Study on Capital Structures Operating Performances of Credit Cooperatives in Taiwan —Application of Panel Threshold Method

advertisement

Study on Capital Structures & Operating Performances of

Credit Cooperatives in Taiwan

—Application of Panel Threshold Method

Kuei-Chiu Lee

Department of Cooperative Economics, Feng Chia University,

Taichung, Taiwan

Chia-Hao Lee

Department of Finance, National Chung Hsing University

Taichung, Taiwan

Submitted to

The 15th Annual Conference on PBFEAM*

held at

the Equatorial Hotel in Ho Chi Minh City, Vietnam

on July 20 and July 21, 2007.

0

Study on Capital Structures & Operating Performances of

Credit Cooperatives in Taiwan

—Application of Panel Threshold Method

Abstract

This paper collects financial data of the credit cooperatives in Taiwan from 1994

through 2005, applies regression model based on panel threshold and explores their

capital structure and operating performance.

This paper uses savings on net worth

value ratio, net worth on loan ratio, net profit margins, current ratio and loan growth

rate as proxy variables.

Overall, the empirical finding is that the credit cooperatives

of Taiwan are under the influence of capital structures.

The threshold variables (net

worth to loan ratio) have two threshold values, 0.16 and 0.212.

When the threshold

value is between 0.16 and 0.212, every unit of growth in loans increases net profit

margins by 2.094 times.

On the contrary, with a poor capital structure, the increase

in loans reduces net profit margins.

The empirical finding also shows that the

growth in loans for the credit cooperatives in northern and central Taiwan affects net

profit margins, especially for those in central Taiwan.

However, threshold

relationship does not exist for the credit cooperatives in southern Taiwan.

Keywords: Credit cooperatives, capital structure, Panel Threshold, performance.

1

Introduction

Credit cooperatives in Taiwan are not only a foundation in the financial system,

but also a member of cooperative enterprises. They have been around for over 90

years. In 1989, the Taiwanese government started to lift its controls over interest rates.

In 1991, the market was open to new banks. After the liberalization of the financial

markets, structural changes have been happening in Taiwan. As banks gradually

expanded their scope of services and operations, credit cooperatives that focus on

small loans in the regions have been heavily hit. Over the past decade, the market

share of credit cooperatives in the deposit market went from 13.28% in 1991 to 4.37%

in December 2000. Their market share in the loan market declined from 10.07% in

1991 to 3.38% at the end of 2000. Return on equity dropped from 18.84% to 1.2%. In

1991, the number of branches of credit cooperatives totaled 572 and accounted for

20.5% of all the branches in the financial market. In 1994, there were still 74 credit

cooperatives. However, the run on the Fourth Credit Cooperative of Changhua in

1995 and continuous transformation of large credit cooperatives into commercial

banks since 1997 have reduced the number of credit cooperatives to only 28 at the end

of 2005, as certain credit cooperatives were taken over or merged into commercial

banks.

At the end of 2005, there were a total of 295 branches of credit cooperatives,

accounting only 3.47%1 of the total branches in the financial market in Taiwan.

In

other words, over the course of the 13 years, 46 credit cooperatives disappeared from

the financial market.

Their competitiveness also declined.

In 1996, the deposits

with credit cooperatives totaled NT$1,620.2 billion and the loans totaled NT$1,286.6

billion.

By the end of 2005, the deposits with credit cooperatives totaled NT$598.3

billion while the loans totaled NT$337.7 billion only.

cooperatives were seriously hit.

This shows that credit

Aiming for a turnaround, many credit cooperatives

started to transform themselves into commercial banks or merged with commercial

banks since 1995, as attempts to improve operating performance.

However, in

addition to mergers with commercial banks or transformations into ones, credit

cooperatives should continue to endeavor to improve their performance and efficiency.

As credit cooperatives operate in the banking market as cooperatives, they need to

strike a balance between keeping up the spirits as cooperatives and operating as banks.

In the fierce competition of the financial market over the past years, how to improve

1

Chang, S.Y., Operating Performance of Credit Cooperatives in Taiwan Over the Past Decade,

Cooperatives Report, Issue 58, Jan. 2006, p.3

2

capital structure and operating efficiency is a critical issue for credit cooperatives.

For any credit cooperatives to strengthen capital structure and improve operating

efficiency, the first task is optimal asset allocations, i.e. the most appropriate mix of

equity and liabilities, in order to minimize cost of capital and to maximize

shareholders’ value.

This is the goal that capital structure theory tries to achieve.

The previous studies on capital structure include Titman and Wessels (1988), who

pointed out the inverse correlation between the short-term debt ratio and scale of

company operations.

Bradley et al. (1984) applied computer simulation analysis,

find that there exists an optimal liabilities ratio for companies and indicate the inverse

correlation between debt ratio and earnings volatility.

