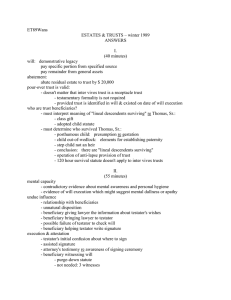

Sitkoff

advertisement