Chapter 12

Managing Merchandise

Assortments

McGraw-Hill/Irwin

Retailing Management, 7/e

© 2008 by The McGraw-Hill Companies, All rights reserved.

12-2

Merchandise Management

Merchandise

Planning

System

Chapter 13

Buying

Merchandise

Chapter 14

Managing

Merchandise

Assortments

Chapter 12

Retail

Pricing

Chapter 15

Retail

Communication

Mix

Chapter 16

12-3

Questions

■ How is the merchandise management process

organized?

■ Why do the merchandise management processes differ

for staple and fashion merchandise?

■ How do retailers evaluate the quality of their

merchandise management decisions?

■ How do retailers forecast sales for merchandise

classifications?

■ How do retailers plan their assortments and determine

the appropriate inventory levels?

■ What trade-offs must buyers make in developing

merchandise assortments?

12-4

Merchandise Management

Process by which a retailer offers the correct

quantity of the right merchandise in the right

place at the right time and meets the company’s

financial goals.

■ Sense market trends

■ Analyze sales data

■ Make appropriate adjustments in

prices and inventory levels

c) image100/PunchStock

12-5

Merchandise Management and

Investment Portfolio Management

■ Dollars to invest in inventory

■ Invest in “hot” merchandise

■ Save a little for opportunities

(open to buy)

■ Monitor portfolio of

merchandise (stocks)

■ Sell losers (markdowns)

Traders on the stock exchange floor

manage a portfolio of stocks, and retail

buyers manage a portfolio of merchandise

inventory. Both continuously assess the risks

associated with their purchase decisions.

12-6

Buying Organization

Merchandise Group

Department

Classification

Category

SKU

Each merchandise group is managed by

a general merchandise manager (GMM),

senior VP

Departments are managed by

a divisional merchandise manager (DMM),

A group of items targeting the same

customer type, such as girls’ sizes 4-6

Each buyer manages several merchandise

categories (e.g., sportswear, dresses,

swimwear, outerwear categories for girls’

sizes 4-6

The smallest unit available for inventory control

Size, color, style

12-7

The Buying Organization

Ryan McVay/Getty Images

Merchandise Group…………Men’s wear

Department………….……….Young Men’s wear

Classification………….……..Pants

Category……………………..Jeans

Sock Keeping Unit (SKU)…..Levi, 501, size 26

waist, 32 inseam

12-8

Merchandise Classifications

and Organization

12-9

Merchandise Category –

The Planning Unit

A merchandise category is an assortment of items that

customers see as substitutes for each other.

Vendors might assign products to different categories

based on differences in product attributes

Retailers might assign two products to the same

category based upon common consumers and buying

behavior

12-10

Category Management

■ The process of managing a retail business with the

objective of maximizing the sales and profits of a category

■ Objective is to maximize the sales and profits of the entire

category, not just a particular brand

Breakfast cereal category vs. Kellogg Corn

Flakes

Men’s knitted shirts vs. Polo shirts

Diary product category vs. Carnation milk

products

12-11

Category Captain

Selected vendor responsible for managing a category

Vendors frequently have more information and analytical skills

about the category in which they compete than retailers

■ Helps retailer understand consumer behavior

■ Creates assortments that satisfy the customer

■ Improves profitability of category

Problems

■ Vendor category captain may have different goals than

retailer

12-12

Antitrust Considerations

The vendor category captain could

collude with retailer to fix prices

It could block brands from access to shelf

space

Category captains need to temper zeal

for control over retailers

■ Actions to avoid antitrust problems

Divulge all information obtained from the

retailer to the other brands in the category

Appoint another large brand as a

“category advisor”

To circumvent potential collusion in price

setting, refuse to serve as captain for two

retailers in the same market

Stockbyte/Punchstock Images

12-13

Evaluating Merchandise Management

Performance - GMROI

Merchandise managers have control over

■ The merchandise they buy

■ The price at which the merchandise is sold

■ The cost of the merchandise

Merchandise managers do not have control over

■ Operating expenses

■ Human resources

■ Real estate

■ Supply chain management

■ Information systems

SO HOW ARE MERCHANTS EVALUATED?