Eric (2002) argued that the tax

shields achieved by leverage can effectively increase the value of the firm, but such

benefits get offset by the cost associated with leverage.

Therefore, liability ratio

must be at its optimal level in order to effectively enhance the value of the firm.

Hameeteman and Scholtens (2000) applied Pearson method and a multiple regression

model to examine the correlation between growth rates and capital structures, assets,

changes of pre-tax earnings and scales of the top 100 banks listed by The Banker from

1987 through 1997.

They found that there exists a significant negative correlation

between capital sizes, assets, growth rates and pre-tax earnings.

Also, the growth

rates of large banks decline gradually with the increase of capital, assets and pre-tax

earnings.

The majority of previous studies focus on the operating performances of

commercial banks.

As credit cooperatives are similar to commercial banks in nature,

this study attempts to analyze operating performances of credit cooperatives in order

to identify the optimal capital structure.

Meanwhile, as credit cooperatives are

highly regional, this paper divides the credit cooperatives into three groups in

northern, central and southern Taiwan, in order to explore whether capital structures

have differing effects on operating performances in different regions.

Therefore, this

paper adopts Panel Threshold model proposed by Hansen (1999) to conduct analysis

so as to explore whether there is an optimal debt ratio for credit cooperatives.

If the

debt ratio of a credit cooperative is smaller than the threshold of optimal debt ratio,

capital structure and operating performance is positive correlated.

In other words,

the increase of loans within this scope may effectively increase efficiency.

On the

contrary, if the debt ratio is higher than the threshold of optimal debt ratio, the

increase of financial risks may reduce operating performances for credit cooperatives.

3

This paper studies on the 28 credit cooperatives from 1994 through 2005 and uses

proxy variables to construct Panel Threshold model to explore the relationship

between their capital structures and operating performances.

Data description

The major businesses of credit cooperatives are to take deposits and offer loans.

Therefore, this paper uses deposits, share capital, operating expenses, loans, operating

income, assets and net worth as relevant proxy variables.

Operating expenses are the

costs dedicated to the taking of deposits and offering of loans.

Operating income is

mainly the interest income from loans, but also includes fee incomes, gains from the

money markets and other investments.

Customers for loans and deposits include

members, associate members and non-members, while loans are mainly offered to

members or associate members.

Share capital paid by members is the major source

of equity and equity is paid-up based on the legal requirements for a number of

businesses of credit cooperatives.

This paper converts all the relevant variables into

proxy variables, such as capital adequacy, capital structure, profitability, liquidity and

business growth.

The definitions of all the relevant proxy variables in this paper are

as follows:

1. Capital Adequacy:

In order to measure the adequacy of their own capital for credit cooperatives, this

paper uses deposit to net worth ratio as the proxy variable for capital adequacy.

The higher the deposit to net worth ratio means the lower the capital.

Deposit to net worth ratio = deposit/net value

2. Capital Structure

This variable measures business risks of credit cooperatives.

This paper uses net

worth to loan ratio as the proxy variable for capital structure.

The lower the net

worth to loan ratio, the higher the business risks are.

The inability to recover

loans may trigger an operational crisis.

Net worth to loan ratio = net value / loans

3. Operating Performance

Profitability is a measurement for operating performance for credit cooperatives.

Net profit margin is used as the proxy variable for operating performance.

Net

profit margin measures the pre-tax earnings as a percentage of operating income.

The highest the margin, the better profitability is.

4

Net profit margin = pretax earnings/revenue

4. Liquidity

Liquidity measures the ability of credit cooperatives to convert assets into cash to

pay back debts within one year.

liquidity ratio should be over 2.

It is also debt repayment ability.

In principle,

The higher the ratio, the more likely credit

cooperatives are to pay back current liabilities.

If current ratio is smaller than 1,

it means there are liquidity risks in the short term.

Current ratio = deposits/loans

5. Business Growth

As loans are the main driver of profitability, the growth in loans is an indicator of

business growth and capital utilization for credit cooperatives.

Loan growth rate = loans (t) – loans (t-1) / loans (t-1)

As capital structure affects loans offered by credit cooperatives, a strong balance

sheet is able to allow growth in loans and hence to boost profitability and overall

operating performance.

Empirical Model - Single Threshold Model

This model uses balance panel data yit , qit , xit :1 i n,1 t T , where i

indicates the number of cross-section samples, t indicates the length of interval, yit

dependent variable, qit threshold variable, xit independent variable.

The Formula

is as follows:

yit ui 1 xit I (qit ) 2 xit I (qit ) eit

(1)

where I ( ) is an objective function. Therefore, the above formula may also be

expressed as follows:

u x e , if q

i

1 it

it

it

yit

ui 2 xit eit , if qit

Assume ( 1 2 ) , Eq.(1) can also be expressed as :

yit ui xit ( ) eit

(2)

From the above formula, we know that when threshold variable qit is bigger or

smaller than threshold value , the samples can be divided into two groups, which can

be expressed in different slopes 1 and 2 . To tell 1 from 2 , independent

5

variable xit has to be time invariant.

