Questions for Review class

advertisement

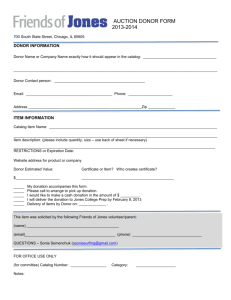

Time Value of Money Review 1. Consider a cash flow of $100 received five years from now and an interest rate of 5%. a. Calculate the future value of this cash flow ten years from now. b. Calculate the present value of this cash flow at time zero. c. What will be the value of this cash flow two years from now? d. Recalculate part a. for interest rates of 2% and 10%. e. Recalculate part b. for interest rates of 2% and 10%. 2. A manager is considering expanding her firm “Sweet Food Inc.” and developing a new production line for ice-cream. The cost of developing the production line involves an initial investment of $2.6 million today and an additional investment at the end of the first year of $1.5 million. After thorough analysis of demand for the ice-cream, the manager was able to estimate the future revenues from ice-cream sales for the next few years. The expected revenues will be $1.3 million at the end of year 2, 1.8 million at the end of year 3 and 2.1 million at the end of year 4. No production of the ice-cream will be possible after year 4 (the equipment will become obsolete). In today’s Wall Street Journal the manager have found that the interest rate was equal to 10 percent. a. What is the present value of the project’s costs? b. What is the present value of the project’s revenues? Should the manager execute the project? 3. You own an oil pipeline which will generate a $2 million cash return over the coming year. The pipeline’s operating costs are negligible, and it is expected to last for a very long time. Unfortunately, the volume of oil shipped is declining, and cash flows are expected to decline by 4 percent per year. The discount rate is 10 percent. a. What is the PV of the pipeline’s cash flows if its cash flows are assumed to last forever? b. What is the PV of the cash flows if the pipeline is scrapped after 20 years? 4. Attached to this problem set is a page from Foresight from the Art Institute of Chicago (all information required to solve this problem is provided below). It describes the details of a charitable annuity agreement. Let’s focus on the figures for a one-person annuitant. For example, if a donor is 50 years old when the donation is made, the donor receives an annual annuity equal to 6.5% of the donation until the donor dies. If the donor is 60 years old when the donation is made, the annuity percentage is 6.9%. In this example, a donation of $100,000 would provide income to the 50-year old donor of $6,500 per year for life. The same donation would provide income to the 60-year old donor of $6,900 per year for life. Ignore tax effects for now. Assume that the donor is 60 years old and has a life expectancy of 25 years. Also assume that the donor and the Art Institute both have a cost of capital equal to 10%. If the donor donates $1,000,000 to the Art Institute for a charitable gift annuity, what is the present value of the actual gift to the Art Institute?