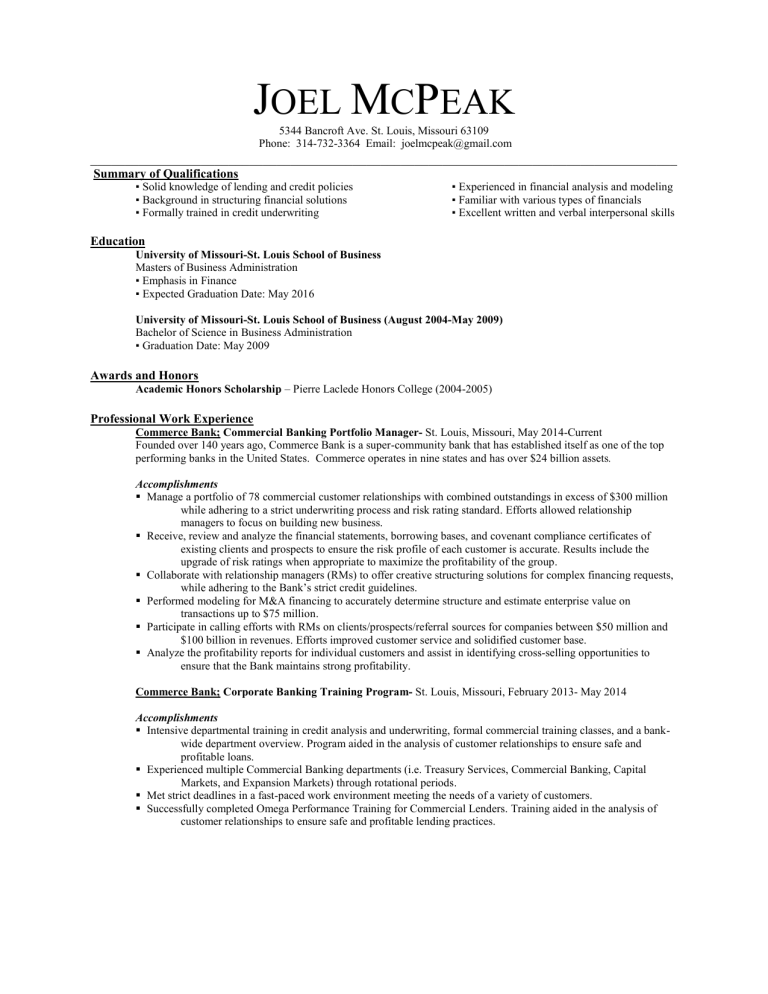

This is my resume

J OEL M C P EAK

5344 Bancroft Ave. St. Louis, Missouri 63109

Phone: 314-732-3364 Email: joelmcpeak@gmail.com

_____________________________________________________________________________________

Summary of Qualifications

▪ Solid knowledge of lending and credit policies

▪ Background in structuring financial solutions

▪ Formally trained in credit underwriting

Education

▪ Experienced in financial analysis and modeling

▪ Familiar with various types of financials

▪ Excellent written and verbal interpersonal skills

University of Missouri-St. Louis School of Business

Masters of Business Administration

▪ Emphasis in Finance

▪ Expected Graduation Date: May 2016

University of Missouri-St. Louis School of Business (August 2004-May 2009)

Bachelor of Science in Business Administration

▪ Graduation Date: May 2009

Awards and Honors

Academic Honors Scholarship

– Pierre Laclede Honors College (2004-2005)

Professional Work Experience

Commerce Bank; Commercial Banking Portfolio Manager- St. Louis, Missouri, May 2014-Current

Founded over 140 years ago, Commerce Bank is a super-community bank that has established itself as one of the top performing banks in the United States. Commerce operates in nine states and has over $24 billion assets .

Accomplishments

Manage a portfolio of 78 commercial customer relationships with combined outstandings in excess of $300 million while adhering to a strict underwriting process and risk rating standard. Efforts allowed relationship managers to focus on building new business.

Receive, review and analyze the financial statements, borrowing bases, and covenant compliance certificates of existing clients and prospects to ensure the risk profile of each customer is accurate. Results include the upgrade of risk ratings when appropriate to maximize the profitability of the group.

Collaborate with relationship managers (RMs) to offer creative structuring solutions for complex financing requests, while adhering to the Bank’s strict credit guidelines.

Performed modeling for M&A financing to accurately determine structure and estimate enterprise value on transactions up to $75 million.

Participate in calling efforts with RMs on clients/prospects/referral sources for companies between $50 million and

$100 billion in revenues. Efforts improved customer service and solidified customer base.

Analyze the profitability reports for individual customers and assist in identifying cross-selling opportunities to ensure that the Bank maintains strong profitability.

Commerce Bank; Corporate Banking Training Program- St. Louis, Missouri, February 2013- May 2014

Accomplishments

Intensive departmental training in credit analysis and underwriting, formal commercial training classes, and a bankwide department overview. Program aided in the analysis of customer relationships to ensure safe and profitable loans.

Experienced multiple Commercial Banking departments (i.e. Treasury Services, Commercial Banking, Capital

Markets, and Expansion Markets) through rotational periods.

Met strict deadlines in a fast-paced work environment meeting the needs of a variety of customers.

Successfully completed Omega Performance Training for Commercial Lenders. Training aided in the analysis of customer relationships to ensure safe and profitable lending practices.

US Bank; Personal Banker / Small Business Specialist- St. Louis, Missouri, February 2011- January 2013

Accomplishments

Consistently performed in the top 5% of retail bankers in the region by originating personal finance loans, providing referrals to mortgage and small business partners, and generating branch revenue.

Gained experience in cold calling as well as in underwriting personal finance loans.

Extracurricular Activities

General Member , St. Louis Chapter of the Risk Management Association (2013-present)

Athletic Participant , Clayton Corporate Challenge (2013-present)

Volunteer Experience

Habitat for Humanity (2015)

Worked in the build-out of new homes in the Hamilton Heights, and University City neighborhoods.

Walk a Mile in Her Shoes- (2014)

Participated in an event to raise awareness on domestic violence as well as raise funds for the charity

St. Louis World Food Day- (2014)

Assembled rice and soy meals which were sent to a children’s school in Tanzania.