Meanwhile, it is also assumed that threshold

variable qit is time invariant. Error item eit must comply with the iid assumptions ,

where the average is 0, and variance is 2 . The extended model allows the existence

of heterogeneous variables.

When T remains constant, and n , this model

derives similar conclusions.

The purpose of this paper is to use known data yit , qit and xit , to estimate

known parameters , and 2 .

Therefore, it uses the balance threshold model

proposed by Hansen (1999) to validate the asymptotic distributions of threshold

values. Example for single-threshold models that do not contain controlled variables

are as follows:

(A) Estimates

The traditional method to eliminate individual effect ( ui ) is to cross out

individual averages, i.e. de-mean.

This method is easy to understand in linear

models, but requires extra cautions in non-linear models.

Therefore, this paper

derives the average of Eq.(1):

yi ui xi ( ) ei

(3)

Where yi T 1 t 1 yit , ei T 1 t 1 eit

T

T

T 1 T xit I (qit )

t 1

xi ( ) T t 1 xit ( )

T

1

T

t 1 xit I (qit )

1

T

Eq.(2) subtracts Eq.(3) can derive:

yit* xit* ( ) eit*

(4)

Where yit* yit yi , xit* ( ) xit ( ) xi ( ) 及 eit* eit ei .

All the data and errors of the second phase and the following get stacked up and

can be defined as follows:

yi*2

xi*2 ( ) '

ei*2

*

yi* , xi* ( )

, ei

y*

x* ( ) '

e*

iT

iT

iT

Based on the above definition, Y * yi* , X * ( ) xi* ( ) , e* ei* , therefore, Eq.(4)

can be rewritten into the following:

Y * X * ( ) e*

(5)

6

When is known, ordinary least squares estimator (OLS) can be used to estimate

the slope parameter .

The estimation is as follows:

ˆ ( ) ( X * ( ) X * ( )) 1 X * ( )Y *

(6)

The residual of the regression vector, e * Y * X * ( ) ˆ ( ) .

Meanwhile, sum

square error can be derived:

S1 ( ) e * ( )e * ( )

(7)

Y * I X * ( )( X * ( ) X * ( )) 1 X * ( ) Y *

Chan (1993) and Hansen (2000) suggested the use of ordinary least squares

estimator should be used to estimate threshold value .

This derives the minimum

residual sum of square so that the estimation of the minimum squares of should

be:

ˆ arg min S1 ( )

(8)

When threshold value ( ˆ ) is determined, it is possible that the number of

observations in certain section are too few or null.

Therefore, in the selection of the

optimal threshold value ( ˆ ), limits can be added that 1% or 5% (or any percentage)

observations should be included in-between two sections.

As soon as the optimal threshold value ˆ is derived, the estimation of slope

should be (ˆ) , and residual vector should be ê eˆ* (ˆ ) .

The estimation of

residual variances should be:

ˆ 2

1

1

S1 (ˆ )

eˆ* eˆ*

n(T 1)

n(T 1)

(9)

(B) Testing

It is very important to test whether threshold effects exist.

Based on the linear

limitations of Eq.(1), the null hypothesis that threshold effects do not exist can be

expressed as H 0 : 1 2 .

Under the null hypothesis, threshold value cannot be

derived and there exist nuisance parameters.

This type of testing yields non-standard

distributions so these questions are generally described as Davies Problem2.

Hansen

(1996) suggests that the approximations derived from bootstrapping simulations that

are similar to distributions are more effective than testing.

2

Please refer to Davies (1977,1987).

7

Therefore, under the null

hypothesis that there is no threshold effect, the model can be modified into the

following:

yit ui 1 xit eit

(10)

After conversion to eliminate fixed-effect, we derive:

yit* 1 xit* eit*

(11)

Where regression coefficient 1 can be estimated with ordinary least squares,

therefore, it is possible to derive ̂1 , residual ( eˆit* ) and sum of residual squares

( S 0 eˆ* ê* ). At this point, the likelihood ratio of null hypothesis is as follows:

F1

S0 S1 (ˆ )

ˆ 2

(12)

Where asymptotical distribution of F1 is not standard distribution.

Hansen

(1996) derives a first-order asymptotic distribution by bootstrapping, and finds that

p-value constructed during bootstrapping is effective.

Therefore, the asymptotical

distribution of F1 using bootstrapping under the null hypothesis is close to p-value.

When p-value is smaller than threshold value, the null hypothesis is rejected.

(C) Estimations of Asymptotical Distribution of Threshold Value

According to Chan (1993) and Hansen (2000), the threshold effects of the

regressions do exist.

In other words, when coefficient 1 2 , the estimated

threshold value ˆ and the actual threshold value 0 will be consistent.

