PowerPoint for Chapter 16

advertisement

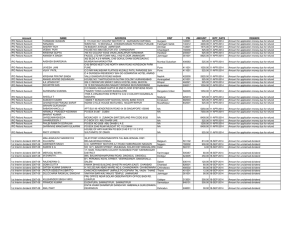

Financial Analysis, Planning and Forecasting Theory and Application Chapter 16 Dividend Policy and Empirical Evidence By Alice C. Lee San Francisco State University John C. Lee J.P. Morgan Chase Cheng F. Lee Rutgers University Outline 16.1 Introduction 16.2 The value of dividend policy to the firm Methods of Determining the Relevance of Dividends 16.3 Issues marring the dividend problem The Classical CAPM Brennan’s CAPM with Taxes The Litzenberger and Ramaswamy CAPM with Taxes Empirical Evidence 16.4 Behavioral considerations of dividend policy Partial Adjustment and Information Content Models An Integration Models 16.5 Summary and conclusions 16.1 Introduction Classical CAPM Neo-classical Option pricing (Further extension) 16.2 The value of dividend policy to the firm Methods of determining the relevance of dividends a) The Discounted Cash-Flow Approach b) The Investment Opportunities Approach c) Stream-of-Dividends Approach d) Stream-of-Earnings Approach 16.2 The value of dividend policy to the firm D 1 , P0 = K-g (16.1) where P0 = Today’s stock price, K = Investor’s required rate-of-return, and 16.2 The value of dividend policy to the firm P0 = f(D, g, K) (1 - b)X P0 = K - br d P0 X ( r - K ) = db ( K - br ) 2 (16.2) (16.3) 16.2 The value of dividend policy to the firm Pjt rjt D jt Pj ( t 1) 1 rjt d jt Pj ( t 1) Pjt Pjt (16.4) (16.5) 16.2 The value of dividend policy to the firm 16.2 The value of dividend policy to the firm V jt D jt V j ( t 1) 1 rjt D jt + ( n jt )( P j(t+1) ) . V jt = 1 + r jt V jt [ D jt (n jt )( Pj (t 1) m jt p j ( t 1) ) /1 rjt N (16.6a) V j,N X jt - I jt + V jt = t N (1 + (1 + r jt ) r jN ) t=1 (16.6b) (16.7) (16.8) 16.2 The value of dividend policy to the firm The Discount Cash Flow Approach N N CI jt CO jt V jN + V jt = t t N (1 + r jN ) t=1 (1 + r jt ) t=1 (1 + r jt ) The Investment Opportunity Approach * r jt - r jt I jt [ ]. r jt (16.10) * X jt I jt (r jt - r jt ) . V jt t t t 1 (1 r jt ) t 1 r jt /[(1 r jt ) ] (16.11) (16.9) 16.2 The value of dividend policy to the firm Stream of Dividends Approach N V jt t 1 D jt . t (1 r jt ) N X jt I jt . V jt t t t 1 (1 r jt ) t 1 (1 r jt ) (16.12) N (16.13) Stream of Earnings Approach N N t X jt r jt I j . V jt t t t 1 (1 r jt ) t 1 0 (1 r jt ) (16.14) 16.3 Issues marring the dividend problem The classical CAPM Brennan’s CAPM with taxes The Litzenberger and Ramaswamy CAPM with taxes Empirical evidence 16.3 Issues marring the dividend problem The classical CAPM R jt R f j ( R mt - R f ), where Vi Xji z Pj tgi dj tdj q X0i (16.15) = Value of the ith person’s portfolio; = Dollar amount of security j in the ith portfolio; = Expected end-of-period price of security j; = Initial equilibrium price of security j; = Effective capital gains tax on ith investor; = Dividend payment on security j; = Effective marginal tax rate applicable to dividend receipt by the ith investor; = Expected return on the riskless asset; = Dollar amount invested in the riskless asset at t = 0 by the ith investor. 16.3 Issues marring the dividend problem Brennan’s CAPM with Taxes N V i X ji[ z j ( z j P j )t gi d ji (1 t di )] X 0i[q (q 1)t di], (16.16) j 1 N N jk X ji (1- t gi ) X ki (1- t gi ), 2 i (16.17) j 1 k 1 where σjk = Covariance between the returns on security j and security k. N P (X j ji - X 0ji ) ( X 0i - X 00i ) 0, (16.18) j 1 where X 0ji and X 0i0 represent initial endowment of Xji and X0i, respectively. 16.3 Issues marring the dividend problem U i U i ( i , ) 2 i N L U i ( i, i2) [ P j ( X j 1 ji (16.19) X ) (X X 0 ji 0i 0 0i )], (16.20) ( R j r ) j [( Rm r ) T (r d m )] T (d j r ) (16.21) 16.3 Issues marring the dividend problem The Litzenberger and Ramaswamy CAPM with taxes N k L f ( k , ) (1- X i - X f ) k k 2 k k 1 i 1 N k2[ X ik d i X kf r f - S 2k ] i 1 where (16.22) N 3k[(1- ) X ik X kf - S 3k ], i 1 1k = Lagrange on the kth investor’s budget; 2k , S 2k = Lagrange on the kth investor’s income and the associated slack variable; , S = Lagrange on the kth investor’s borrowing and the associated slack variable; di = Dividend yield on security i. k 3 k 3 16.3 Issues marring the dividend problem E ( R j ) - r f A B j C (d j - r f ). k k k C m [T - 2 / f 1 ], k 1 N (16.23) k (16.24) f ( k , 2k ) m = ; = k k k f1 k C= m T - m , f kn kb k k k 2 k 1 k . k (16.25) 16.3 Issues marring the dividend problem E(Rj) - Tmdj = [rf(1 - Tm) + A](1 - βj) + [E(Rm) - Tmdm]βj, (16.23a) E(Rj) - Tmdj = [rf(1 - Tm)] + [E(Rm) - Tmdm - rf(1 - Tm)] βj. (16.23b) E(Rj) = (A + rf)(1 - βj) + E(Rm) βj. E(Rj) = rf + [E(Rm) - rf)] βj. (16.23c) (16.23d) 16.3 Issues marring the dividend problem Empirical Evidence P = a0 + a1D + a2Y. (16.26) P = a0 + a1D + a2(Y - D). (16.27) 16.3 Issues marring the dividend problem P = B 0 + B 1d + B 2(d - d ) + B 3( g ) + E 4(g - g ), where P = Price per share/Book value; d = 5-year average dividend/Book value; d = Current year’s dividend/Book value; g = 5-year average retained earnings/Book value; g = Current year’s retained earnings/Book value. P = a0 + a1D + a2R + F. (16.29) (16.28) 16.3 Issues marring the dividend problem CAPM Approach Empirical Work E( R j ) = T 2 R f + j(E( R m ) - T 1d m - T 2 R f ) + T 1d j, (16.30) where dj = Dj/Vj, dm = Dm/Vm, T1 = (Td - Tg)/(1 - Tg), T2 = (1 - Td)/(1 - Tg) = 1 - T1, Td = Average tax rate applicable to dividends, Tg = Average tax rate applicable to capital gains. Rjt - Rft = A + Bβjt + C(djt - Rft) Rit - Rm = a0 + a1 it, (16.31) (16.32) 16.4 Behavioral considerations of dividend policy Partial adjustment and information content models An integration model 16.4 Behavioral considerations of dividend policy • Partial adjustment and information content models D* = rEt, (16.33) and Dt - Dt-1 = a + b(D* - Dt-1) + ut (16.34) where D* = Firm’s desired dividend payment, Ft = Net income of the firm during period t, r = Target payout ratio, a = A constant relating to dividend growth, b = Adjustment factor relating the previous period’s dividend and the new desired level of dividends, where b is assumed to be less than one. 16.4 Behavioral considerations of dividend policy Dt - Dt-1 = a + b(rEt - Dt-1) + ut, Dt = rE* + ut. (16.36) E bEt (1 b) E 1 * t (16.35) * t (16.37) Dt - Dt-1 = rbEt - bDt-1 + ut + ut-1(1 - b). (16.38) 16.4 Behavioral considerations of dividend policy • An Integration Model D* rEt* Dt - Dt-1 = a + b1(D* - Dt-1) + ut, Et* Et*1 b2 ( Et Et*1 ) (16.39) (16.40) (16.41) Dt - Dt-1 = ab2 + (1 - b1 - b2)Dt-1 - (1 - b2)(1 - b1)Dt-2 + rb1b2Et - (1 - b2)ut-1 + ut. (16.42) 16.5 Summary and conclusions In this chapter we examined many of the aspects of dividend policy, primarily from the relevance-irrelevance standpoint, and from multiple pricing-valuation frameworks. From the Gordon growth model, or classical valuation view, we found that dividend policy was not irrelevant, and that increasing the dividend payout would increase the value of the firm. Upon entering the world of Modigliani and Miller where some ideal conditions are imposed, we found that dividends were only one stream of benefits we could examine in deriving a value estimate. However, even in their own empirical work on those other benefit streams, M&M were forced to include dividends, if only for their information content. 16.5 Summary and conclusions Building on the Sharpe, Lintner, and Mossin CAPM derivations, Brennan showed that dividends would actually be determinantal to a firm’s cost of capital as they impose a tax penalty on shareholders. While this new CAPM is useful, however, Brennan considered only the effects associated with the difference between the original income tax and the capital-gains tax. Litzenberger and Ramaswamy extended Brennan’s model by introducing income, margin, and borrowing constraints. Their empirical results are quite robust, and show that higher and lower dividends mean different things to different groups of investors. 16.5 Summary and conclusions Option-pricing theory was shown to make dividends a valuable commodity to investors due to the wealth-transfer issue. The theory (and the method) of dividend behavior also showed dividend forecasting to have positive value in financial management. In sum, we conclude that dividends policy does generally matter, and it should be considered by financial managers in doing financial analysis and planning. The interactions between dividend policy, financing, and investment policy will be explored in the next chapter.