Asian crisis and China

advertisement

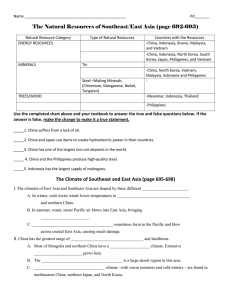

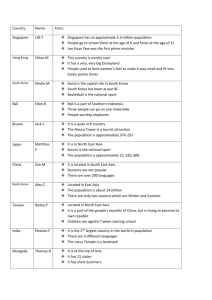

The Asian Financial Crisis Hung-Gay Fung University of Missouri-St. Louis Presentation Outline Discuss briefly the behavior of the Foreign Exchange (FX) of Southeast Asian Countries. Assess different factors that lead to the currency crisis. Opportunities and Implications for U.S. companies Foreign Exchange Rates Since June 1997, FX rates in many Southeast Asian countries have experienced a substantial decline. These countries include the Philippines, Malaysia, Thailand, Indonesia, and Korea. Many of these countries linked their exchange rates to the U.S. dollar before the currency crisis. Change in FX rates (6/30/1998) Chinese yuan HK dollar Indonesia rupiah Japanese yen Malaysian ringgit Korean won Philippine peso Thai baht FX:1 $US FX: 1 $US % 6/30/98 6/30/97 change 8.281 7.745 14568.89 138.31 4.1 1370 41.5 42.16 8.289 7.747 1760 114.61 1.827 641.4 19.08 17.9 +0.09 +0.03 -87.92 -17.58 -55.44 -53.18 -54.02 -57.54 Immediate Results of Crisis In addition to currency devaluation: Collapse of their Stock Markets (all Southeast countries); Call for an IMF rescue plan in the Philippines, Thailand, Indonesia and Korea; Bankruptcy and financial reforms (all Southeast countries). What Happens to Capital Flows? Private flows, net Equity Investment Private Creditors 1994 1995 1996 1997* 40.5 12.2 28.2 77.4 15.5 61.8 93.0 19.1 74.0 Source: Institute of International Finance, Inc., “Capital Flows to Emerging Economies,” January 1998. -12.1 -4.5 -7.6 Reasons for the Currency Crisis Decline in Export Earnings Excessive and Risky Investment Current Account Deficit Overvalued Currency Underdevelopment of credit market Property market bubble Decline in Export Earnings Regional Annual Growth Rate of Exports (%) Country China Indonesia Korea Malaysia Philippines Thailand Mexico 1990 18.2 15.9 4.2 17.4 4.0 14.9 17.7 1991 15.8 13.5 10.5 16.8 8.7 23.2 0.7 1992 18.1 16.6 6.6 18.5 11.2 14.2 1.4 1993 7.1 8.4 7.3 15.7 13.7 13.3 9.2 1994 33.1 8.8 16.8 24.7 20.0 22.7 14.2 1995 22.9 13.4 30.3 24.7 31.6 25.1 40.3 1996 1.6 9.7 3.7 26.0 16.7 -1.3 22.6 Excessive and Risky Investment Incremental Capital-Output (ICOR) Ratios Country 1987-1992 1993-1996 China 3.1 2.9 Hong Kong 3.7 6.1 Indonesia 3.8 4.9 Korea 4.0 4.9 Malaysia 3.7 4.8 Philippines 6.0 5.5 Singapore 3.6 4.0 Taiwan 2.4 3.9 Thailand 3.4 5.1 Source: Corsetti and Pesenti (1998) Current Account Deficit (% of GDP) Asian Country: China Hong Kong Korea Singapore Taiwan Indonesia Malaysia Philippines Thailand 1990-1995 (average) 0.9 3.3 -1.2 12.7 4.0 -2.5 -5.9 -3.8 -6.7 1996 0.9 -1.2 -4.8 15.5 4.0 -3.7 -4.9 -4.7 -7.9 Current Account (continued) Latin America Argentina Brazil Chile Colombia Mexico Other countries: Israel Africa (average) Hungary 1990-95 -1.6 -0.6 -2.6 -1.7 -5.1 1996 -1.4 -3.3 -5.4 -5.5 -0.6 -3.9 -11.1 -4.0 -7.4 -7.8 -3.7 Source: Bank for International Settlements Overvalued Currency Country Hong Kong Indonesia Korea Malaysia Philippines Singapore Thailand 1990 99.7 97.4 97.1 97.0 92.3 101.2 102.2 1991 103.9 99.6 91.5 96.9 103.1 105.7 99.0 1992 108.5 100.8 87.8 109.7 107.1 106.0 99.7 1993 115.9 103.8 85.2 111.0 97.4 108.6 101.9 1994 114.5 101.0 84.7 107.1 111.6 111.9 98.3 Note: The base figure (100) is the average for the year 1990 Source: J.P. Morgan 1995 1996 116. 