At this time,

due to the presence of nuisance parameter, asymptotic distribution exhibits a highly

non-standard pattern.

Hansen (1997) suggested that it is necessary to construct a

no-rejection region of confidence interval to test .

When the value of LR1 ( 0 ) is

big enough so that p value falls outside the confidence intervals, it means that we can

significantly reject null hypothesis H 0 .

This means that threshold estimated value

does not equal to the actual threshold value 0 . The testing method is as follows.

The first step is to test the null hypothesis H 0 : 0 , and the maximum

approximation of estimates is :

LR1 ( )

S1 ( ) S (ˆ )

ˆ 2

(13)

8

LR1 ( 0 ) is to test whether H 0 : 0 .

Eq.(12) and Eq.(13) are different.

In other

words, it is to test whether threshold estimate value equal to the actual threshold value.

F1 is to test whether H 0 : 1 2 .

In other words, it is to test whether threshold

effects exist.

Hansen (1999) pointed out that when null hypothesis H 0 : 0 stands and

meets with the assumptions3, LR1 ( ) d , when n , is a random variable

of a probability distribution:

P( x) (1 exp( x 2)) 2

(14)

If there are no nuisance parameters, according to Eq.(14), the asymptotical

distribution of likelihood ration statistic is not standard.

When n , 2 1 0 ;

this implies that the larger the sample size, the smaller the variances becomes between

the slopes of the two sections.

However, if the threshold effects are significant,

threshold values (regardless of the levels) can be accurately estimated.

asymptotic distribution derived from Eq.(14) is critical.

The

Approximate confidence

intervals can be derived from Eq.(14). The inverse function of Eq.(14) can derive

the following:

C ( ) 2 log(1 1 )

(15)

Eq.(15) can derive the threshold value.

When the confidence interval is

and LR1 ( 0 ) C ( ) , we can reject H 0 : 0 , i.e. the actual threshold value not

equal to threshold estimate value.

(D) Asymptotical Distribution of Slope Parameters

Estimate formula ˆ ˆ (ˆ ) is under the influence of threshold estimate value.

This makes it even more difficult to determine .

Chan (1993) and Hansen (2000)

indicate that when threshold estimate is equal to the actual threshold value, ˆ ˆ (ˆ ) .

Therefore, ˆ is close to normal distribution and its covariance matrix is as follows:

n T

Vˆ xit* (ˆ ) xit* (ˆ )

i 1 t 1

1

ˆ 2

(16)

In estimating the confidence interval for , errors should meet with the iid

3

Please refer to Hansen (1999) in the attachments regarding the assumptions 1 to 8 on P.363.

9

assumptions; however, in estimating slope parameters, the assumptions can be

broadened.

If the allowed error exists conditional heterogeneous variances, the

covariance matrix of ˆ is as follows:

1

1

n T

n T

n T

Vˆh xit* (ˆ ) xit* (ˆ ) xit* (ˆ ) xit* (ˆ)(eˆit* ) 2 xit* (ˆ) xit* (ˆ) (17)

i 1 t 1

i 1 t 1

i 1 t 1

Multiple Threshold Models

Model (1) is a single threshold model.

thresholds may appear.

However, in practice, multiple

Below is an explanation of double threshold model:

yit ui 1xit I (qit 1 ) 2 xit I ( 1 qit 2 ) 3xit I ( 2 qit ) eit

where threshold value 1 2 .

(18)

It is possible to extend the method of double

threshold model into multiple threshold models.

(A) Estimates

When ( 1 , 2 ) is known, the linear slope parameters ( 1 , 2 , 3 ) can estimated

with ordinary least square to computer sum square of errors S ( 1 , 2 ) .

However,

the process is highly complex and it requires approximate N 2 (nT )2 to gradually

identify by grid search.

Chong (1994), Bai (1997) and Bai-Perron (1998) found that in the multiple

change point model, the continuous estimates are fixed.

applicable to the multiple threshold models.

Some of the logic seems

The process is as follows.

The first

step is to let S1 ( ) in Eq.(7) be the residual sum of squares of single threshold

models.

Also, let the minimum value of S1 ( ) equal to the optimal threshold

value ˆ1 .

Chong and Bai suggest that ˆ1 will be consistent with either 1 or 2

in the double threshold model (depending which one has stronger effects).

After fixing the first stage, the estimation is ˆ1 .

The selection criteria of

thresholds in the second stage are as follows:

S ( , ) if 1 2

S2r ( 2 ) 1 2

S ( 2 , 1 ) if 1 2

(19)

Where the threshold estimate of the second stage is as follows:

ˆ2r arg min S2r ( 2 )

(20)

2

10

The estimate cannot accept too few observations within any interval.

Therefore,

in Eq.(20), a condition to limit the number of minimal observations in the three

intervals is added.

does not.

