محاضرة 4 جزء2

advertisement

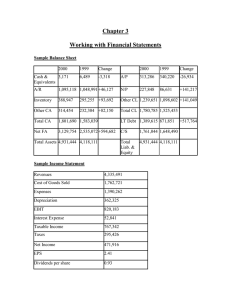

principles of corporate finance Chapter 4b Lecturer Sihem Smida Analyzing and interpreting Financial statement 1- 2 Ratio Analysis Financial ratios are relationships determined from a firm’s financial information. Used to compare and investigate relationships between different pieces of financial information, either over time or between companies. Ratios eliminate the size problem. 1- 3 Categories of Financial Ratios Liquidity—measures the firm’s short-term solvency. Capital structure—measures the firm’s ability to meet long-run obligations (financial leverage). Asset management (turnover)—measures the efficiency of asset usage to generate sales. Profitability—measures the firm’s ability to control expenses. Market value—per-share ratios. 1- 4 Liquidity Ratios Current assets Current ratio Current liabilitie s Current assets Inventory Quick ratio Current liabilitie s Bank overdraft 1- 5 Capital Structure Ratios Total financial debt Cash Total equity Intangible s Total debt Debt/equit y ratio Total equity Total assets Equity multiplier Total equity EBIT Net interest cover Interest finance charges Interest - bearing debt Debt to gross cash flow Net profit after tax depreciati on amortisati on Net debt/equit y ratio 1- 6 Turnover Ratios Cost of goods sold Inventory turnover Inventory 365 days Days' sales in inventory Inventory turnover Sales Receivable s turnover Accounts receivable 1- 7 Turnover Ratios (continued) 365 days Days' sales in receivable s Receivable s turnover Sales Fixed asset turn over Non - current assets Sales Total asset turn over Total assets 1- 8 Profitability Ratios Profit margin Net profit Sales Net profit Return on assets (ROA) 100% Total assets EBIT Return on investment 100% Total assets Return on equity (ROE) Net profit 100% Total equity 1- 9 Market Value Ratios Price per share Price/earn ing ratio Earnings per share Market val ue per share Market - to - book ratio Book value per share 1- 10 The Du Pont Identity Breaks ROE into three parts: – operating efficiency – asset use efficiency – financial leverage ROE Net profit Sales Assets Sales Assets Equity Profit margin Total asset turn over Equity multiplier ROA Equity multiplier 1- 11 Uses for Financial Statement Information Internal uses: – performance evaluation – planning for the future External uses: – evaluation by outside parties – evaluation of main competitors – identifying potential takeover targets