,230.77

(1+0.16)3

(1.16)3

1.56

240,000

240,000

240,000

PV of year 4 cash flow = --------------- = --------------- = -------------- = 132,596.69

(1+0.16)4

(1.16)4

1.81

So NPV = cash inflow – cash out flow

= (52,592.59+269,230.77+132,596.69) – (420,000+90,517.24)

= 454420.05 – 510517.24

= - 56097.19

So at 16% cost of capital, NPV is negative and this project is not profitable.

By using SHARP financial calculator

Press CFi 2ndF CA{MODE} to clear any previous cash flows.

+/- 420,000 Data

+/- 105,000 Data

71,000 Data

420,000 Data

240,000 Data

Press ON/C

Press 2ndF CASH{CFi}

Enter the interest rate: 16 ENT

Press ▼ COMP to compute the NPV

NPV = - 56097.19

The NPV is negative. Thus this project is not profitable.

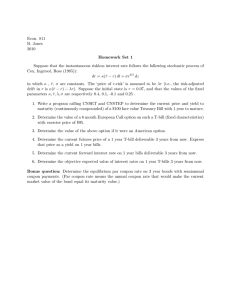

Q7.

If ARAMCO has just paid a dividend of 50 cents per share (D0), which

is expected to grow at 5 per cent per annum (g). What price should

you pay for the share if the required rate of return (r) on the

investment is 12 per cent?

Answer:

Manual solution

With the constant growth of dividends, the price (value) of a share is:

𝑃0 =

𝐷0 ×(1+𝑔)

𝑟−𝑔

Here, D0 = 50 cents = $0.50

g = 5% = 0.05

r = 12% = 0.12

So, 𝑃0

=

0.50×(1+0.05)

0.12−0.05

=

0.50×1.05

0.07

=

0.525

0.07

= $7.5