12-14

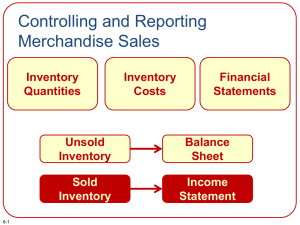

GMROI

Productivity Measures

Inventory

Input

Gross

Margin

Output

A measurement of how many gross margin dollars

are earned on every dollar of inventory

investment made by the buyer

12-15

GMROI

Gross Margin Return on Investment

GMROI = Gross Margin Percent x sales-to-stock ratio

= gross margin

net sales

=

x

net sales

avg inventory at cost

gross margin

avg inventory at cost

Inventory Turnover

= (1 – Gross Margin Percent) x sales-to-stock ratio

12-16

How do buyers influence GMROI?

GMROI = Gross Margin Percent x sales-to-stock ratio

= gross margin x

net sales

net sales

avg. inventory at cost

=

gross margin

avg. inventory at cost

Components that buyers can control:

■ Gross margin component:

Price:

• Prices that buyers set

• Prices that buyers negotiate with vendors

■ Sales-to-stock ratio component:

Popularity of the merchandise buyers buy

12-17

ROI and GMROI

Asset Productivity Measures

Strategic Corporate Level

■ Return on Assets = Net Profit

Total Assets

Merchandise Management Level

■ GMROI

=

Gross Margin

Avg. Inventory at Cost

12-18

Illustration of GMROI

Merchandise categories with different margin/turnover profiles

can be compared and evaluated

Canned food

Fresh Bakery

Canned food

Fresh Bakery

12-19

GMROI for Selected Department

in Discount Stores

12-20

Measuring Sales-to-Stock Ratio

■ Net Sales/Average Inventory at Cost

■ Retailers report on an annual basis

■ If the sales-to-stock ratio for a three-month

season is 2.3, the annual sales-to-stock ratio will

be 9.2

■ Estimation of average inventory

Use information system: averaging the inventory in

stores and distribution centers at the end of each day

Divide the sum of the end-of-month (EOM)

inventories for several months by the number of

months

12-21

Managing Inventory Turnover

Calculation

Inventory turnover =

Inventory turnover =

Average inventory =

Net Sales

Average inventory at retail

Cost of goods sold

Average inventory at cost

Month1 + Month2 + Month 3 +…

Number of months

■ Inventory Turnover helps assess the buyer’s performance in managing

asset (merchandise inventory)

■ But focusing on increasing inventory turnover can actually decrease RMROI

■ Buyers need to consider the trade-offs associated with managing Inventory Turnover

12-22

Inventory Turnover

Month

■ EOM January

■ EOM February

■ EOM March

■ Total Inventory

Retail Value of Inventory

$22,000

33,000

38,000

$93,000

■ Average inventory = $93,000 ÷ 3 = $31,000

12-23

Inventory Turnover and

Stock-to-Sale Ratio

Inventory turnover =

(at retail)

Net Sales

Average inventory at retail

Inventory turnover =

(at cost)

Sock-to-Sales Ratio =

Cost of goods sold

Average inventory at cost

Net Sales

Average cost of

inventory

12-24

Advantages of Rapid Turnover

■

■

■

■

Increased sales volume

Less risk of obsolescence and markdowns

Improved salesperson morale

More resources to take advantage of new

buying opportunities

12-25

Approaches for Improving Inventory Turnover

■ Reduce number of categories

■ Reduce number of SKUs within a category

■ Reduce number of items in a SKU

BUT if a customer can’t find their size or color or

brand, patronage and sales decrease!

