2305Accting.doc

advertisement

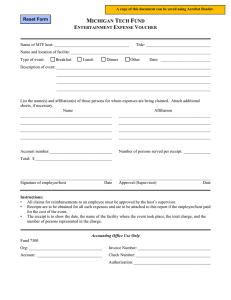

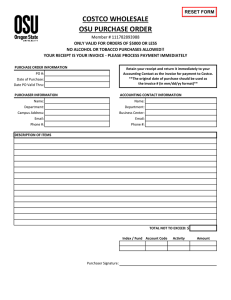

Houston Community College System Travel & Tourism COURSE DESCRIPTION: TRVM 2305 TRAVEL INDUSTRY MANAGEMENT(3 CREDITS) An overview of mid-management responsibilities within the travel and tourism industry. Students will describe the management functions including; analyzing, coordinating, implementing, and supervising tasks of managing a business. COREQUISITES: None PREREQUISITE: None COURSE GOALS: At the completion of this course, the student should be able to: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. Explain the importance of accounting and financial management to business and industry. Demonstrate a working knowledge of basic travel agency accounting terms. Describe the petty cash record keeping and replenishment process. Complete a simple petty cash report. Discuss the reasons why travel agency bookkeepers and accountants should be involved in the agency's goal setting process. Identify basic goals and complete an elementary goal-setting objective form. List the criteria that must be met by well-written objectives. Identify at least one financial goal, one travel agency marketing goal, one personnel goal, and one equipment goal. Discuss the basic reasons for the differences between accounting practices utilized in the travel agency industry and those utilized by most other small businesses. Identify the benefits and the drawbacks of the ASTA accounting system. Explain the historical development of the ASTA accounting system. List the major reasons why travel agency accounting systems utilize a modified accrual accounting system. Complete the recording of a simple airline ticket charge and payment by any of the three standard forms of payment on an invoice/receipt form. Describe what credit card data goes on the "credit card" line of an invoice/receipt. List the circumstances under which invoice reference numbers and recorded on invoice/receipts. Describe the distribution of invoice/receipt copies and explain why each copy goes where it is designed to go. Complete a voucher check reflecting a simple travel payment. List the points of distribution of each of the five copies of the voucher check. Compare the information which appears on a voucher check utilized in a travel agency and the information which appears on standard business checks. Identify the major categories of chart-of-accounts numbers which appears in the detachable section of the voucher check. Correlate simple direct check expenses to appropriate chart-of-accounts lines. Verbally evaluate the pros and cons of a travel agency industry chart of accounts. Identify the purpose of each digit in a multi-digit chart-of accounts system. Explain the benefits to the travel industry of having a uniform classification of accounts. Apply equity build-up approaches and principles to a simple equity position determination application. Calculate a return on equity percentage utilizing given figures for net income after taxes and for owner's equity. Calculate a return on assets percentage when given the net income after taxes and the total assets of a travel agency. Explain a travel agency's comparative dollar profit per sales employee pattern based on business mix and dollar volume of business. Explain the procedures for preparing the weekly ARC Report. 30. Complete a simple Sales Report Settlement Authorization form. 31. Prepare the required adding machine tapes that accompany a simple Sales Report Settlement Authorization form. 32. Identify all key calendar dates inherent in the completion and processing of an ARC Report. 33. Identify the major ledgers and journals utilized in a travel agency and the purpose for each. 34. Prepare a simple ticket delivery routing based upon a ticket delivery log. 35. Explain how data in entered on a miscellaneous receipt log. 36. Identify the reason(s) why a miscellaneous receipt log. 37. Explain the benefits to a travel agency of having detailed and accurate monthly and annual income statements. 38. Take line-item total expense and income figures for a one-month period for a travel agency and prepare a simple draft monthly income statement showing both end-ofmonth totals and year-to-date totals for both the month's income and the month's expenditures. 39. Explain the advantages and the disadvantages of considering familiarization trips to be marketing expenses. 40. Identify the three expense sections on the income statement and explain in general terms the line items included in each of the three expense sections. 41. Identify the titles of the categories of financial data needed to complete the travel agency balance sheet and several options for alternative titles and approaches. 42. Complete a simple balance sheet when the financial figures are provided in each required category of assets, liabilities, and capital. 43. List the reasons why some travel agencies list account numbers under the "cash in bank" section of "current assets". 44. Explain the reasoning used by travel agency accountants to justify the elimination of a line on the balance sheet for "Advanced deposits form customers". 45. Identify the raw data needed to prepare the annual budget. 46. Prepare a simple weekly status report when all required basic weekly financial information is provided. 47. Explain what is included on a source analyses report and why the report is important. 48. Explain why a comparison of weekly employee compensation with weekly travel agency income is important, and detail the steps that need to be taken to calculate the percentage of weekly employee salaries compared to weekly income. 49. Justify an employee's salary increase request when the employee's return-ininvestment analyses data is made available and to do this based upon a studentcompleted personnel return-on-investment analysis. 