Mr. Hiroto Arakawa

advertisement

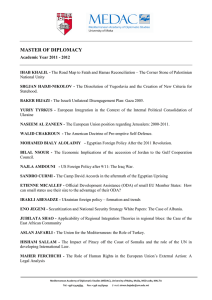

Rethinking Catalytic Roles of ODA November 30, 2008 HIROTO ARAKAWA - Table of Contents I. Background: Financial Flow to Developing Countries II. Challenges Ahead III. Rethinking Catalytic Roles of ODA 2 I. Background Financial Flow to Developing Countries 1. Impact of Current Financial Turmoil Real GDP Growth and Trend (%) Source: IMF staff estimates (World Economic Outlook Update, November, 2008) 3 I. Background Financial Flow to Developing Countries 2. Impact of Current Financial Turmoil Overview of the World Economic Outlook Projections (unit: %) Private flow to developing countries seems to decrease in 2008 and 2009 due to the slowdown of GDP growth rate. 4 Source: IMF staff estimates (World Economic Outlook Update, November 2008) I. Background Financial Flow to Developing Countries 3. Who’s Major Players? ODA OOF PRIVATE FLOWS NET PRIVATE GRANTS (unit: 100 million $) 5,000 4,500 4,000 3,500 3,000 2,500 2,000 1,500 1,000 500 0 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 1972 1970 1968 1966 1964 1962 1960 *2007 data is based on estimation. Source: OECD. Stat Extracts, DAC1 Official and Private Flows, 2008 * 2008? 5 I. Background Financial Flow to Developing Countries 4. Characteristics Private Flow ODA Could be Large and Small according to Economic Situation Gradually Increasing but yet Small Volatile Stable and Predictable Profit-oriented: Tend to specific sectors and countries Could touch upon Policy & Institutional Reform for better administration 6 II. Challenges Ahead Trend of Development Agenda and Way Forward Before Asian Currency Crisis in 1997 Infra-development: Public-led Private Sector Investment Before Financial Crisis in 2008 Way Forward 2008 and beyond ODA further promoted private investment ・Huge Infrastructure + Pro-poor Growth: Inclusiveness + Revalue of Infra-development Basic Human Needs demand (Acceleration of PPP) ・Global Climate Change MDGs (2000) 7 II. Challenges Ahead Huge Infrastructure Demand -East Asia: $200 BILLION/ year (2006-10) (Connecting East Asia, ADB/JICA/WB, 2005) -Africa: $20 BILLION/ year (An Africa Action Plan, WB, 2005) Implication from East Asian Economic Growth led by Private Sector Development, encouraged by Infrastructure Development, supported by Public Finance Inclusive Development Model (“Connecting East Asia” (ADB/JICA/WB flagship study)) Coordination Poverty Reduction Inclusive Growth Development Accountability and Risk Management Growth Determinants Service Access Infrastructure Access Determinants 8 II. Challenges Ahead Conceptual Figure: Expected Share of Private Investment with PPP MIDDLE LOW INCOME COUNTRY Share of Finance GRADUATION INCOME COUNTRY FROM ODA HIGH INCOME COUNTRY PRIVATE INVESTMENT ODA LOAN Expected share of private investment with PPP ODA GRANT PUBLIC INVESTMENT Income Level 9 II. Challenge Ahead “The Growth Report: Strategies for Sustained Growth and Inclusive Development” (Commission on Growth and Development, 2008) (1) The Common Characteristics of High, Sustained Growth - Strategic integration with the world economy - Mobility of resources, particularly labor - High savings and investment rates - Capable government committed to growth (2) Policy Ingredients of Growth Strategies (should be customized, though) - High levels of investment - Macroeconomic stability - Urbanization and rural investment - Effective government - Competition and structural change - Export promotion and industrial policy, etc. 10 II. Challenge Ahead World Development Report ’09 “Reshaping Economic Geography” 1. Geographic Transformations: “3D” Needed for Progress (i) Higher Densities No country has grown to high income without urbanizing (ii) Shorter Distances Growth seldom comes without the need to move closer to density (iii) Fewer Divisions Growth seldom comes to a place that it isolated from others 2. Challenges for policy makers How to get both unbalanced growth and inclusive development? > Economic Integration (from spatial targeting to spatial integration) > Infrastructure development: Important tool to improve spatial connectivity 11 III. Rethinking