another approach…

12-26

…another approach

To improve inventory turnover

■ Buy merchandise more often

■ Buy in smaller quantities which should reduce average

inventory without reducing sales

BUT by buying smaller quantities

■ Buyers can’t take advantage of quantity discounts so

■ Gross margin decreases

■ Operating expenses increase

■ Buyers need to spend more time placing orders and

monitoring deliveries

12-27

Merchandise Planning Process

12-28

Types of Merchandise Management

Planning Processes

Two distinct types of merchandise management systems

for managing

■ Staple (Basic) Merchandise Categories

Continuous demand over an extended time period

Limited number of new product introductions

Hosiery, basic casual apparel

Easy to forecast demand

Continuous replenishment

■ Fashion Merchandise Categories

In demand for a relatively short period of time

Continuous introductions of new products, making existing

products obsolete

Athletic shoes, laptop computers, women’s apparel

■ Discussed in Chapter 13 in detail

12-29

Merchandise Management Process

1. forecasting sales

2. Developing an assortment plan

3. Determining the appropriate inventory level

12-30

Developing a Sales Forecast

■ Understanding the nature of the product life cycle

■ Collecting data on sales of product and comparable

products

■ Using statistical techniques to project sales

■ Work with vendors to coordinate manufacturing and

merchandise delivery with forecasted demand

(CPFR)

12-31

The Category Product Life Cycle

Knowing where a category is in its life cycle is important in developing

a sales forecast and merchandising strategy

12-32

Variations in the Category Life Cycle

12-33

Fad vs. Fashion

How do buyers tell the

difference?

Are Crocks, a Fad or a Fashion?

■ Is it compatible with changes in

consumer lifestyles?

■ Does the innovation provide real

benefits?

■ Is the innovation compatible with

other changes in the marketplace?

■ Who is adopting the trend?

12-34

Types of Merchandise

Fashion Merchandise

Unpredictable Demand

Limited Sales History

Difficult to Forecast Sales

The McGraw-Hill Companies, Inc./Lars A. Niki,

photographer

Staple Merchandise

Predictable Demand

History of Past Sales

Relatively Accurate Forecasts

The McGraw-Hill Companies Inc./Ken Cavanagh Photographer

12-35

Forecasting Staple Merchandise

Based on

extrapolating

historical sales

because sales are

constant from year to

year

12-36

Sales of 12-Inch Lodge Frying Pans

Plot of Sales by Year

Plot of Sales by Quarter

12-37

Forecasting Staple Merchandise

Forecast sales for 2009: Lodge frying pan

■ 2009 annual sales = 1.036(3.6% growth) x

118,963 (2008 annual sales) = 123,245

■ The estimated quarterly sales:

First-quarter sales

= 123,245 x .21 = 25, 881

Second-quarter sales = 123,245 x .26 = 32,044

Third-quarter sales = 123,245 x .18 = 22,184

fourth-quarter sales = 123,245 x .35 = 43,136

12-38

Factors Affecting Sales Projections

Controllable

■ Promotions

■ Store Locations

■ Merchandise Placement

■ Cannibalization

Uncontrollable

■ Seasonality

■ Weather

■ Competitive Activity

■ Product Availability

■ Economic Conditions

12-39

Forecasting Fashion Merchandise

Categories

Retailers develop fashion forecasts by relying on:

■

■

■

■

■

Previous sales data

Personal awareness

Fashion and trend services

Vendors

Traditional market research

12-40

Personal Awareness

How do fashion buyers know the trends?

■

■

■

■

■

Internet chat rooms

Look in closets

Go to the movies

Go to rock concerts

Go to nightclubs

Ryan McVay/Getty Images

SCAN

Shop the retail stores, Web sites and catalogs of competitors as a

customer would

Converse with consumers, sales clerks, and neighbors

Act like your customer

Notice

12-41

Fashion and Trend Services

Buyers subscribe to forecasting services and fashion

publications

■ Trendzine (www.FashionInformation.com)

■ Doneger Creative Services (www.Doneger.com/web )

■ Fashion Snoops (www.fashionsnoops.com)

■ Earnshaw’s

■ Women’s Wear Daily (WWD)

■ DNR

■ Home Furnishings News (HFN)

12-42

Work with Vendors:

Collaboration, Planning, Forecasting, and Replenishment

Systems (CPFR)

■ Vendors have proprietary information about their

marketing plans (e.g., new product launches, special

promotions)

■ Procedures used by retailers and vendors to work

together to insure that the right merchandise is at the

right place at the right time.

