Unit 04 - Cash Flow Forecast - Lesson element presentation (PPT, 1MB) New

advertisement

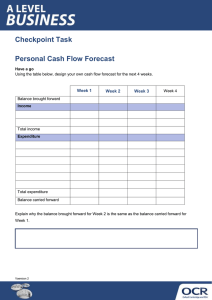

OCR Level 3 Cambridge Technicals in Business Unit 4: Business Accounting Cash Flow Forecast Cash Flow Forecast The cash flow records money flowing in and out of the business. Income is recorded on the date the money was received Expenditure is recorded on the date the payment was made Definitions Income - money that has come into the business and includes: Initial capital (money) to start the business Money received from sale of products or services offered Money received from loans Money received from the sale of fixed assets Definitions Expenditure – any money that is spent during the normal activities of the business. It can include: Payment for expenses, eg petrol, wages Payment for purchases (stock for resale) Purchase of fixed assets Layout The cash flow forecast is broken down into segments of time: Weeks Months Days Layout The first section records the money coming into the business. heading money gained through the sale of goods or services money received from a third party – will require repayment plus interest total flow of income into the business Layout The second section records the expenditure made by the business during each segment of time. This is totalled at the end of the time segment. Layout All figures in £ January February Income Sales 600 1,000 Loan 1,000 0 Total Income 1,600 1,000 Purchases 800 500 Wages 400 400 Total Expenditure 1,200 900 Expenditure Layout The final section is where the calculations are made. The business needs to see if there has been a greater outflow than inflow of money. Opening balance – the money Inflow/outflow Closing balance is total is that was available within the opening incomebalance minus total add bank/cash account at the totalexpenditure inflow/outflow beginning of the time period Layout January February Opening Balance 300 700 Total income 1600 Total expenditure 1200 Inflow/outflow 400 Closing Balance 700 Using the example above: The opening balance in January was £300 Total income £1,600 – Total expenditure £1,200 = £400 Closing balance was opening balance + inflow/outflow = £700 The closing balance of January is the opening balance of February Thank you for using this OCR resource. Other OCR resources are available at www.ocr.org.uk To give us feedback on, or ideas about, the OCR resources you have used e-mail resourcesfeedback@ocr.org.uk