125.5 100.5 105.1 87.8 86.8 107.0 111.9 109.5 116.0 112.7 117.9 101.7 107.6 Japanese Model Limit bond market to support long-term growth. Keep savings in a small number of powerful banks which are not properly regulated . Loans are made to favored customers and businesses with national ambitions, such as textiles, steel, shipbuilding, electronics, and automobiles (such as Japan, Thailand, Korea, and Indonesia). Size of Banking sector U.S. Japan Malaysian Philippine Thailand Indonesia 1995 % of GDP Bond Bank Market Lending 110% 54% 74 152 56 100 39 54 10 100 6 57 Bank Credit to Private Sector Annual Rate of Expansion % of GDP Country 1990-1997 1997 China 13 97 Hong Kong 8 157 Indonesia 18 57 Japan 1.5 111 Korea 12 64 Malaysia 16 95 Philippines 18 52 Singapore 12 97 Thailand 18 105 United States 0.5 65 Short-Term Debt to Reserves Indonesia Korea Malaysia Philippines Thailand June 1996 June 1997 1.724 1.623 0.252 0.405 0.992 1.704 2.073 0.612 0.848 1.453 1.325 0.702 1.721 0.740 4.050 1.319 1.210 0.792 1.187 2.440 3.124 1.635 Other countries Argentina Brazil Mexico Pakistan South Africa Zimbabwe Non-Performing Loans (% of Total Loans) Indonesia Korea Malaysia Thailand 1990 4.5 2.1 20.4 9.7 1994 12.0 1.0 8.1 7.5 1995 10.4 0.9 5.5 7.7 1996 8.8 0.8 3.9 N/A Mexico Argentina 2.3 16.0 10.5 8.6 14.4 12.3 12.5 9.4 Source: Bank for International Settlements. Property Market Bubble Period Q4, ‘90 Q4, ‘91 Q4, ‘92 Q4, ‘93 Q4, ‘94 Q4, ‘95 Q4, ‘96 Q2, ‘97 Sale Price: Bangkok (000B/m. sq.) 66.0 67.0 60.0 59.5 60.5 60.5 60.4 43.0 Source: Data Stream and Jones Lang Wootten. Capital Value Jakarta ($/m. sq.) 3019 2788 2482 2327 2358 2179 2250 2267 Central Business District Office Vacancy Rates Bangkok Hong Kong Kakarta Kuala Lumpur Manila Singapore Shanghai 1997 15.0% 6.0% 10.0% 3.0% 1.0% 8.0% 30.0% Source: JP Morgan “Asian Financial Markets,” January 1998. What Really Causes A Crisis? Corruption? Korea, Indonesia, Thailand -corruption Italy and India have corruption, but no crisis Bank Transparency inadequate regulatory framework irrational lenders? Fundamental Factors-GDP growth (%) Indonesia Korea Malaysia Philippines Thailand 1993 6.5 5.75 8.41 2.12 8.27 1994 7.54 8.58 9.24 4.39 8.85 Source: Corsetti, Pesenti and Roubini (1998). 1995 8.22 8.92 9.46 4.76 8.68 1996 7.98 7.13 8.20 5.67 6.66 Inflation Rate Indonesia Korea Malaysia Philippines Thailand 1993 9.60 4.82 3.57 7.58 3.36 1994 8.53 6.24 3.71 9.06 5.19 1995 9.43 4.49 5.28 8.11 5.69 Source: Corsetti, Pesenti and Roubini (1998). 1996 8.03 4.96 3.56 8.41 5.85 Savings Rates (% of GDP) Country China Hong Kong Indonesia Japan Korea Malaysia Philippines Singapore Taiwan Thailand 1990 38.1 35.8 27.9 33.5 36.1 29.1 18.7 44.1 22.4 32.6 1991 38.3 33.8 28.7 34.2 35.9 28.4 18.0 45.4 22.2 35.2 Source: Statistical Appendix, IMF, 1997. 