TopicNine.GreatDepression.doc

advertisement

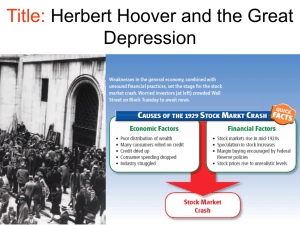

1302 Topic Nine: The Great Depression The Crash Itself The bull market that occurred between 1925 and September of 1929 encouraged rampant speculation in the stock market. Everyday Americans were encouraged to speculate in the stock market. For example John Jakob Raskob, CEO of General Motors, published an article entitled “Everybody Ought to Be Rich”. His premise was that the average American could retire wealthy in 20 years if they invested $15 a week in the stock market (the average American worker made $17 dollars/week). His article was published in the Ladies Home Journal two months before the crash. Small investors took out loans (and were given loans) in order to buy stocks. To make matters worse, more “money” was loaned out to buy stocks than the amount of currency in circulation. The Dow Jones Industrial Average reached its peak in September of 1928 at 381 points. The crash started on Black Thursday, Oct. 24, when the Dow Jones Industrial Index (DJIA) began to slide. To stop this, a group of investment bankers (including the owners of JP Morgan Bank and Chase Bank) bought stock at above market price. By Monday, however, consumer confidence in the stock market was shaken, (false) rumors abounded that several speculators had committed suicide, and the DJIA began to tumble. 29 October, 1929, Black Tuesday, the stock market index dropped over 30 points. It’s the largest point drop in history (percentage wise) and it wiped out the investments of many Americans. The Dow Jones lost $14 billion in value in one day. On November 13, the DJIA was at 198.6 points and the economy had lost over $30 billion dollars. The market reached its low point in July of 1932 at 41 points. It is important to note that the Wall Street Crash of 1929 did not CAUSE the Great Depression. It was a symptom of the weaknesses already inherent in the American economy. The Psychology of the Crash The “crash” took many people by surprise. The prosperity of the 1920’s was such that people thought that it would go on forever. All through October the stock market fluctuated wildly, yet Americans still believed in the capitalist system even though their faith in the stock market had wavered. In the following months after Black Tuesday, and into 1930, Americans still had optimism that the economy would recover. Most requested song of 1930 was Happy Days Are Here Again. The stock market did make some gains during the 1930’s, but government policies actually were counterproductive and contracted the economy further. American optimism slowly faded as the economy showed no signs of recovery. By 1932, Americans were singing Brother Can You Spare a Dime. So What Happened? The market crash of October 1929 was the end result of weaknesses already present in the American economy. The first was that American manufacturing was not diversified; it was tied heavily to the automobile and construction industry. When those industries failed, other industries weren’t developed enough to correct the economy. The great industries of the 19 th century, such as railroad and textile, were no longer viable because of trucking and synthetic fabrics. When the two major industries in the U.S. fail, the cycle of production was reversed. There was also a tremendous gap in wealth distribution in the United States, which meant that most Americans had very little purchasing power or discretionary income. Only 1% of Americans had incomes of over $50k per year. Only 3% earned $10k or more a year. While it took an income of $2500 to sustain a family, 60% of families earned less than $2k/year and over 40% had average incomes of $1500 or less. During the 1920's, wage earners experienced wage stagnation. Even worse, farmer's incomes were 40% of the national average. Agriculture was already in a recession. Because of the high demand for food and other agricultural products during the war years, farmers ramped up production and even bought more land to farm. With the end of the Great War, the boom years were over, and American farmers found themselves overproducing and in trouble as they could not pay back their debts. Yet during the first half of the decade, consumption of goods was high due to easy credit. As the decade entered its second half however, consumer spending dropped and the average American had high consumer debt. American manufacturing and the American economy still looked prosperous though because of speculation in the stock market. Furthermore, the American credit structure was built on a house of cards. Small banks were in trouble all through the '20's since they were tied to the agricultural sector. As farmers defaulted on loans, small, rural banks could seize farms and farmland, but that wouldn't give them credit (cash) to operate. During the decade, banks closed at a rate of two per day. Large banks invested heavily in the stock market (with customers money), so that the crash depleted their credit reserves, which crippled the banking industry. To make matters worse, Americans took out loans to speculate in the stock market (which is illegal today). With the market crash, of course these loans were almost impossible to pay back. There was also a practice called "buying on margin" (which is still practiced today). Here's an example: we are going to buy 1000 shares of Starbucks stock, which is selling for $1/share. We should pay our stockbroker $1000, but we are buying on margin, so we sign a contract. We give our stockbroker a down payment of $250, leaving a balance of $750. We are betting that shares in Starbucks will go up (after all, it is a bull market at the moment). When shares of Starbucks reaches $2 (or whatever is written in our contract), we will pay off our balance of $750, leaving us a profit of $1000. What happens if the price of Starbucks' stock goes down instead of up? Also written in our contract is a "margin call". Let's say our margin call is .50 cents. If Starbucks shares drop to that price, we have to meet our margin call: that means we are forced to sell our shares (which would give us $500), we would have to pay our balance of $750, AND we would have to pay our stockbroker an extra $500 (the difference in price between the shares at .50 cents and $1). Nifty right? There are two important things to consider when we look at buying on margin. First, they can trigger a market crash. Say we up those 1000 shares to 10,000 or 50,000. Margin calls demand that those shares be sold, which will bring the price of stocks down. This might force others to make their margin calls, setting up a negative cycle of stock sell-offs, and then boom, the market crashes. The other thing to think about is that on paper, it looks like we have invested $1000 dollars in the economy, when in reality, we have only paid $250 into the system. Is it any wonder that in the three weeks following Black Tuesday, $30 billion dollars disappeared from the American economy? It wasn't just the American credit structure that was shaky. The international banking system was also in bad shape. Germany especially was experiencing hyper-inflation as it tried to pay the reparations demanded by the Treaty of Versailles. As European countries tried to recover economically from the Great War, almost all imposed trade restrictions, making it difficult for global commerce to take place. And remember those loans that the Allied countries borrowed from American banks? Britain and France increasingly had a hard time making those loan payments. Instead of reducing the payments or forgiving the debt, however, U.S. banks loaned money to Britain and France so they could turn around and pay the U.S. Even more ridiculous, U.S. banks loaned money to Germany, so that it could make reparation payments to Britain and France, which in turn made loan payments to the U.S. All this meant is that money wasn't being invested; it was just chasing itself. Moreover, the credit systems of the U.S. and Europe were tied together. When the stock market crashed in the United States, it took down the economies of Europe also. Results of Black Tuesday For three years, the economy worsened. The banking system in the United States went to the very edge of collapsing. Over 9000 banks closed and 2.5 billion dollars of customer deposits were lost. This was on top of the $30 billion the economy lost in the market crash. The currency supply severely contracted, leading to deflation, and a decline in purchasing power. Manufacturers begin cutting prices, but also closing factories and laying off workers. The Federal Reserve worsens the situation by raising interest rates, making credit harder to get and shrinking the currency supply even further, driving more banks and business' into bankruptcy. By 1932, the unemployment rate was a conservative 25% (the government didn't keep track of domestic employees, the self-employed, farmers, etc.). Among African-Americans the unemployment rate was 50%. One important gain, the NAACP broke down racial barriers in the unions, which now admitted African-American members. Even if you did have a job, wages fell drastically. Almost all business' cut pay and hours, so that the majority of Americans worked part-time at reduced wages. The average wage for most families fell to roughly $1000 (it still took $2500 to support a family). Industrial output fell by 50%. In rural areas, farm incomes decline by 60% between 1929-1932. One-third of farmers will lose their land. As it always happens during a recession, a drought, this one major, hit the farm belt. It was so severe that soil would blow away during huge dust storms that were thick enough to choke livestock to death, giving the region the nickname "The Dustbowl". It was a sign, however, of how much purchasing power had decreased that farmers were still producing more than the American consumer could buy. American Society during the Depression Usually, economic downturns were called "panics" (Panic of 1819, 1837, 1873, 1893). President Hoover, however, didn't want people to...panic. Hoover called the economic crisis a "depression". Since it lasted for well over a decade, it became known as the Great Depression. Today, we call them recessions, but if a recession lasts