PowerPoint for Chapter 19

advertisement

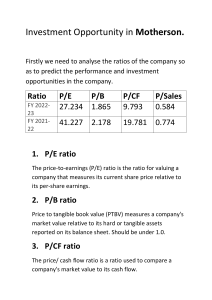

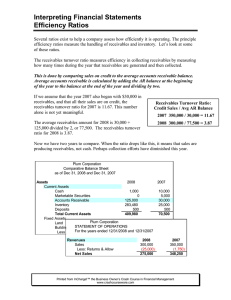

Financial Analysis, Planning and Forecasting Theory and Application Chapter 19 Credit Management By Alice C. Lee San Francisco State University John C. Lee J.P. Morgan Chase Cheng F. Lee Rutgers University Outline 19.1 Introduction 19.2 Trade credit 19.3 The cost of trade credit 19.4 Financial ratios and credit analysis 19.5 Credit decision and collection policies 19.6 Summary 19.1 Introduction 19.2 Trade credit ARt ARt 1 AR AR N t 0 t (19-1) Table 19-1 Aging of Accounts Receivable January Accounts Receivable February ﹪ of Total Accounts Receivable ﹪ of Total $ 250,000 25.0﹪ $ 250,000 22.7﹪ 31-60 days 500,000 50.0﹪ 525,000 47.8﹪ 61-90 days 200,000 20.0﹪ 250,000 22.7﹪ 50,000 5.0﹪ 75,000 6.8﹪ $1,000,000 100.0﹪ $1,100,000 100.0﹪ 0-30 days Over 90 days Total accounts receivable 19.3 The cost of trade credit The seller’s perspective The buyer’s perspective 19.3 The cost of trade credit S 0 = Current sales =$1 million per year. S = Incremental sales =$250,000. V = Variable costs as a percentage of sales = 70 percent. includes the cost of administering the credit department and all other costs except bad-debt losses and financing costs (interest charges) associated with carrying the investment in receivables. Costs of carrying inventories are included in . 1-V = Contribution margin = 30 percent or equivalently, the percentage of each sales dollar that goes toward covering overhead and increasing profits. k = The cost of financing the investment in receivables = 12 percents. k is the firm’s cost of new capital when the capital is used to finance receivables. ACP0= Average collection period prior to a change in credit policy = 20 days. ACPN = New average collection period after the credit policy change = 30 days. In this example, we assume that customers pay on time, thus ACP = specified collection period). 19.3 The cost of trade credit I (increased investment in receivables associated with original sales) (additional investment in receivables associated with new sales) (change in collection period)(old sales per day) V ( ACPN ) (incremental sales per day) S0 S ACPN ACP0 V ACPN 360 360 1, 000, 000 250, 000 30 20 .7 30 360 360 42,361 (19-2) 19.3The cost of trade credit P new sales contribution margin cost of carrying new receivables S 1 V k I $ 250,000(.3) .12(42,361) $ 69,917 (19-3) P new sales contribution margin cost of carrying new receivables (bad-debt losses) S 1 V k I B S $ 250,000(.3) .12(42,361) .05($ 1,250,000) $ 7.417 (19-4) 19.4 Financial ratios and credit analysis Financial ratio analysis Numerical credit scoring Benefits of credit-scoring models Outside sources of credit information 19.4 Financial ratios and credit analysis (19-5) Y AX BX i 1i 2i Table 19-2 Status and Index Values of the Accounts Yi Account Number Account Status 7 Bad .81 10 Bad .89 2 Bad 3 Bad 1.45 6 Bad 1.64 12 Good 1.77 11 Bad 1.83 4 Good 1.96 1 Good 2.25 8 Good 2.50 5 Good 2.61 9 Good 2.80 1.30 19.4 Financial ratios and credit analysis Figure19-1 Distributions of Good and Bad Accounts Probability of Occurrence Bad Good 12 1.64 1.83 1.77 1.96 Discriminate Function Value 19.4 Financial ratios and credit analysis Fi b1Y1 b2Y2 Credit Score from Scoring Model -.200 b jY j bpYp Cumulative Frequencies “Goods” 0﹪ “Bads” 0﹪ .208 0 35 .226 2 36 .245 3 40 .356 6 58 .543 16 76 .577 17 82 .596 20 85 .699 34 97 .763 49 99 .898 75 100 1.200 100 100 (19-6) 19.4 Financial ratios and credit analysis Figure 19-2 Key to Dun and Bradstreet Ratings 19.5 Credit decision and collection policies Collection policy Factoring and credit insurance 19.6 Summary The subject of Chapter 19 is the management of trade credit for both buyer and seller. For the buyer, the essential issue is to determine the cost of using trade credit as a form of financing, then compare this cost with the cost of alternative sources of capital. While some argue that accounts payable have no cost, we support the arguments against this view. That is, for the buyer, trade credit involves opportunity costs in the form of foregone discounts, implicit bankruptcy costs for taking on too much accounts payable, and costs associated with the timing of taxes and the accounting procedure used. The grantor of trade credit, the seller, has a large array of decisions to make. The first of these we discussed was determining the cost of granting trade credit. Next, we examined a numerical credit-scoring method via linear discriminant analysis to make the credit-granting decision more effective in terms of risk and related collection and bad-debt costs. Finally, we discussed the other aspects of the firm’s credit policy, including the decision of how much credit to grant, on what terms, and the collection policy procedures to be pursued for delinquent accounts. We noted that the evaluation of various collection policies can be viewed and even carried out in the framework of a capital budgeting problem. Chapter 13 offer a number of methods to deal with the capital budgeting problem with uncertainty, including(1)the risk-adjusted discount rate method,(2)the certainty equivalent method,(3)the statistical distribution method, and(4) various simulation methods.