1992 37.7 33.8 27.3 33.8 35.1 31.3 19.5 47.3 23.2 34.3 1993 40.6 34.6 31.4 32.8 35.2 33.0 18.4 44.9 23.7 34.9 1994 42.6 33.1 27.6 31.4 34.6 32.7 19.4 49.8 22.9 34.9 1995 41.0 30.4 28.4 30.7 35.1 33.5 17.8 50.0 22.9 34.3 1996 42.9 30.6 28.1 31.3 33.3 36.7 19.7 50.1 21.0 33.1 Human Development Indicators Country Indonesia Korea Malaysia Philippines Thailand Life-Expectancy Literacy Rate (years) (%) 1970 48 60 62 57 58 1995 64 72 72 66 69 Source: Radelet and Sachs (1998). 1970 54 88 60 83 79 1995 84 98 85 95 94 Average Income of Poorest 20% in ‘85 US$ 1970 1995 392 908 303 2071 431 1070 218 435 361 726 Fixed Exchange Rate System FX rates more efficient. Imposes impediments in the FX system. Government guarantees investors potential upside return if FX devalues. Currency Model of Attack by Speculators Due to the “fixed” exchange arrangement in many Southeast Asian countries, speculators start with local borrowings (i.e., borrowing from local banks). They then sell the local currencies, convert into US dollars, and sell forward contracts. They realize a profit if the currencies devalue, because their US holdings can be exchanged for more local currencies to pay off loans. Defenses by Governments Buy up sales transactions - FX reserves can be exhausted quickly. Jack up the interest rate to deter speculative borrowings, implying high cost for business that leads to: bankruptcies discouraging real investment collapse of stock markets Penalize banks speculators. who lend money to The Impact of Crisis on China More imports from Korea due to lowered prices, e.g., products imported from Korea have increased, including steel (32.4%), petrochemicals (11.8%), and textiles (9%). China’s exports slow down. Economic growth slows down. China’s Strategy Under pressure to devalue its currency. However, such a decision is political, not economic. Could hurt its credibility as an Asian leader. Devaluation will hurt Hong Kong, a place to raise external funds via initial public offerings (IPO) for its stateowned enterprises. China’s Strategy (continued) Ease Export Credits by encouraging banks to make loans to exportoriented companies. Relax export licenses and give tax rebates: Ministry of Foreign Trade and Economic Cooperation issues more export licenses for base metals. Exporters will receive full 17% valueadded tax. Implications and Strategies Lowered currency value implies products are cheaper to buy -Merger Activities in Asian countries International trade implications Financial reforms (bond market development and banks) Corporate Strategies Corporate Hedging Strategies Increased use of hedging instruments, given the volatile FX markets (use of forward, swaps and other derivative instruments). As a long-term strategy, U.S. firms should pay closer attention in managing their economic exposure, e.g., Avon’s use of a balance sheet hedge in 1997.