for Unit 1

advertisement

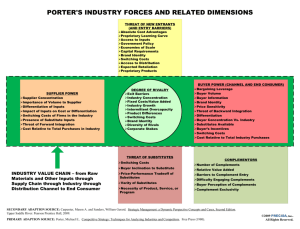

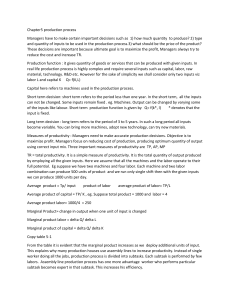

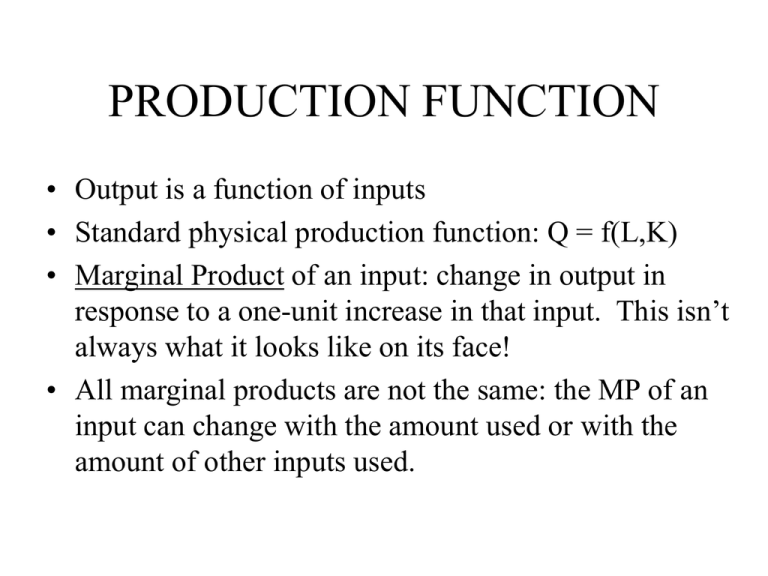

PRODUCTION FUNCTION • Output is a function of inputs • Standard physical production function: Q = f(L,K) • Marginal Product of an input: change in output in response to a one-unit increase in that input. This isn’t always what it looks like on its face! • All marginal products are not the same: the MP of an input can change with the amount used or with the amount of other inputs used. PROPERTIES OF THE PERDUCTION FUNCTION • Diminishing Returns: when increasing a “variable factor” while holding other “fixed factors” constant. • Substitutes and complements (across inputs): compare MP of one input with more/less of the other input. • Economies of Scale: if double all inputs, does output double? • Intertemporal substitutes and complements (for a given input across time): compare MP of an input at one point in time when more/less of the input has been used previously. Examples? OPTIMALITY • Equi-marginal principle. Consider reducing L by $1 and increasing K by $1… • Economies of scale and firm size • How input mix responds to change in input prices • Demand for inputs. Changes in desired output level, output prices, input prices, etc. will lead to changes in the amount of inputs desired. • Diminishing returns influence the output decision, which will be discussed in the next unit. COST CONCEPTS I • Implicit and Explicit Costs • Forward Looking and Backward Looking (Sunk) Costs • Accounting and Economic Costs • Economic Costs (also called Opportunity Costs) are forward looking, implicit and explicit costs COST CONCEPTS II • • • • Fixed and Variable Costs Short Run and Long Run Costs Total, Average, Marginal The reason we make these distinctions is because different kinds of costs are relevant in different circumstances PROPERTIES OF COSTS • Short Run ATC equals or exceeds Long Run ATC for any level of output (equi-marginal principle) • Marginal Costs increase beyond some level of output (diminishing returns) • Average Short Run Costs are smaller than Average Total Costs • Average Costs equal Marginal Costs at the level of output for which Average Costs are lowest (this relates to economies of scale) USES OF COSTS I: Health Interventions • Cost-effectiveness analysis: minimize the cost of producing a given level of output • Cost-benefit analysis: determining whether the benefit exceeds the cost • These concepts can apply in a managerial framework or in a policy framework (should WHO adopt a particular policy intervention?) USES OF COSTS II: Size and Scope of Firm • Merger decisions can be driven by average total costs—economies of scale. (Horizontal integration) • Outsourcing decisions based on another useful cost concept, “comparative advantage.” (Vertical integration) USES OF COSTS III: Supply Decisions • Short run output decisions in profit maximizing, competitive firm determined by price and marginal costs. Long run output decisions, which include entry and exit, by profit maximizing firm determined by price and average costs. • Market short run supply, of perfectly competitive profit maximizing firms, comes from marginal costs (aggregated across firms). Market long run supply comes from average costs, the logic is a little complicated. Long run supply is more elastic than short run supply. HEALTH CARE IS AN INPUT! • Production of Health: Health = f(HC, other inputs). What are those other inputs? • Are there diminishing returns to HC? Yes, another term for it is ….. • Are there substitutes for HC? Complements? • So the demand for health care depends on out of pocket price, the overall value of health (scale effect), the ability to substitute other inputs for HC in health production (substitution effect) EVIDENCE ON HEALTH PRODUCTION • Other important inputs: lifestyle, environment, education, income, nutrition. These impact health directly, and through good hygiene/health habits. • Health care probably not the most important input, even at the margin. Still, tremendous value placed on life/health means that health care is highly valuable! VSL in $mil. EVIDENCE ON HEALTH CARE DEMAND • RAND experiment and many others: HC demand price inelastic, meaning not very sensitive to price. • HC Demand income inelastic (within US studies) or income elastic (cross-country studies) • HC Demand responsive to insurance too—RAND experiment. More coinsurance will make demand more elastic.