Appendix 17A

advertisement

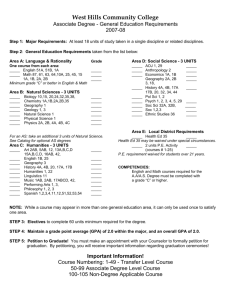

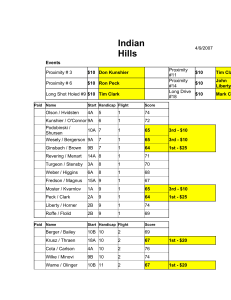

Appendix 17A Application of the Binomial Distribution to Evaluate Call Options Appendix 17A: Applications of the Binomial Distribution to Evaluate Call Options • In this appendix, we show how the binomial distribution is combined with some basic finance concepts to generate a model for determining the price of stock options. • What is an option? • The simple binomial option pricing model • The Generalized Binomial Option Pricing Model 2 Appendix 17A: Applications of the Binomial Distribution to Evaluate Call Options Cu Max(0, uS X ) (17A.1) Cd Max(0, dS X ) (17A.2) h(uS ) Cu h(dS ) Cd Cu Cd h (u d ) S 3 (17A.3) (17A.4) Appendix 17A: Applications of the Binomial Distribution to Evaluate Call Options (1 r )(hS C ) h(uS ) Cu h(dS ) Cd R d u R C Cu C d R ud u d Rd p ud u R so 1 p u d C pCu (1 p)Cd R 4 (17A.5) (17A.6) (17A.7) (17A.8) Appendix 17A: Applications of the Binomial Distribution to Evaluate Call Options Table 17A.1 Possible Option Value at Maturity Today Stock (S) Option (C) Next Period (Maturity) uS = $110 $100 Max (0,uS – X) = Max (0,110 – 100) = Max (0,10) = $ 10 Cd = Max (0,dS – X) = Max (0,90 – 100) = Max (0, –10) = $0 C dS = $ 90 5 Cu = Appendix 17A: Applications of the Binomial Distribution to Evaluate Call Options • Let • X = $100 • S = $100 • u = (1.10). so uS = $110 • d = (.90), so dS = $90 • R = 1 + r = 1 + 0.07 = 1.07 • Next we calculate the value of p as indicated in Equation (17A.7): p • • 1.07 .90 .85 1.10 .90 1 p 1.10 1.07 .15 1.10 .90 Solving the binomial valuation equation as indicated in Equation (17A.8), we get C = [.85(10) + .15(0)] / 1.07 = $7.94. Appendix 17A: Applications of the Binomial Distribution to Evaluate Call Options CT = Max [0, ST – X] Cu = [pCuu + (1 – p)Cud] / R Cd= [pCdu + (1 – p)Cdd] / R (17A.9) (17A.10) (17A.11) C p 2 Cuu 2 p(1 p)Cud (1 p) 2 C dd R 2 (17A.12) C p3Cuuu 3p2(1 p)Cuud 3p(1 p)2Cudd (1 p)3Cddd R3 (17A.13) 7 Example 17A.1 Figure 17A.1 Price Path of Underlying Stock and Value of Call Option Source: R.J.Rendelman, Jr., and B.J.Bartter (1979), “Two-State Option Pricing,” Journal of Finance 34 (December), 1906. 8 Example 17A.1 • In addition, we can Equation (17A.13) to determine the value of the call option. p R d (1.16) 1.15 0.4 u d 1.175 1.15 u R 1.175 1.16 1 p 0.6 u d 1.175 1.15 C p3Cuuu 3 p2 (1 p)Cuud 3 p(1 p)2 Cudd (1 p)3Cddd R3 3 2 3 0.4 52.22 3 0.4 (0.6) 7.3 3 0.4 (0.6)2 0 (0.6)3 0 1.16 3 2 3 0.4 52.22 3 0.4 (0.6) 7.3 1.16 3.4880 • The cumulative binomial density function can be defined as: B n, p • n n! k !(n k )! p n k (1 p)k k 0 • (17A.14) where n is the number of periods,k is the number of successful trials, n! n n 1 n 2 1 k ! k k 1 k 2 1 n k ! n k n k 1n k 2 1 Appendix 17A: Applications of the Binomial Distribution to Evaluate Call Options 1 C n R n n! k nk k nk p ( 1 p ) Max [ 0 , u d S X ] (17A.15) k 0 k!( n k )! C1 = Max [0, (1.1)3(.90)0(100) – 100] = 33.10 C2 = Max [0, (1.1)2(.90) (100) – 100] = 8.90 C3 = Max [0, (1.1) (.90)2(100) – 100] = 0 C4 = Max [0, (1.1)0(.90)3(100) – 100] = 0 10 Appendix 17A: Applications of the Binomial Distribution to Evaluate Call Options 1 3! 3! 0 3 1 2 C (.85) (.15) X 0 (.85) (.15) X0 3 (1.07) 0!3! 1!2! 3! 3! 2 1 3 0 (.85) (.15) X 8.90 (.85) (.15) X 33.10 2!1! 3!0! 1 3X 2 X1 3X 2 X1 0 0 (.7225)(.15)(8.90) X (.61413)(1)(33.10) 1.225 2 X 1X 1 3 X 2 X 1X 1 1 (.32513 X 8.90) (.61413 X 33.10)] 1.225 $18.96 11 Appendix 17A: Applications of the Binomial Distribution to Evaluate Call Options k nk n X n n! n! K nk u d k nk C S p (1 p) p (1 p) n n R R k m k!(n k )! k m k!(n K )! P (1 p) k nk k nk u d Rn (17A.16) p rk (1 p ) nk X C SB1 (n, p , m) n B2 (n, p, m) R n B1 (n, p , m) C kn p k (1 p ) n k k m n B2 (n, p, m) C kn p k (1 p ) n k k m 12 (17A.17) Appendix 17A: Applications of the Binomial Distribution to Evaluate Call Options 16 Pi 190.61 137.89 . . . 52.20 P 16 16 i 1 $105.09 12 (190.61 105.09) . . . (52.20 105.09) P 16 2 $34.39 13 2