for over 24 months, it is generally classified as a depression (although additional criteria to define an economic depression are used by economists). There was suffering in all areas of the United States. No sector was immune from the depression. The college-educated, the middle-class, professionals, small business owners, industrial workers, farmers, all were affected by the Great Depression. Public relief was unable to cope with the growing number of people that needed assistance. There was no such thing as government welfare programs at the time. All charity was provided through private or religious organizations, such as the Red Cross, or local fraternal/sorority clubs. In many cities, relief efforts collapsed. State and local governments were unwilling to provide money to charity organizations because they were facing budget crises themselves. The number of high school dropouts doubles. Although most believed that jobs should go to men, more women moved into the workforce. With men out of the workforce and women going to work, the balance of power shifted in some households. Divorce rates, which had gone up during the 20's, fell during the 30's, simply because it was too expensive to separate. On the other hand, many single people had to delay marriage, and couples had to put off having children. The birthrate dropped below mortality rates for the first time since the early Colonial period. It was the middle class who had to learn to adjust to their new circumstances; the poor knew how to be poor. With no incomes and no purchasing power, people did without meat, without sugar, without milk, without bread. They put off medical and dental visits, or tried to doctor themselves. Americans went back to the days where they produced their own home goods. They made their own clothes (and mended them when they wore out), they planted vegetable gardens, they canned and preserved, they kept chickens, etc. The majority of Americans weren't living in squalor and severe destitution; but it was the sheer dismalness of their lives that wore them down. Imagine eating beans and rice every day. Every day. Or only having meat for a special occasion (a holiday maybe). NEVER having new clothes, only secondhand. And the Great Depression lasted for over a decade. Americans lived like this for over ten years. Some industries did well during the depression. The tobacco industry, the petroleum industry and the radio industry grew during the '30's. "We're the first nation in the history of the world to go to the poorhouse in an automobile", remarked the social commentator Will Rogers. The straitened circumstances in which Americans lived called for a new type of culture, Escapism. Instead of the social Realism of Progressivism, Americans wanted to get away from the drabness of their everyday lives. Superman and Batman were introduced through cheap comic books. In movies, the Marx Brothers provided comic relief, while spaghetti westerns and g-men provided larger than life heroes. On the radio, the Lone Ranger and the Shadow battled evil doers ("who knows what evil lurks in the hearts of men?"). Novels such as Steinbeck's The Grapes of Wrath and Richard Wright's Native Son examined class and racial issues, but the most popular book of the decade was Margaret Mitchell's Gone With the Wind. It is, of course, one of the quintessential books about surviving hard times ("as God is my witness, I'll never go hungry again"). There was very little social protest during the Great Depression. There were a record number of worker's strikes, but Americans didn't take to the streets to riot in great numbers, as they did in France and Britain (there were riots in the U.S., but the number of people who took part were much smaller than those in Europe). In essence, the depression didn't change our values or belief system. While European governments moved towards welfare states or fascism, America clung to its faith in the market system and capitalism. We blamed ourselves (how Puritan, right?). But our faith in our economic system was sorely tested. Clearly, it needed some revision. President Hoover Responds to the Depression When Herbert Hoover accepted the Republican nomination for the presidency in 1928, he responded with "we in America today are nearer to the final triumph over poverty than ever before...the poorhouse is vanishing from among us." Seven months after his inauguration as president, the stock market crashed and the Great Depression began. While Hoover has gained a reputation as a cold, unfeeling man, unresponsive to the needs of the American people during the largest economic crisis in U.S. history, this is too simplistic an assessment of his character, if not his administration. Remember his actions during the Great War and during the 1920's as Commerce secretary. Hoover attempted to restore public confidence in the American economy. An extremely hard worker himself, Hoover tried to rely on "volunteerism", that is, cooperation between the public and private sectors. Each side would make sacrifices and work to ensure the well-being of the country, and little government action would be