Bai (1997) finds that ˆ2 boasts gradual efficiency while ˆ1

This is because ˆ1 is derived by computing the residual sum of squares in

the single threshold model.

Therefore, due to the fact that effects of one threshold

are neglected and ˆ2 boasts gradual efficiency, it is possible to further modify ˆ1

through the estimate of the third step.

estimate ˆ2 of the second stage.

The third step is to first fix the threshold

At this point, the selection criteria of thresholds in

the third step are as follows:

S ( , ) if

2

2

1

S1r ( 1 ) 1

S ( 2 , 1 ) if 1 2

(21)

Further refined threshold estimate are as follows:

ˆ1r arg min S1r ( 1 )

(22)

1

Bai (1997) pointed out that refined threshold estimate ˆ1r boasts gradual

efficiency at change point estimation.

(B) Determination on the Number of Thresholds

According to the previous mentioned model Eq.(18), it is possible that there may

be no threshold, only one threshold or two thresholds.

In the single threshold model,

it is suggested that F1 stats are used to test whether there is one single threshold or

no threshold.

value.

Bootstrapping method should be applied to estimate the gradual p

If F1 stats reject the null hypothesis, it should be further tested whether

there is one threshold or two thresholds.

It is possible to derive, in the estimates of

the second stage, minimum residual sums of squares S 2r ( 2 ) and variance

estimate ˆ 2 S2 (ˆ2 ) / n(T 1) .

Therefore, the likelihood ratio stats to test single or

double thresholds are as follows:

F2

S1 ( 1 ) S 2 ( 2 )

ˆ 2

(23)

When F2 stats reject the null hypothesis, it means double thresholds exist.

11

(C) Construction of Confidence Intervals

It is necessary to construct a confidence interval for the two threshold

parameters { 1 , 2 } .

Bai (1997) uses change point models and finds that the refined

threshold estimates and that of single threshold model share the same asymptotic

distribution.

Therefore, it is suggested that confidence interval should be

constructed in the same way that single threshold model is constructed.

LR2 ( )

Therefore,

S2 ( ) S2 (ˆ2 )

S1 ( ) S1 (ˆ1 )

and

LR

(

)

1

ˆ 2

ˆ 2

Where S2 ( ) and S1 ( ) are defined in Eq.(19) and Eq.(21) respectively.

Therefore, the confidence interval of (1 )% of 1 and 2 can be defined as

LR1 ( ) C ( ) and LR2 ( ) C ( ) .

Empirical Result

This paper conducts its research and analysis based on Panel threshold model

proposed by Hansen (1999) to explore whether loans of credit cooperatives in Taiwan

are under the influence of capital structures and whether there exist any threshold

relationship between loans and operating performances so that it is possible to analyze

the optimal capital structures for credit cooperatives in Taiwan.

Meanwhile, this

paper also examines whether there are differences in the impacts of loans to capital

structures for credit cooperatives in northern, central and southern Taiwan.

This

paper studies on the 28 credit cooperatives, including 11 in northern Taiwan (Taipei

First Credit Cooperative, Taipei Fifth Credit Cooperative, Taipei Ninth Credit

Cooperative, Keelung First Credit Cooperative, Keelung Second Credit Cooperative,

Tamshui Credit Cooperative, Tamshui First Credit Cooperative, Ilan Credit

Cooperative, Taoyuan Credit Cooperative, Hsinchu First Credit Cooperative, Hsinchu

Third Credit Cooperative), 9 in central Taiwan (Chunan Credit Cooperative, Taichung

Second Credit Cooperative, Changhua First Credit Cooperative, Changhua Fifth

Credit Cooperative, Changhua Sixth Credit Cooperative, Changhua Tenth Credit

Cooperative, Lugang Credit Cooperative, Chiayi Third Credit Cooperative, Chiayi

Fourth Credit Cooperative) and 8 in souther Taiwan (Tainan Third Credit Cooperative,

Hualien First Credit Cooperative, Hualien Second Credit Cooperative, Penghu First

Credit Cooperative, Penghu Second Credit Cooperative, Kinmen Credit Cooperative,

Kaohsiung Second Credit Cooperative, Kaohsiung Third Credit Cooperative).

12

All

the data regarding credit cooperatives are the annual reports from 1994 through 2005.

Based on the previous operational variable explanations and the research method

proposed by Hansen (1999), the model is defined as follows:

git i i hit i dit (

I qit ) it

Where g it represents net profit margins, hit represents controlled variables

and they are deposit to net wroth ratio and current ratio, respectively, d it represents

loans growth while qit represents net worth to loan ratio.

This study uses net worth to loan ratio as threshold variable to examine whether

loans growth and operating performances of credit cooperatives are under the

influence of capital structure, and whether there exists asymmetric threshold

relationship.

In the process of panel threshold regression, it is necessary to first test

whether threshold effects exist.