Benefits both retailers and vendors

Increases fill rate, reduces stockouts, increases inventory turns

12-43

Developing Assortment Planning

Assortment plan is a list of the SKUs that a retailer will offer

in a merchandise category and reflects the variety and

assortment that the retailer plans to offer in a merchandise

category

Variety (breadth) is the number of different merchandising

categories within a store or department

Assortment (depth) is the number of SKUs within a

category.

Product availability defines the percentage of demand for a

particular SKU that is satisfied.

12-44

Is This Store Heavy on Variety?

On Assortment?

PhotoLink/Getty Images

12-45

Determining Variety and Assortment

PhotoLink/Getty Images

Buyers consider

■ Retail strategy

The number of SKUs to offer in a merchandise

category is a strategic decision

■ GMROI of the merchandise mix

■ Trade-off between too much versus too little assortment

Increasing sales by offering more breadth and depth

can potentially reduce inventory turnover and GMROI

by stocking more SKUs

■ Physical characteristics of the store

■ Complementary Merchandise

12-46

Assortment Plan for Girls’ Jeans

12-47

Product Availability

■ The percentage of demand for a particular SKU

that is satisfied

■ Level of support or service level

■ The backup (buffer) stock in the model stock

plan determine product availability

■ The higher product availability, the higher the

amount of backup stock necessary to ensure that

the retailer won’t be out of stock on a particular

SKU when consumers demand it

12-48

Model Stock Plans

12-49

Importance of Backup (Buffer) Stock

Choosing an appropriate

amount of backup stock is

critical to successful

assortment planning

■ If the backup stock is too low

loose sales and customers

■ If the backup stock is too high

scare financial resources will be

wasted on needless inventory that

could be more profitably invested in

more variety or assortment

12-50

ABC Analysis

Rank - orders merchandise by some performance

measure determine which items:

■ should never be out of stock

■ should be allowed to be out of stock

occasionally

■ should be deleted from the stock selection

12-51

Product Availability

Factors considered to determine the appropriate

level of buffer stock and thus the product

availability for each SKU

■ ABC Classification of merchandise (inventory)

A – higher product availability

B – medium product availability

C – lower product availability is acceptable

■ Fluctuations in demand

■ Lead time for deliver from the vendor

■ Frequency of store deliveries

Trade-off among variety (breadth), assortment (depth), and product availability

12-52

Understanding the Challenges of

Assortment Planning and Allocation

Adapted with permission from ProfitLogic, now part of

Oracle Retail

12-53

Assortment Planning – A Key to Financial

Success

Right

+

Product

Right

Place

good assortment

strategy

+

Happy

Right

Right

+

= Customer

+

Time

Quantities

good assortment

execution

=

Financial success

12-54

Reality

■ Customers respond to a promotion, only to find

the store is out of stock

■ Customers find a piece of clothing in every

size…but not hers

■ Customers go to a store, only to find the

inventory ‘picked over’

12-55

55

For A Retailer,

These Situations Are Very Costly

“

• Objective of assortment planning system is to

match Inventory to demand

–By quantity

–By size

–By geography

–By store format

• Mismatch Results In Serious Consequences

–Overstocks create markdowns and lost

gross margin dollars

–Under stocks create lost sales and

unhappy customers

A retailer was stuck with $400 million in excess inventory…after

misreading consumer demand for products at the right price point.

”

--Forrester Research

12-56

56

Agenda

■ Why Is This So Hard To Do Well?

■ Symptoms Of Less-Than-Perfect Assortment

Planning

■ How Has Merchandise Optimization Helped?