Catalytic Roles of ODA 1. Huge Infra-Demand: Mobilization of Private Capital (1) Enabling Environment for Private Investment - Reforming Policy & Institution / Investment Environment (2) Risk Mitigation for Private Investment - Mitigating “Risks” Political Risk, Implementation Risk (ex. land acquisition), Demand Risk, etc. - Burden Sharing (ex. “Bottleneck Facility”) 12 III. Rethinking Catalytic Roles of ODA Model: Mobilization of private capital catalyzed by ODA (Case of PRSC and related ODA projects in Vietnam) ODA grant/loans, technical assistance for capacity building ODA Private Enabling Environment Investment climate •Legal reform for Investment, FDI, BOT(PPP), procurement •-do- for SOE reform, equal footing between private & public ODA grants/loans to induce investments Actions in PRSC Matrix Capital market development •Market infrastructure (legal system, settlement system), •Capacity building for market players (SEC, privatized SOEs) ODA technical assistance Infrastructure development by public sector (governments, municipalities, SOEs, PPPs) Enabling Environment to develop borrowers’ credibility and debt capacity Enabling Environment Private sector investment Private capital Fund raising from capital markets and private financial institutions Private capital 13 III. Rethinking Catalytic Roles of ODA Policy and Institutional Reform : PRSC in Viet Nam Improvement of business investment environment: Legal reform for Investment, FDI, BOT(PPP), procurement, SOE reform, equal footing between private & public 5 Banks initiative in procurement Prime example: Public Procurement System Local Competitive Bidding Project Level Now LCB Standard for use in Vietnam’s overall procurement systems With JICA’s well-focused T/A Public Expenditure Management (PFM, MTEF) JICA “5 Banks” WB, ADB, AFD, KfW Donor Coordination Govt. of Vietnam UN, DFID and others 14 III. Rethinking Catalytic Roles of ODA Phu My Electrical Power Project in Vietnam Generation Systems (thermal power plant) Japanese Company Investment Phu My 1 Phu My 2 Phu My 3 Private Financial Institutions JBIC ODA Loans Project Financing JICA Transmission Lines / Distribution Systems Loans WB & ADB ODA’s roles on the ground: (i) Mitigating Risk for Private Sector JICA’s ODA loan assisted the 1st generation plant for aiming demonstration effects for the 2nd plant financed by private investment. (ii) Reforming Policy & Institution / Investment Environment JICA co-financed PRSC, which paves the way for equal treatment for domestic and foreign firms. (iii) Assisting “Bottleneck Facility” JICA’s ODA loan assisted transmission line (“Bottleneck Facility”) for making BOT works. 15 III. Rethinking Catalytic Roles of ODA 2. Global Climate Change ・ Multi-sectoral approach ・ Mitigation/Adaptation 16 III. Rethinking Catalytic Roles of ODA 1. Approach: Climate Change and ODA Policy Dialogue with Partner countries ODA Private Climate Change ODA agreement on policy matrix for climate change Implementation of climate change policies based on agreed matrix Identification of necessary investments Mitigation and adaptation projects Enabling Environment Private sector investments for sustainable growth Technical assistance (advisor/expert) to monitor implementation and develop next steps ODA grants/loans to induce investments Private capital 17 III. Rethinking Catalytic Roles of ODA 2. INDONESIA:Climate Change Program Loan Pillar 1: Mitigation 1.1:LULUCF (Land Use, Land Use Change and Forestry) -Reforestation -REDD -Forest management Pillar 2: Adaptation 1.2:Energy -Power plant -Industry, domestic and commercial -Others 2.1:Water Resource Management, Water Supply and Sanitation 2.2:Agriculture -Watershed management -Water supply and sanitation Pillar 3: Cross-cutting Issues 3.1: Understanding the Impact of Climate Change 3.2:Mainstreaming Climate Change in the National Development Program 3.3: Improving Spatial Plans 3.4:CDM 3.5:Co-benefits 3.6:Fiscal Incentives 3.7:Early Warning System Assistance to executing agencies (line ministries) Project Multi-donor fund and other donors’ projects TA Project TA Project TA Project TA mutually complementary relationship 18