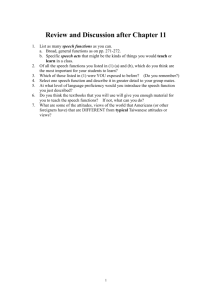

0709 SS2

advertisement

The Taiwanese Economy and Cross-strait Relations The 19th Annual Conference on Pacific Basin Finance, Economics, Accounting,and Management Hosted by the Foundation of Pacific Basin Financial Research and Development Rong-I Wu Chairman Taiwan Brain Trust July 9, 2011 The Taiwanese Economy and Cross-strait Relations I. Introduction II. Changes in the Taiwanese Economy since the 1980s Table 1 Major Economic Indicators for Taiwan (1980-2010) 1980-1989 1990-1999 2000-2010 GDP growth rate 7.70 6.35 4.10 Private consumption growth rate 7.71 7.29 2.49 Government expenditure growth rate 7.32 4.14 1.09 Fixed capital formation growth rate 8.09 7.56 0.70 Exports growth rate* 11.62 7.54 8.48 Imports growth rate** 10.73 8.27 4.94 16.21 14.32 1,611 7,530 2.069 2.042 4.483 6.79 3.91 0.20 Service industry 6.66 3.40 -0.40 Average per capita Amount (US$) 3,734 10,781 13,959 income Growth rate 15.22 4.95 2.90 Exports to China growth rate*** Investment in China*** (annual average in US$1 million) Unemployment rate Real wages growth rate Manufacturing industry Source: *DGBAS, Executive Yuan **Ministry of Finance statistics ***Investment Commission, MOEA The Taiwanese Economy and Cross-strait Relations III. Changes in the Government’s Policy of Economic Opening Toward China 1.On July 15, 1987, the government lifted the “Martial Law for Taiwan Province” that had been imposed for 38 years. The same year the government opened up direct imports of selected agricultural raw materials from China, which kicked off some sporadic trade (such as ingredients for traditional Chinese medicine). 2.In 1988 China promulgated a law that encouraged Taiwanese entrepreneurs to invest in China. Subsequently the Taiwanese government permitted Taiwanese businessmen to conduct indirect trade and investment with China, but cross-strait economic and trade relations were still tightly controlled. 3.During an orientation phase between 1990 and 1996 the government essentially maintained its original strict control over cross-strait trade contacts. The Taiwanese Economy and Cross-strait Relations 4.During the 1996-2000 period then President Lee Teng-hui adopted a “no haste, be patient” policy that still maintained strict restrictions. 5.Under the active opening, effective management policy during the 2001-2008 period the original restrictions were greatly relaxed. In 2006 the policy changed to “active management, effective opening,” with the goal of strengthening the management of cross-strait trade liberalization, but the effects of the new policy were limited. 6.In May 2008 the stage of massive opening under the Ma government began. The Taiwanese Economy and Cross-strait Relations IV. The Economic Reasons Behind Soaring Taiwanese Investment in China 1.Changes in the Economic Environment Favor Overseas Investment 2. The Effects of the Core-Periphery Model The Taiwanese Economy and Cross-strait Relations 3.International Comparison of Foreign Direct Investment (FDI) Table 2 Cumulative Inward and Outward FDI as Share of GDP Unit: % 1990 2000 2009 Inflow Outflow Inflow Outflow Inflow Outflow 9.8 10.0 23.3 25.2 30.7 33.2 9.0 11.2 23.0 28.8 31.5 40.8 13.6 4.1 25.0 12.0 29.1 16.5 United States 9.3 12.6 28.5 27.6 21.9 30.2 Japan 0.3 6.7 1.1 6.0 3.9 14.6 South Korea 2.0 0.9 7.1 5.0 13.3 13.9 Taiwan 5.9 18.4 6.0 20.4 12.7 47.8 Worldwide Developed nations Developing nations Source: World Investment Report 2010, UNCTAD The Taiwanese Economy and Cross-strait Relations 4. An Assessment of ECFA The Taiwanese Economy and Cross-strait Relations V. Taiwan’s Counter Strategy 1.we need to transform economic and trade relations between Taiwan and China into trade between countries and adopt concrete investment and trade policies to extricate ourselves from our reliance on China. 2.Therefore our counter policy must be dissolving the bilateral regional trade relationship with China as the core and Taiwan as the periphery. 3.In order to prevent a negative impact from possible economic instability or social unrest in China, we should adopt risk diversification and prevention measures. Accordingly we need to take safeguards beforehand with regard to spreading risk from an overconcentration of exports and investment. The Taiwanese Economy and Cross-strait Relations VI. Concrete Policies 1.Principle of autonomy: Industry must not excessively rely on the Chinese market alone. Our future development direction must be using autonomy in innovation and technology to reach the goal of industrial autonomy. 2.Principle of sustainable development: ECFA only benefits specific industries and causes industrial hollowing out, rendering sustainable development impossible. The Taiwanese Economy and Cross-strait Relations 3.Principle of normalizing cross-strait relations: We hope that China will be able to understand that cross-strait relations can only be normalized if it renounces the threat of military force. In the past Taiwanese investors have poured tens of billions of U.S. dollars into the Chinese economy. They have helped China’s industrial development, created a large number of jobs, transferred business management skills and production technology to China and even provided export markets for Chinese products which allowed China to earn a huge amount of foreign currency. Taiwanese investors have made important contributions to and have been a major force behind the economic development that China enjoys today. China should not bite the hand that feeds it. Cross-strait confrontation is not only detrimental to stable economic development in Taiwan and China, but also negatively affects peace in the Asia-Pacific region. The Taiwanese Economy and Cross-strait Relations 4. WTO principle: Since Taiwan and China are both WTO members, cross-strait trade normalization should be negotiated under WTO rules. The two sides need also to sit down to discuss whether ECFA complies with WTO regulations. 5. Repatriating earnings from overseas investment: A high ratio of Taiwanese companies invest overseas. Not only does the government provide business friendly tax benefits, other factors in the domestic investment environment such as talent, financing, and capital markets all contribute in a positive way. Businesses should therefore repatriate overseas income and share it with the Taiwanese people, thus fulfilling their social responsibility. The Taiwanese Economy and Cross-strait Relations VII. Conclusion -2 Source: DGBAS , Executive Yuan , TAIWAN 4 2010 2008 2009 2007 2006 2005 2003 2004 2002 2001 1999 2000 1998 1997 1995 1996 1994 1993 1992 1990 1991 1989 1988 1986 1987 1985 1984 1983 1981 1982 1980 Figure 1. Growth Rate of Private consumption % 14 12 10 8 6 3.65 2 0 -5 -10 -15 -20 Source: DGBAS , Executive Yuan , TAIWAN -11.01 2010 20 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 Figure 2. Growth Rate of Fixed Capital Formation % 25 23.44 15 10 5 0 Figure 3. Taiwan’s Unemployment Rate and Investment Amount in China Value(Unit:US$ billion) Source : Council of Labor Affairs(CLA),Executive Yuan ;Investment Commission,MOEA,TAIWAN Figure 4. Taiwan’s Unemployment Rate and Number of Unemployed Persons % 1,000 people 577 5.21 Source: CLA , Executive Yuan , TAIWAN Figure 5. Taiwan’s Real Wages and Growth Rate New Taiwan Dollar(NT) Growth Rate 7.3 3.1 -8.4 Source: Directorate-General of Budget , Accounting and Statistics(DGBAS),Executive Yuan , TAIWAN Figure 6. The value and % of Taiwan’s Exports to China US$ billion % 115 42 Source : Bureau of Foreign Trade, MOEA,TAIWAN