12-57

Fast Changing Product Lines and Large-Scale

Expansion Have Made It a Lot More Complex

Wall Street

Retail is Detail

1,000 Stores

X

• 27 years old

50,000 SKUs

• Liberal Arts degree

X

• 4 years in

26 Weeks

merchandising X

organization

4 Measures

(Sales, Inventory, Receipts, On Order)

• Motivated by fashion

X

and trends

Plan, Actual, Last Year

X

Main

Street

4 Seasons

One Trillion Numbers

Source: Fortune 50 Retailer

12-58

What’s So Hard About

Executing On The Assortment Strategy?

Key Challenges

1. Build localized assortments

2. Create accurate Initial Allocations

3. Allocate in-season to match store demand

4. Manage Merchandise Effectively Across the Entire Lifecycle—

Be Out-of-stock at the end of the season

Problem: Execution Complexity Exceeds Capacity

Most retailers consider two of the legs: location

and product decisions. Can’t deal with TIME

Location

12-59

What is the consequence of poor execution?

• Cluttered selling floor

• Unclean seasonal

transitions

Location

• Excessive stock-outs and overstocks

• Customers leave without buying

Bottom Line Impact:

Lost sales and lowered margin and depressed

inventory turn

12-60

60

Agenda

■ Why Is This So Hard To Do Well?

■ Symptoms Of Less-Than-Perfect Assortment

Planning

■ How Has Merchandise Optimization Helped?

12-61

Approach

PreSeason

Ability to build localized assortments

InSeason

“Treat every store like it was your only store” and “Never treat

a Store as an Average Store again”

Analytics determines each store’s buy quantities, receipt flows

and initial allocation

Enables more profitable & efficient in-season inventory mgt. and

allocations

In-season updated forecasts track sales against plan—

sophisticated sell-through analysis.

Analytics lead to fewer over- and under-allocations

12-62

62

What’s the value creation opportunity?

■ Financial

9 – 16 % improvement in gross margin $$s

4 – 7 % improvement in sales $$s

■ Merchandising

Store assortments that reflect the vision of the

assortment strategy

Cleaner seasonal transitions and fresher merchandise in

the stores

Value to a $650M specialty retailer is $60M

incremental profit

12-63

How Does it Work?

1. Identify demand drivers

•

price sensitivities and seasonalities

2. Understand sales potential with Optimized History

•

optimal inventory levels and pricing schedules

3. Convert sales demand to receipt quantities by size and

pack

•

optimal size profiles, prepacks, and receipt quantities

12-64

Seasonality by Regions

•

•

Comparing regions: Capri peaks in late-June in the Midwest and in mid-July in the west

Could be due to seasonality differences and/or different sensitivities to a price change.

8

7

6

5

4

3

2

1

0

Capri - Atlantic

Pants - Atlantic

Capri – Midwest

Pants – Mid west

Capri - West

Pants - West

12-65

Price Elasticity by Divisions

Different product divisions respond differently to price cuts. With the Division 4 business being

the most impacted by price while the Division 2’s business is still affected, but not as much as

the others.

Price Elasticity Chart

700%

Sales Lift

600%

Division 1

Division 2

Division 3

Division 4

500%

400%

40% OFF

300%

200%

100%

0%

5%

10% 15% 20% 25% 30% 35% 40% 45% 50% 55% 60%

Price Discount

12-66

Underbought - Cotton T-Neck Sweater

Sales: +35% Gross Margin: +37%

12-67

Underbought - Cotton T-Neck Sweater

An increased buy quantity across all sizes would lead to a large increase in

sales units, sales dollars and gross dollars.