50. Analyze vendor override proposals utilizing data that is provided for the product profitability report and based upon a student-completed product profitability report. 51. Compare the profitability of two or more commercial accounts by completing a commercial account profitability analysis when the report data has been provided. 52. Identify the similarities between the commercial account profitability analysis, the product profitability report, and the personnel return-on-investment analysis form. 53. Prepare a simple travel agency budget based upon having all key figures for the budget available in advance. 54. Calculate a next-year projected break--even required revenue for a travel agency when the next-year projected total operating expenses and the next- year projected average commission are provided. 55. Identify the pros and the cons of selling vendors "with a preference" in order to increase the agency's average commission. 56. Determine the total amount of sales needed by a travel agency to reach its next-year financial goals when the next-year projected total operating expense level has been identified, the next-year projected profit has been identified, and the next-year projected average commission has been identified. INSTRUCTOR INFORMATION: TEXTBOOK INFORMATION: Ms. Shouping Liu (713)718-6072 – work or (832)668-6828 - cell Email: shouping.liu@hccs.edu Travel Agency Accounting Procedures by James M. Poynter; Delmar Publishers Inc. 0-8273-3389-7 LAB REQUIREMENTS: None STUDENT WITH DISABILITIES: Students who require reasonable accommodations for disabilities are encouraged to report to Room 102 SJAC, or call (713)718-6164 to make necessary arrangement. Faculty are only authorized to provide accommodations requested by the Disability Support Services Office. ACADEMIC HONESTY: Students are responsible for conducting themselves with honor and integrity in fulfilling course requirement. ATTENDENCE AND WITHDRAWAL POLICY: 1. Attendance: A. Students are expected to attend all classes (see college catalog for attendance policy). B. Students are responsible for all work missed during an absence, and it is the student's responsibility to consult with instructors for make-up assignments. C. If a student misses 2 or more consecutive classes(12.5%, including lecture and laboratory time), he/she may be withdrawn from the course by the instructor. This policy will be strictly enforced for veterans. 2. Withdrawal: It is the responsibility of the student to officially drop or withdraw from a course. Failure to officially withdraw may result in the student receiving a grade of “F” in the course. A student may officially withdraw in any of the following ways: A: B. Complete an official withdrawal form at the campus he or she is attending or any other HCCS campus. Send a letter requesting withdrawal to: Registrar Houston Community College Systems P. O. Box 667517 Houston, TX 77266-7517 COURSE REQUIREMENTS AND GRADING POLICY: A. Tests – Students' performance will be evaluated through true/false, fill in the blank, and multiple choice questions. To evaluate the student achievement for the stated objectives he/she will complete two tests and a comprehensive final exam. B. Grades: A = 90-100 B = 80-89 C = 70-79 D = 60-69 F = 59 or below C. Final Evaluation Criteria: Attendance and participation Homework Assignment Midterm Exam Comprehensive Final Exam Project 15% 20% 25% 25% 15% TESTING: Mid-term Exam: Chapters 1 – 4 Final Exam: Chapters 1 - 8 MAKE-UP POLICY: Only under special circumstances which student could not control and with the instructor's approval make-up exam will be given. PROJECTS, ASSIGNMENTS, PROTFOLIOS, SERVICE LEARNING, INTERNSHIPS, ETC.: To be announced in class. COURSE CONTENT: A comprehensive course which covers management accounting practices. The basic concepts will be covered through lecture/discussion. Because the course emphasized a practical approach to travel accounting the class time is taken up with exercises and filling out the forms related to specific operations in the airline industry. Also class discussion are supplemented by out of class projects. COURSE CALENDR WITH READING ASSIGNMENT Class Date Homework Assignment(due by following Tues. 12noon) Week 1: 08/25/2015 Course syllabi and Introduction Week 2: 09/01/2015 Chapter 1(page 1-13). Chapter Exercise and Discussion Questions 1, 4, 5, 8. Week 3: 09/08/2015 Chapter 2(page 16-21). Chapter Exercise and Discussion Questions 1, 5. Week 4: 09/15/2015 Open discussion & review Week 5: 09/22/2015 Chapter 3(page 25-30). Chapter Exercise and Discussion Question 1. Week 6: 09/29/2015 Chapter 4(page 33-44). Chapter Exercise and Discussion Questions 2, 5, 7, 9. Week 7: 10/06/2015 Mid-term Examination: Chapters 1 - 4 Week 8: 10/13/2015 Chapter 5(page 48-52). Chapter Exercise and Discussion Questions 4, 6, 7. Week 9: 10/20/2015 Chapter 6(page 56-65). Chapter Exercise and Discussion Questions 2, 4, 8. Week 10: 10/27/2015 Chapter 7(page 68-101). Week 11: 11/03/2015 Chapter 8 (page 105-113). Week 12: 11/10/2015 Chapter 8 (page 114-131). Chapter Exercise and Discussion Questions 1, 3, 5-8. Week 13: 11/17/2015 Open discussion Week 14: 11/24/2015 Review for final examination. Week 15: 12/01/2015 Final Exam: Chapters 1 – 8 Week 16: 12/08/2015 Final Project Presentation *Last day for administrative/student withdrawals – October 30, 2015 HCC is committed to provide a learning and working environment that is free from discrimination on the basis of sex which includes all forms of sexual misconduct. Title IX of the Education Amendments of 1972 requires that when a complaint is filed, a prompt and thorough investigation is initiated. Complaints may be filed with the HCC Title IX Coordinator available at 713 718-8271 or email at oie@hccs.edu.