Bohbrink Growmark

advertisement

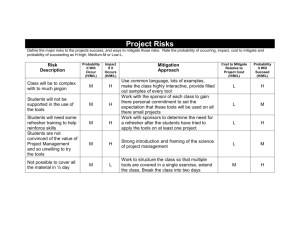

Managing Credit and Counterparty Risk Marshall Bohbrink VP Risk Management & Treasurer GROWMARK, Inc. November 9, 2009 1 2 3 30-Day LIBOR Rate - 1 Year 4.50% 4.00% 3.50% 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00% 4 SAFETY AND INSURANCE POLICY AND PROCEDURES 5 6 Various Types of Risks (ERM) Commodity price risk Interest rate exposure Governmental and Regulatory issues Property and Liability Strategic issues Succession planning Disaster Recovery Credit and Counterparty 7 Do you roll the dice with credit? 8 Types of Credit and Counterparty Risks Accounts receivable Vendor prepayments Deposit or down payments 9 Types of Credit and Counterparty Risks Derivative Transactions – Interest Rates – Foreign currency – Commodity 10 Types of Credit and Counterparty Risks Contractual – Fixed price – Hold harmless – Indemnification – Make whole – Moral/Failure to deliver Product or Work Quality 11 How to Forecast and Mitigate Analytical analysis Subjective analysis Forms of financial support Proactive vs reactive strategies Written policies 12 How to Forecast and Mitigate Analytical analysis – Review financials – Ratio analysis – Obtain credit scores – Bank or vendor references – Signed credit application – Industry comparatives or benchmarks CA WC CL 13 How to Forecast and Mitigate Subjective Analysis – Reputation – Personal success – Years in the business – Personal references – View of management skills – Quality of operations or business 14 How to Forecast and Mitigate Financial Support – Letter of Credit – Security filing – Guarantee 15 How to Forecast and Mitigate Proactive vs. Reactive Risk Management – Do the homework – Early and often – Be fair but firm – Know the limits – Create a balance – Adjust to the times 16 How to Forecast and Mitigate Policies – Board risk management – Credit approval – Communication requirements – In writing 17 Or is it being managed? 18