Sales Units

Sales Dollars

Total Buy Quantity

Gross Margin Dollars

Gross Margin $

Actual

Optimized

Results

Results

Variance

#

%

22,114

30,039

7,925

35.8%

$549,154

$746,780

$197,626

36.0%

22,176

30,039

7,863

35.5%

$309,416

$424,110

$114,695

37.1%

56.3%

56.8%

12-68

Overbought -- Merino Cardigan

Sales: +10% Gross Margin: +58%

Optimized vs. Actual Sales

250

$40.00

$35.00

200

Units

150

$25.00

$20.00

100

$15.00

Selling Price

$30.00

Unprofitable Sales

from Deep

Markdown Activity

$10.00

50

$5.00

0

/1

09

03

3/

$0.00

3

4

4

3

4

4

4

4

4

03

03

03

03

03

/

/

/0

/0

/0

/

/0

/0

/

/0

/0

/0

/

/0

2

7

5

6

7

8

7

8

0

3

4

1

1

3

/2

/2

/0

/1

/2

/2

/2

/0

/1

/1

/0

/2

/3

/1

09

10

10

11

11

12

12

01

01

01

02

02

03

03

Inventory / 5

Actual Selling Price

Actual Sales Units

Optimized Selling Price

Optimized Sales Units

12-69

Overbought -- Merino Cardigan

A reduced buy quantity coupled with an accurate flow would have led to a

much higher quality of sales, reduced markdowns and an increased gross

margin percentage more in line with other products.

Sales Units

Sales $

Total Buy

GM$

GM%

Actual

Optimized

Results

Results

1,265

1,037

$33,391

$37,022

1,277

1,037

$12,393

$19,809

37.1%

53.5%

Variance

#

%

(228)

$3,631

(240)

$7,416

(18.0%)

10.9%

(18.8%)

59.8%

12-70

How to Allocate Optimal Sizes

Example: Ribbed Black Turtleneck

40.00

Actual Size Profile

Optimized Size Profile

35.00

30.00

Percent

25.00

Shortage of

Sizes Needed

by Customers

20.00

15.00

10.00

5.00

0.00

Average of XS

Average of S

Average of M

Average of L

Average of XL

12-71

Size Profiling Analysis:

Shortages were consistent across regions

40.00

40.00

Atlantic

30.00

30.00

25.00

25.00

20.00

20.00

15.00

15.00

10.00

10.00

5.00

5.00

0.00

0.00

Average of XS

Average of S

Average of M

Average of L

Average of XL

Average of XS

Average of S

Average of M

Average of L

Average of XL

40.00

40.00

Mid West

35.00

30.00

30.00

25.00

25.00

20.00

West

35.00

Percent

Percent

South

35.00

Percent

Percent

35.00

20.00

15.00

15.00

10.00

10.00

5.00

5.00

0.00

0.00

Average of XS

Average of S

Average of M

Average of L

Average of XL

Average of XS

Average of S

Average of M

Average of L

Average of XL

12-72

Pre-pack Analysis

Example: Ribbed Black Turtleneck

Changes to Pre-Packs Leads to

Better Store Demand Matching

Existing Pre-packs

• (S, M, L) with scale (2,2,1)

• (S, M, L) with scale (2,3,2)

Optimized Two Pre-Packs

• (XS, S, M, L, XL) with scale (2,2,3,2,2)

• (XS, S, M, L, XL) with scale (1,3,3,2,1)

12-73

Buy Quantity Optimization

Apparel Retailer Drives Assortment Productivity

12-74

How to Optimize Buy Quantity by Store

Apparel Retailer Drives Assortment Productivity

The Problem: Imprecise buy quantities by item are resulting in lost sales for

some items and greater markdowns for other items

Driving the Need for Change: “Our planning process heavily relies on averages. We conduct classlevel analysis to create an average per store buy quantity for all items in the class. We know we ’re leaving

money on the table because of our customers’ brand-driven purchasing habits. Today we have

insufficient tools and systems to do it any other way. We use Excel for analysis and have another

system that serves as the place of record for the decisions.” – VP of Planning

Store

Store 1

Actual

Over /

Store

Ordered & Under

Demand

Shipped Stocked

581

450

Averages Lead to Over Stocks, Under

Stocks and Missed Opportunity

-131

Store 2

493

450

-43

Store 3

471

450

-21

Store 4

404

450

46

Store 5

391

450

59

Store 6

358

450

92

Avg.