Hanen (1999) points out that it is possible to derive

p-value and F-stats using bootstrapping method and test in order to know whether

there exist single-threshold, double-threshold or triple-threshold effects.

This study

first tests the threshold effects for the 28 credit cooperatives in Taiwan.

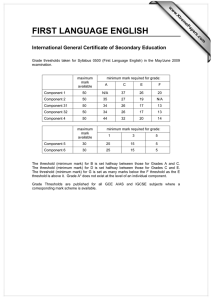

According

to Table 1, under 5% significant level, both single threshold and double thresholds are

significant.

Their F-stats are 6.851 and 39.134, respectively and double-threshold

effects are more significant.

The empirical research finds that loans growth and

operating performances of credit cooperatives in Taiwan exists double threshold

relationships.

In other words, loans growth and operating performances of credit

cooperatives are influenced by their capital structures. There are asymmetric

double-threshold relationships between them.

Figure 1, Figure 2 and Figure 3 show

the threshold estimates from plots of the concentrated likelihood ratio function

LR1 ( ), LR2r ( ) and LR1r ( ) (details about these three figures see Hansen (1999)).

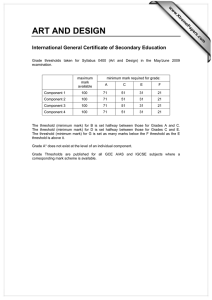

The empirical finding of Table 2 shows the threshold values and threshold

parameter estimates of these 28 credit cooperatives in Taiwan.

The model can be

expressed as follows:

i 1hit 1dit it

git i 1hit 2 dit it

h d

3 it

it

i 1 it

if qit 0.16

if 0.16 qit 0.212

if qit >0.212

The threshold parameters in Table 2 show that there are two threshold values for

net worth to loan ratio and these two threshold values are 0.16 and 0.212, respectively.

13

These two threshold values divide observations into three regimes and form a

non-linear asymmetric relationship.

In other words, the corresponding threshold

parameter value of different regimes will have different i .

These results indicate

that when net worth to loan ratio is either lower than 0.16 or higher than 0.212, loans

growth creates negative impacts on net profit margins of credit cooperatives.

The

poor capital structures of credit cooperatives within this range indicate that increase in

loans will hurt net profit margins.

14

Table 2 further indicates that the optimal net worth to loan ratio of credit cooperatives

should be between 0.16 and 0.212. Within this range, the impacts of loans growth to

net profit margins are obvious and the impact is significant.

In other words, one-unit

increase in loans growth creates 2.094-unit increase in net profit margins.

Meanwhile, this paper also finds that two controlled variables such as the deposit to

net worth ratio and current ratio have significant impacts on net profit margins.

The

deposit to net worth ratio show significant and positive impact on net profit margins,

however, on the other hand, current ratio show significantly but negative impact on

net profit margins.

In sum, this paper finds that there exists an asymmetric

relationship in the effects of loan growth on operating performance of credit

cooperatives in Taiwan.

Table 3 reports the number of firms in each regime by year.

We find that most of the firms are in the lower net worth to loan ratio regime and this

result indicates that most of the credit cooperatives are involved in the higher risk.

As we know that the lower the net worth to loan ratio, the higher the business risks are.

The inability to recover loans may trigger an operational crisis.

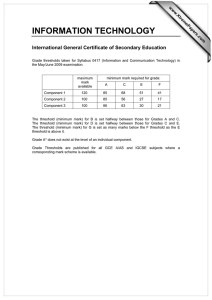

Moreover, this paper also examines whether threshold relationships are different

in northern, central and southern Taiwan.

This paper tests the threshold effects for

11 credit cooperatives in northern Taiwan, 9 in central Taiwan and 8 in southern

Taiwan. The empirical finding on Table 4 shows that under 5% significant levels,

there is a double-threshold relationship in northern Taiwan.

15

The F-stats and p-value

of the threshold values in northern Taiwan are 18.282 and 0.028, respectively.

There

exists a triple-threshold relationship in central Taiwan under 10% significant levels.

The F-stats and p-value of the threshold values for central Taiwan are 8.255 and 0.09,

respectively.

However, there seems to be no significant threshold effects in southern

Taiwan. These results indicate that both operating performance and loans growth of

credit cooperatives in northern and central Taiwan are under the influence of net

worth to loan ratio and therefore, there exist threshold relationships.

However, there

is no threshold relationship in southern Taiwan, which means that financial structures

do not create significant effects on operating performances.

This may be explained

by differences between urban and rural areas or management styles.

As only credit cooperatives in northern and central Taiwan experience significant

threshold effects, this paper only evaluates these credit cooperatives.

Table 5 shows

that credit cooperatives in northern Taiwan exists threshold values of 0.106 and 0.115

for their net worth to loan ratio.

