Deposit Insurance in the Wake of the Asian Financial Crisis

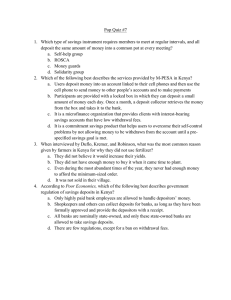

advertisement