needed. As the economy worsened, however, businesses laid off more workers and more and more Americans found themselves in desperate straits. It was not that Hoover was indifferent to suffering; he just truly believed in American individualism and self-reliance. Hoover failed to realize the enormity of the economic crisis. In 1930, Congress passed the Smoot-Hawley Tariff, which raised tariff rates so that Americans would buy American products. Hoover opposed the bill, but signed it anyway. Of course, other countries raised their own tariff rates on American products. The results were devastating. U.S. imports/exports declined by over 50%. Global trade declined by over 30%. European banks began to fail, and the American recession deepened and spread to the rest of the world. Unemployment doubled every year after the tariff was passed, until it peaked in 1933. President Hoover began to lose political clout. In the midterm elections of 1930, the Democrats won 49 House seats and 8 Senate seats. They push for more government spending but Hoover was opposed. Public opposition to the president and his apparent inaction was obvious, however, in the slang people used. Hoovervilles were shanty towns the homeless constructed of tin sheets, crates or tents. A Hoover flag was an empty pocket turned inside out, Hoover caviar was beans, Hoover leather was cardboard used to line the soles of worn-out shoes, a Hoover blanket was a newspaper used to keep warm, a Hoover wagon was an automobile pulled by a horse. You get the idea. Also detrimental to Hoover's reputation was the Bonus Army incident. Veterans of the Great War were given a service certificate that could be redeemed in 1945 for cash payment. In the summer of 1932, around 20,000 veterans (some with their families) marched to Washington D.C. Their goal was immediate redemption of their bonus certificates. They camped in a Hooverville across the Potomac River and waited for Congress to act. The answer the Bonus Army received was no. In an initial skirmish with police, two veterans were killed. Alarmed by the escalation in violence, Hoover ordered the U.S. Army to clear out the Bonus Army. Gen. Douglas McArthur and his aide Dwight Eisenhower led a force of infantry, cavalry and six tanks against the veterans camped at Anacostia Flats. Although McArthur had orders from Hoover not to use force, the general was convinced that the Bonus Army was actually an attempt by communists to take over the government. The army attacked the veterans, using bayonets and tear gas. Over 50 were wounded, a veteran's wife miscarried and an 8 month old baby died. To make matters worse, government employees had left their office buildings to watch the army in action and were horrified by what they saw. President Hoover's political career was in tatters. Hoover began to see that government intervention was called for in 1932, but it was too late to save his political career. The Reconstruction Finance Corporation was created to provide government loans to banks, businesses, farmers, mortgage companies, etc. A problem with the RFC was that it was a large government agency, so that it couldn't distribute the money fast enough. Also, the money went to banks and businesses, not to consumers, and did little to prime the pump of the economy. The Presidential Election of 1932 The Republicans stuck with Hoover, even though it was clear that he was the most unpopular man in America. Wherever he went, he was booed, pelted with rotten eggs and the Secret Service had a full time job protecting him from assassination attempts. Hoover himself didn't want the job, but felt he had no choice but to run. The Republicans tried to run on a platform of economic recovery (just around the corner), cutting government spending, adherence to the Gold Standard, and immigration restriction (Hoover and Congress had kicked out around 500k Mexicans and American citizens of Hispanic descent without due process, in a law known as the Mexican Repatriation Act). The Democrats nominated Franklin Delano Roosevelt (FDR), a distant cousin of Theodore Roosevelt, and Governor of New York. He was married to his cousin, Eleanor Roosevelt, who was the niece of Theodore Roosevelt, and Uncle Teddy (who was president of the United States at the time) gave the bride away. The Democratic platform rested on repeal of Prohibition, lowering the tariff rate, unemployment insurance, old-age pensions, reform of the currency system and economic regulation. Since Roosevelt called his program a "new deal" for the American people, his policies became known as the New Deal. It really didn't matter who the Democrats ran against Hoover. The election of 1932 was a referendum against the incumbent, not a vote of confidence for FDR. The Democratic Party not only won the presidency in a landslide, but they also won large majorities in both houses of Congress. During the lame duck session, no congressional legislation was passed, but the 20th Amendment was introduced, which moved presidential inaugurations from March to January, and moved the start date of Congress to January. It was ratified in February, 1933.