The model for northern Taiwan is as follows:

i 1hit 1dit it

git i 1hit 2 dit it

h d

3 it

it

i 1 it

if qit 0.106

if 0.106 qit 0.115

if qit >0.115

This paper finds that the two threshold values in northern Taiwan are both

smaller those of all Taiwan (0.16 and 0.212).

The impacts of loans growth to net

profit margins within the range of optimal net worth to loan ratio in northern Taiwan

is (1.539) smaller than that for all Taiwan (of 2.094).

This may be due to the fact

that northern Taiwan is where the competition in the financial market is the fiercest so

that the room for credit cooperatives is squeezed to use financial structures to improve

operating performances.

This paper finds that the threshold values of net worth to loan ratios of credit

cooperatives in central Taiwan are 0.145, 0.16 and 0.214. The three threshold model

for central Taiwan is presented as follows:

i 1hit

h

i 1 it

git

i 1hit

i 1hit

1dit it

if qit 0.145

2 dit it

if 0.145 qit 0.16

3dit it

if 0.16 qit 0.214

4 dit it

if qit >0.214

The threshold values for central Taiwan is not far from the average threshold

values for all Taiwan.

However, the effects on net profit margins (3.052) from loans

growth within the range of optimal net worth to loan ratios are far greater than the

16

average (2.084) for all Taiwan.

This implies that credit cooperatives in central

Taiwan may use leverage to improve their operating performances and the effects are

significant.

Conclusion

Although credit cooperatives in Taiwan do not hold high market shares in either

deposits or loans markets, they have made their contributions to the local economies

in Taiwan, due to their historical roles, especially in the society.

The empirical

research of this paper finds that the 28 credit cooperatives from 1994 through 2005 in

general, experienced double threshold effects.

should be 0.16~0.212.

The optimal net worth to loan ratio

This indicates that when loans grow by 1%, it creates 2.094%

growth in net profit margins.

As credit cooperatives expect to write off bad debts to

bring down non-performing loans under the initiatives of the government policies, the

loan growth went from the positive to negative from 1997 to 2002.

Therefore, this

paper finds that 1 unit of increase in loans creates 2 units of increase in net profit

margins.

Also, both loan growth rates and operating performances of credit

cooperatives in northern and central Taiwan are under the influence of net worth to

loan ratio and threshold effects exist; however, there is no significant threshold effect

for credit cooperatives in southern Taiwan.

17

Table 1 Testing of Threshold Effects

F

Threshold Value

P Value

10%

5%

1%

0.088

6.746

8.141

12.576

Double Threshold 39.134***

0.004

13.443

16.884

27.484

Triple Threshold

0.402

4.402

6.591

23.349

Single Threshold

6.851*

2.020

Note: p-value and threshold values are computed after 500 samplings based on

bootstrapping method. The symbols *, ** and *** represent they are statistically

significant under 10%, 5% and 1%. Source: this paper.

18

Table 2 Estimates of Threshold Values & Parameter Values

95% Confidence

Threshold Value

Estimates

1

0.160

0.076

0.229

2

0.212

0.212

0.214

Controlled Variable

Intervals

Estimates

t OLS

OLS se

tW hite

White se

1

0.007

1.909**

0.004

1.759*

0.004

2

-0.037

-1.323

0.028

-1.695*

0.022

Estimates

t OLS

OLS se

tW hite

White se

1

-0.016

-0.148

0.109

-0.210

0.077

2

2.094

6.088***

0.344

2.937***

0.713

3

-0.202

-0.761

0.265

-1.369

0.147

Parameter Estimates

Threshold Variable

Parameter Estimates

Note: OLS se is homogenous standard deviations. White se is heterogeneous

standard deviations. The symbols *, ** and *** represent they are statistically

significant under 10%, 5% and 1%. Source: this paper.

Table 3 Firm of each regime by year

Year

Firm class

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005

qit 0.16

26

26

26

25

25

25

22

19

20

23

23

0.16 qit 0.212

1

1

1

1

1

0

4

5

5

2

2

qit >0.212

1

1

1

2

2

3

2

4

3

3

3

19

Table 4 Testing of Threshold Effects of All Regions

F

10%

5%

1%

0.586

7.484

9.252

12.049

Double Threshold 18.282***

0.028

9.065

13.57

26.146

Triple Threshold

6.556

0.476

27.779

49.458

90.53

Single Threshold

4.155

0.16

5.158

6.241

8.579

Double Threshold

17.89

0.116

18.838

23.742

34.717

Triple Threshold

8.255*

0.09

7.814

10.039

15.565

Single Threshold

5.102

0.606

19.456

25.493

44.885

Double Threshold

5.432

0.598

33.571

50.885

111.859

Triple Threshold

0.906

0.922

12.243

17.544

55.133

Single Threshold

Northern

Central

Southern

Threshold Value

P Value

1.991

Note: p-value and threshold values are computed after 500 samplings based on

bootstrapping method. The symbols *, ** and *** represent they are statistically

significant under 10%, 5% and 1%. Source: this paper.

