ppt- investments

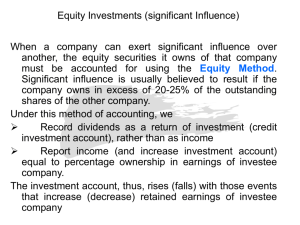

advertisement

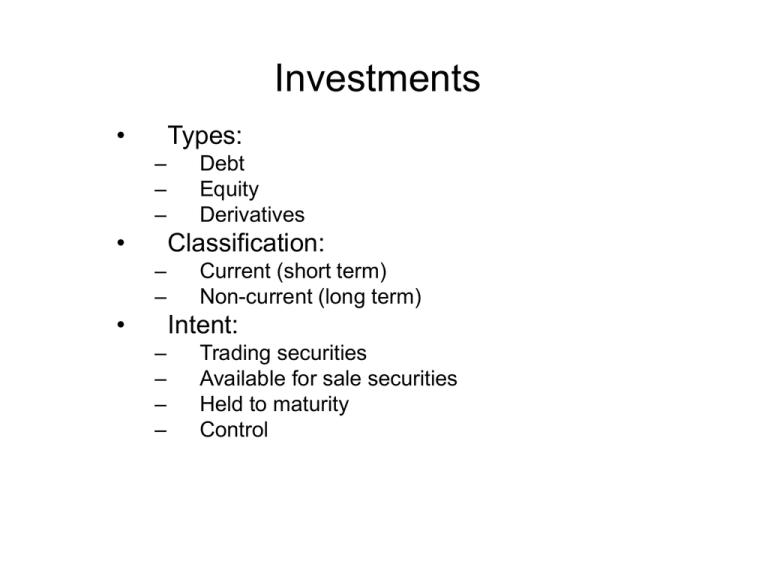

Investments • Types: – – – • Debt Equity Derivatives Classification: – – • Current (short term) Non-current (long term) Intent: – – – – Trading securities Available for sale securities Held to maturity Control Debt Investments • Short term: CDs, commercial paper, near maturity bonds: Often used to temporarily invest idle funds. • Should not be likely to fluctuate in value • Reported on B/S at maturity value (current market value) • If decline in market value – write down. Debt Investments • Short term OR long term: corporate or government bonds • May be classified according to management intent as – Trading – Available for sale – Held to maturity – Long term investment Debt Investments • Trading and Available for sale: • May fluctuate in value, are reported at FMV on B/S • Different treatment for gain or loss: • Trading Securities: gain or loss is recognized in current income • Available for Sale Securities: gain or loss bypasses income statement (reported as part of comprehensive income only) Debt Investments • Held to Maturity • Temporary fluctuations are ignored – reported on B/S at historical cost (amortized discount/premium) • Permanent decline – recognized in current income, write down to FMV. NO recovery recognized. Exercise 17-3 1. Determine the amount of interest income to be recognized on December 31, 2003 2. Determine the amount to be credited to bond investment on December 31, 2004 Exercise 17-18 On 12/31/03, Dominique Co. should recognize A. B. C. D. E. Dr. unrealized loss (equity) $ 80,000 Dr. loss on impairment $ 80,000 Cr. Unrealized gain (equity) $ 80,000 Both B and C No adjustment is needed, bond investments are carried at amortized cost Equity Investments • No Held to Maturity • Trading or available for sale securities: Reported at FMV on B/S. Unrealized gains or losses treated the same as for debt securities (trading securities on income statement, available for sale directly to R/E, comprehensive income reported only Equity Investments Trading or available for sale securities: Income recognition: • Dividends • Gain or loss from fluctuations in market value (trading) • Gain or loss on sale of securities Exercise 17-7 On 12/31/2003 Tiger should record A. B. C. D. Cr. unrealized gain (Income statement) Dr. unrealized loss (stockholders equity) Cr. Realized gain (income statement) Dr. unrealized loss (income statement) $1,400 $1,400 $1,400 $1,400 Exercise 17-7 In 2004 Tiger should record (in connection with the sale of the Colorado stock): A. B. C. D. Dr. loss on sale (Income statement) Dr. unrealized loss (stockholders equity) Cr. loss on sale (income statement) Dr. unrealized loss (income statement) $1,000 $1,000 $ 600 $ 600 Exercise 17-7 On 12/31/2004 Tiger should record A. B. C. D. Dr. unrealized loss (Income statement) Dr. unrealized loss (Income statement) Cr. Unrealized gain (income statement) Cr. unrealized gain (income statement) $ 400 $ 1,000 $ 400 $ 1,000 Exercise 17-9 A. At what amount should Steffi Graf, Inc. report its portfolio of securities on 12/31/2003? Exercise 17-9 Steffi Graf should record which of the following on 12/31/2003 A. B. C. D. E. Dr unrealized loss (income statement) Dr. unrealized loss (equity) Cr. Unrealized gain (income statement) Cr. Unrealized gain (equity) Cr. Unrealized gain equity) $1,500 $1,100 $ 1,100 $1,500 $1,100 Equity Investments • Control Position – Levels of “control”: • Less than 20% – 25% - no control, trading or available for sale classification • More than 20% – 25%, but less than 50%: Accounted under the Equity Method • More than 50%: Consolidate • Special Issue: SPE (now VIE) Equity Investments Equity Method: • Initial investment: at cost • Temporary fluctuations in market value: Ignored • Income/Loss recognition: % of investee company income or loss. Equity Investments Equity Method: • Dividends: treated as a reduction of the investment, NOT income: • dr. cash • cr. investment Exercise 17-12 (b) Monica Co. should report for 2003 A. Dividend income $36,000 B. Dividend income $10,800 C. Investment income $38,300 D. Investment income $25,500 E. Investment income $10,800 Equity Investments Special Purpose Entities (SPEs) New term: Variable interest entities (VIEs) Special entities set up to segregate a pool of assets and sell interest stakes to investors. Answers 1. 2. 3. 4. 5. 6. 7. 8. 9. (slide 6a) $32,274.44 (slide 6b) $ 4,098.11 (slide 7) D (slide 10) D (slide 11) C (slide 12) D (slide 13) $54,400 (slide 14) E (slide 18) D