450

450

Optimal

Actual

Missed

Opportunity

Sales

Dollars

$94,187

$90,348

4.2%

GM

Dollars

$60,872

$56,922

6.9%

Under

Stocked

Over

Stocked

12-75

Determining Buy Quantities

The Challenge of Item Planning is Understanding the Components of Sales

Example Item, Historical Sales

Unit Sales

Actual Sales

1,400

1,200

1,000

800

600

400

200

9/

5

9/

12

9/

19

9/

26

10

/3

10

/1

0

10

/1

7

10

/2

4

10

/3

1

11

/7

11

/1

4

11

/2

1

8/

29

0

Weeks

12-76

Determining Buy Quantities

The Solution: ProfitLogic Buy Quantity Optimization

Understanding the Demand Drivers

Unit Sales

Promotion

Seasonality

1,400

Natural Demand

1,200

1,000

800

600

400

200

9/

5

9/

12

9/

19

9/

26

10

/3

10

/1

0

10

/1

7

10

/2

4

10

/3

1

11

/7

11

/1

4

11

/2

1

8/

29

0

Weeks

12-77

Determining Buy Quantities

The Solution: ProfitLogic Buy Quantity Optimization

Underlying Item Demand

Unit Sales

1,400

1,200

Natural Demand

Natural Demand,

Adjusted for Trend

1,000

800

600

400

200

9/

5

9/

12

9/

19

9/

26

10

/3

10

/1

0

10

/1

7

10

/2

4

10

/3

1

11

/7

11

/1

4

11

/2

1

8/

29

0

Weeks

12-78

Determining Buy Quantities

The Solution: ProfitLogic Buy Quantity Optimization

Underlying Demand Plus Seasonality

Unit Sales

Seasonality

1,400

Natural Demand

1,200

1,000

800

600

400

200

9/

5

9/

12

9/

19

9/

26

10

/3

10

/1

0

10

/1

7

10

/2

4

10

/3

1

11

/7

11

/1

4

11

/2

1

8/

29

0

Weeks

12-79

Determining Buy Quantities

The Solution: ProfitLogic Buy Quantity Optimization

Factoring in the Promotion

Unit Sales

1,400

1,200

Promotion

Seasonality

Natural Demand

1,000

800

600

400

200

9/

5

9/

12

9/

19

9/

26

10

/3

10

/1

0

10

/1

7

10

/2

4

10

/3

1

11

/7

11

/1

4

11

/2

1

8/

29

0

Weeks

12-80

Determining Buy Quantities

Results for Example Item

Unit Sales

Actual Sales

1,400

1,200

1,000

800

600

400

200

9/

5

9/

12

9/

19

9/

26

10

/3

10

/1

0

10

/1

7

10

/2

4

10

/3

1

11

/7

11

/1

4

11

/2

1

8/

29

0

Weeks

12-81

Determining Buy Quantities

Results for Example Item

Unit Sales

Merchandise

Optimization

Actual Sales

1,400

1,200

1,000

800

600

400

200

9/

5

9/

12

9/

19

9/

26

10

/3

10

/1

0

10

/1

7

10

/2

4

10

/3

1

11

/7

11

/1

4

11

/2

1

8/

29

0

Weeks

12-82

Determining Buy Quantities

Results for Example Item

Unit Sales

1,400

Merchandise

Optimization

Actual Sales

1,200

Traditional,

Manual

Methods

1,000

800

600

400

200

9/

5

9/

12

9/

19

9/

26

10

/3

10

/1

0

10

/1

7

10

/2

4

10

/3

1

11

/7

11

/1

4

11

/2

1

8/

29

0

Weeks

12-83

Determining Buy Quantities

Merchandise Optimization vs. Traditional Methods

Merchandise Optimization

200,000

Traditional Methods

Merchandise Optimization Benefit

4.2% improvement in Sales $

6.2% improvement in Gross Margin $

150,000

100,000

Sales $$

GM $

Business Impact:

Improved Customer Satisfaction:

Improves product availability to support the customer’s needs

Increased Financial Performance:

Drives sales and gross margin through greater full price sales

Enhanced Merchandising Process: Provides buyers a greater understanding of the drivers of the business

12-84

Receipt Flow Optimization

Dept. Store Drives Inventory Turn with Demand Driven

Receipt Flow

12-85

Determining Receipt Flow

The Problem: Retailer is frontloading receipts in the beginning of the season,

driving down inventory turnover

Each Store’s Customer Demand

Operational Considerations

How many deliveries from the supplier

can I or should I receive?

What’s the planned date to have the

item on the selling floor?

When is the season over?

How do I ensure I satisfy the size needs

at the store-level (e.g., S-XL, 2-16)

What business rules need to be met?

- Presentation quantities

- Capacity constraints

- Shipment minimums

- Planned safety stock

12-86

Determining Receipt Flow

The Challenge of flow planning is understanding how demand will unfold

over the season and creating a flow that satisfies both demand and

operational constraints

Single Shipment Inventory Flow

Units

Sales Forecast

Inventory / 5

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

Excess

Inventory

Front loading leads to carrying

excess inventory and a reduced

ability to react in-season

0

1

2

3

4

5

6

7

8

9 10 11 12 13 14 15

Optimal

Actual

Missed

Opportunity

Inventory

Turnover

4.7

4.4

6.8%

GM

ROI

1.76

1.67

5.3%

Weeks

Multiple Delivery Inventory Flow

Units

6,000

Sales Forecast

Inventory / 5

5,000

4,000

Responsive

Inventory

3,000

2,000

1,000

0

1

2

3

4

5

6

7

8

9

10 11 12 13 14 15 Weeks

12-87

Determining Receipt Flow

The Solution: Receipt Flow Optimization

Optimal DC and Store Receipt

Flow based on:

Pre-season Style-Color/Store

forecast

Delivery frequencies

Flow dates

Safety stock

Presentation mins and maxs

Shipment minimums

Item size runs (e.g., S-XL, 2-16)

Optimal Order Units based on:

Store level size profiles

Pre-pack configuration options

Purchase order total quantities

Initial and subsequent

allocations

12-88

Optimized Size Profiles

Women’s Apparel Retailer Improves Size Store Allocations

12-89

Optimized Size Profiles

Women’s Apparel Retailer Improves Size Store Allocations

The Problem: Size misallocation was leading to missed sales caused by

stocks-outs and excessive carrying costs due to over-stocking

Driving the need for change: “We’re concerned about a self-fulfilling prophecy –decisions are being

made based on selling history, which is likely to cause us to repeat past mistakes. Customer feedback

indicates that size stock outs at stores are hurting sales and customer satisfaction. We need a quick

hit solution that can address our business -- multiple store formats, thousands of styles per season, 2

seasons per year.” – SVP of Merchandising

Size Profile for Cardigan at Boston store

Client

Size Curve

ChainChain-Wide

Wide Size Profile

Boston Store

Size

ProfitLogic

Store

X Profile

Size Curve

45%

40%

M

35%

30%

S

25%

L

20%

Large cardigan was under stocked

by 55% at one store because of

chain-wide size profile

15%

10%

5%

Missed Sales Opportunity:

XS

0%

XS

S

M

L

12-90

Optimized Size Profiles

Women’s Apparel Retailer Improves Size Store Allocations

The Solution: optimized size profiles by class/store, which codifies size

demand variance. The profiles were used within the retailers’

existing planning and allocation systems

Cardigan Sweater

% Optimal

Contribution

Silk Blouse

% Contribution

Store X

Store Y

30

25

Store X

Store Y

25.00%

20.00%

20

15.00%

15

10.00%

10

5.00%

5

-

2

4

6

8

10

12

2

Size

4

6

8

10

12

14

Size

12-91