Gifts-in-Kind to the University

advertisement

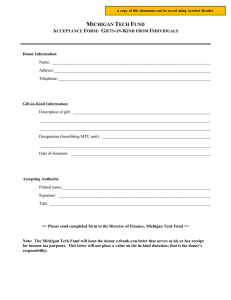

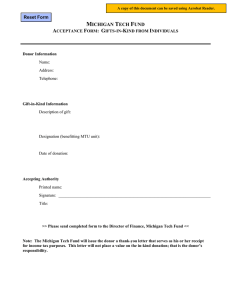

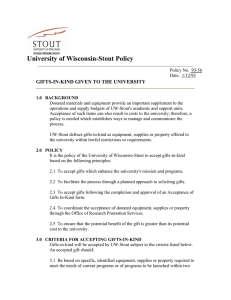

Financial Policies Training: Gifts-in-Kind to the University (2.1.10) Effective: November 17, 2009 These PowerPoint slides are intended for training purposes. In the event of any discrepancy or interpretation difference between the policy and the slides, the policy dictates. Gifts-in-Kind to the University (2.1.10) Topics: What is a gift-in-kind? Why is a gift-in-kind policy needed? Are any exceptions to this policy allowed? What is the process for accepting a gift-in-kind? Other considerations in accepting a gift offer? What gift offers should be declined? How are accepted gifts-in-kind valued? Is an appraisal required? What are the standards for appraisals? What is UC Foundation’s role? Are there special types of gift-in-kind contributions? Gifts-in-Kind to the University (2.1.10) What is a gift-in-kind? Contributions – transactions in which one entity makes an unconditional voluntary transfer to another entity without receiving equal value in exchange Examples of gift-in-kind contributions Tangible personal property (e.g., equipment, antiques) Intangible personal property (e.g., patents, copyrights, software licenses) Real estate Gifts-in-Kind to the University (2.1.10) Why is a gift-in-kind policy needed? Provides assistance in recognizing and accepting gifts-in-kind per Board Rule 10-21-01 Supplements UC Foundation’s gift acceptance policy Are exceptions to this policy allowed? All exceptions to policy 2.1.10 require approval by the Senior Vice President of Administration and Finance Gifts-in-Kind to the University (2.1.10) What is the process for accepting a gift-inkind? Conduct review to show property Is readily marketable (can be sold) -ORIs needed by university (can be used internally) Coordinate acceptance with UC Foundation May also require approval of General Counsel, Director or Real Estate, Purchasing or others For gifts of $5000 or more, provide copy of all documentation to Controller’s Office for recording in UC Flex Gifts-in-Kind to the University (2.1.10) Other considerations in accepting a gift offer? Potential ethical issues Major uncertainty about existence of a value If any financial, promotional or other consideration is paid or given to the donor/vendor/provider – it is not a gift-in-kind What gift offers should be declined? Property that can’t be used internally or sold quickly General rule: automobiles, boats, livestock Gifts-in-Kind to the University (2.1.10) How are accepted gifts-in-kind valued? (Easily sold or used) Fair market value Assigned a value for internal accounting purposes only (Not easily valued) (Equipment and software) value (i.e., what Educational discount UC would have paid if purchased) For software, the educational discount value as documented in writing from vendor If no educational discount value on software, it is the established retail value in relation to the number of concurrent users Gifts-in-Kind to the University (2.1.10) Is an appraisal required? If gift is $5000 or more and donor wants Foundation acknowledgement An independent appraisal is required If gift is valued at $5000 or more and produced/manufactured by entity making the contribution An itemized inventory list, invoice or letter from vendor/donor or published info on value of items is required For gifts having no qualified appraisal, UC does not include a value on the donor receipt Gifts-in-Kind to the University (2.1.10) What are the standards for appraisals? Independent appraisers UC does not perform appraisals UC will not pay for appraisals of contributed assets Must comply with IRS guidelines Must be no earlier than 60 days prior to the date of the gift If the appraisal lists a range of values, the recorded value is the midpoint Gifts-in-Kind to the University (2.1.10) What is UC Foundation’s role? Work with the organizational unit being offered the gift regarding acceptance and eligibility Assure a gift is appropriately recognized within the university donor recognition framework Execute any IRS forms required for acquisition/disposition of gifts of real or personal property Gifts-in-Kind to the University (2.1.10) Are there special types of gift-in-kind contributions? Software Services Use of long-lived assets Gifts-in-Kind to the University (2.1.10) Software that serves the academic or research purpose of the university The terms of the agreement determine if the transaction is a gift: Must be an irrevocable license and in writing No gift if license must be renewed later Upgrades in future with higher value – considered additional gift Gifts-in-Kind to the University (2.1.10) Contributed services Not considered gift-in-kind (per OH state law) Professional design, engineering, construction services May be considered gift-in-kind Advertising and promotions How is eligibility determined? UC Foundation If services (w/ input from General Counsel, Purchasing, org unit to benefit) Create/enhance a non-financial asset Service would need to be purchased if not donated Gifts-in-Kind to the University (2.1.10) Use of long-lived assets Unconditional promise for use of (for example) a building or facility For a specified number of periods Donor retains legal title May be received in connection with a lease with payments below fair rental value or may be similar to a lease with no lease payments Contribution reported: difference between fair rental value & stated amount of lease payments Gifts-in-Kind to the University (2.1.10): Resources Policy (2.1.10): ww.uc.edu/af/documents/policies/giftsinkind.pdf or go to the Financial Policies home page www.uc.edu/af/policies Policy questions e-mail: policyquestions@uc.edu University Board Rule 10-21-01 www.uc.edu/trustees/rules/RuleDetail.asp?ID=98