20

Table 5 Parameter Estimates for Northern Taiwan

95% Confidence

Threshold Value

Estimates

1

0.106

0.076

0.177

2

0.115

0.115

0.116

Estimates

t OLS

OLS se

tW hite

White se

1

0.0005

0.133

0.004

0.265

0.002

2

0.001

0.031

0.047

0.059

0.024

Estimates

t OLS

OLS se

tW hite

White se

1

-0.096

-0.698

0.138

-1.193

0.081

2

1.539

4.157***

0.37

1.506*

1.022

3

0.031

0.224

0.136

0.343

0.089

Controlled Variable

Parameter Estimates

Threshold Variable

Parameter Estimates

Intervals

Note: OLS se is homogenous standard deviations. White se is heterogeneous

standard deviations. The symbols *, ** and *** represent they are statistically

significant under 10%, 5% and 1%. Source: this paper.

21

Table 6 Parameter Estimates for Central Taiwan

95% Confidence

Threshold Value

Estimates

1

0.145

0.071

0.265

2

0.214

0.214

0.214

3

0.16

0.158

0.167

Estimates

t OLS

OLS se

tW hite

White se

1

0.004

0.501

0.008

0.593

0.007

2

-0.053

-1.044

0.051

-1.554

0.034

Estimates

t OLS

OLS se

tW hite

White se

1

-0.273

-0.869

0.314

-1.5

0.182

2

0.781

1.037

0.754

0.638

1.225

3

3.052

4.728***

0.646

3.03***

1.007

4

-0.292

-0.745

0.391

-1.553

0.188

Controlled Variable

Parameter Estimates

Threshold Variable

Parameter Estimates

Intervals

Note: OLS se is homogenous standard deviations. White se is heterogeneous

standard deviations. The symbols *, ** and *** represent they are statistically

significant under 10%, 5% and 1%. Source: this paper.

22

Andrews, D.W.K. and Ploberger, W. (1994), “Optimal tests when a nuisance

parameter is present only under the alternative”, Econometrica, 62, 1383-1414.

Arshadi, N. and Lawrence, E. C. (1987), “An Empirical Investigation of New Bank

Performance”, Journal of Banking and Fianace, 11(1): 33-48.

Bai, J. (1997), “Estimating multiple breaks one at a time”, Econometric Theory, 13,

315-352.

Bai, J. and Perron, P. (1998), “Estimating and testing linear models with multiple

structural changes”, Econometrica, 66, 47-78.

Banz, R. W. (1981), “The Relationship Between Return and Market Value of

Common Stocks”, Journal of Financial Economics, 9(1): 3-18.

Chan, L. K. C., Hamao, Y. and Lakonishok, J. (1991), “Fundamentals and Stock

Returns in Japan”, Journal of Finance, 46(5): 1739-1764.

Chan, K.S. (1993), “Consistency and Limiting Distribution of the Least Squares

Estimator of a Continuous Threshold Autoregressive Model”, The Annals of

Statistics, 21, 520-533.

Chong, T. T-L (1994), “Consistency of change-point estimator when the number of

change-points in structural change model is underspecified”, Working paper,

Chinese University of Hong Kong.

Davies, R.B. (1977), “Hypothesis testing when a nuisance parameter is present only

under the alternative”, Biometrika, 64, 247-254.

Davies, R.B. (1987), “Hypothesis testing when a nuisance parameter is present only

under the alternative”, Biometrika, 74, 33-43.

23

Fama, E. F. and French, K. R. (1992), “The Cross-Section of Expected Stock

Returns”, Journal of Finance, 47(2): 427-465.

Hansen, B.E. (1996), “Inference when a nuisance parameter is not identified under the

null hypothesis”, Econometrica, 64, 413-430.

Hansen, B.E. (1999), “Threshold effects in non-dynamic panels: Estimation, testing

and inference”, Journal of Econometrics, 93, 345-368.

Hansen, B.E. (2000), “Sample splitting and threshold estimation”, Econometrica,

2000, 68, 575-603.

Hameeteman, D. and Scholtens, B. (2000), “Size, Growth and Variance Among the

World’s Largest Non-merged Banks”, International Journal of the Economics of

Business, 7(3): 313-323.

Miller, S. M. and Noulas, A. G. (1996), “The Technical Efficiency of Large Bank

Production”, Journal of Banking and Finance, 20(3): 495-509.

Sherman, H. D. and Ladino, G. (1995), “Managing Bank Productivity Using Data

Envelopment Analysis (DEA)”, Interfaces, 25(2): 60-73.

Wonsik, S., (1998), “Do Universal Banks in Major European Countries Have A Better

Performance Compared to Specialized Banks? An Empirical Investigation”,

Journal of Financial Management and Analysis, 11(2):28-43.

24